Stockwatch: Aviva shares remain a priority for income investors

This FTSE 100 stock has long been a favourite among those wanting a steady and substantial dividend. Analyst Edmond Jackson explain why he’s still backing this insurance giant.

11th June 2024 12:07

by Edmond Jackson from interactive investor

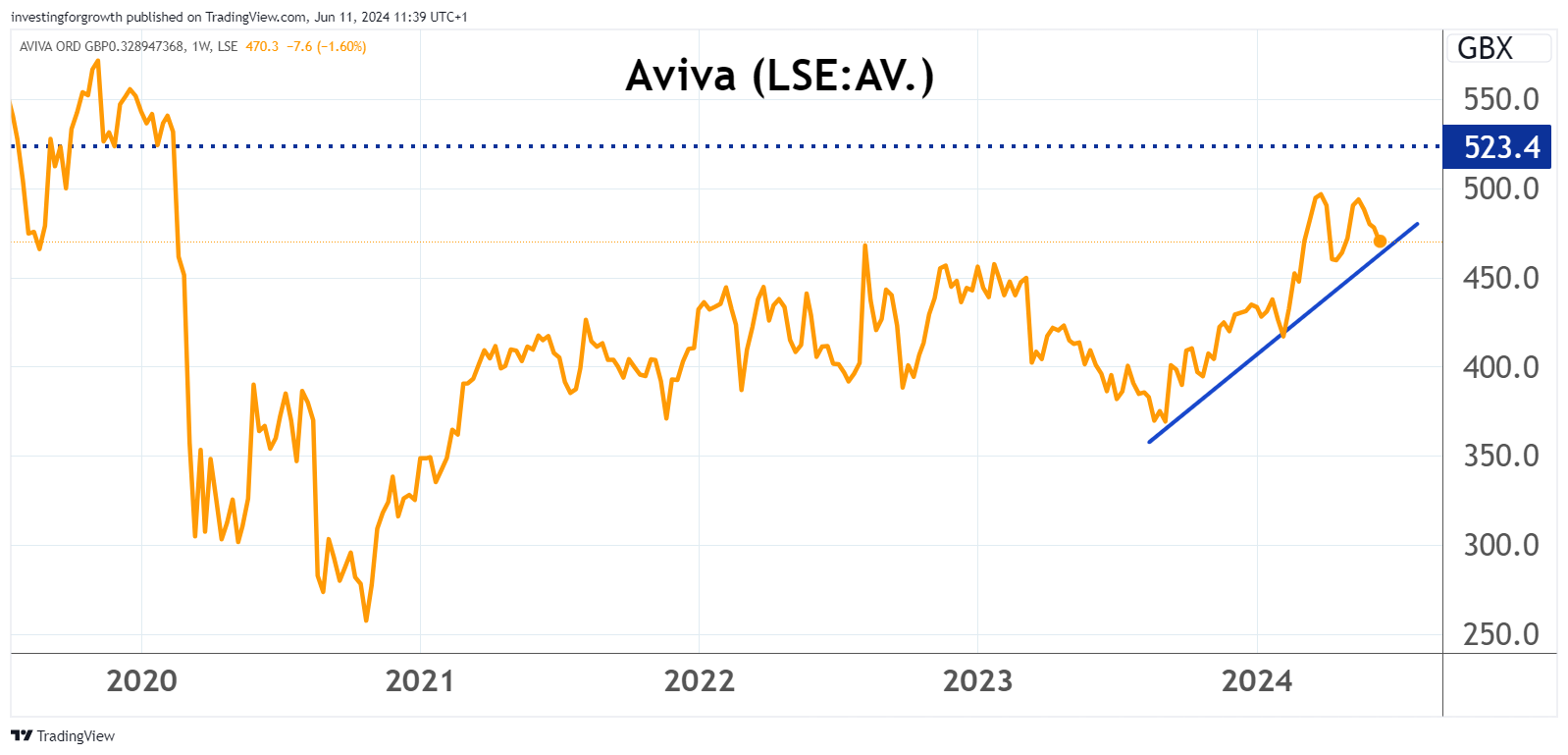

After a firm run from 370p last August, the FTSE 100 shares of insurance group Aviva (LSE:AV.) have consolidated since last spring in a circa 450-500p range. Yesterday, they slipped 8p to 470p after JP Morgan cut its rating to “neutral” from “overweight” and its price target from 575p to 550p, although financial stocks did feel the brunt of concern about political instability in Europe.

HSBC has also recently tempered its stance to “hold” with 525p target, although Berenberg is on at 584p with a “buy” rating. Aggressive investors tend to regard any aspect of downgrading, as well as the stalling share price, as reasons to sell – so how does Aviva stack up?

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Top UK Shares

A second recent bout of weakness, down from near 500p in mid-May, is curious if notable given the stock has continued to fall despite a 5p blip on 23 May when the chief executive proclaimed “excellent” first-quarter results.

Should you take notice of market swings?

A downtrend of sorts is also ironic considering Aviva’s raw financials. Consensus expects around 20% growth in earnings per share (EPS) this year, moderating to 12% in 2025, hence at 470p the forward price/earnings (PE) ratio is 10.5, easing to 9.3. Dividing the PE ratio by the expected earnings growth rate derives a “PEG” ratio of 0.5, rising to near 0.8 when investment value supposedly exists below 1.0.

- ii view: Aviva has something for income and growth investors

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

You could say that such a timeline focus benefits from the way Aviva is recovering from an earnings trough and is yet to achieve its 2019-21 earning power. The table does not suggest a consistent growth company, hence the PEG does not properly apply. It so happens that cost-cutting is aiding a profit advance while annuities are selling well.

Aviva - financial summary

Year-end 31 Dec

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Operating profit (£m) | 1,833 | 2,374 | 1,734 | 3,916 | 1,895 | 877 | -2,138 | 1,793 |

| Net profit (£m) | 703 | 1,497 | 1,568 | 2,548 | 2,798 | 1,966 | -1,051 | 1,085 |

| Reported EPS (p) | 19.9 | 45.0 | 49.7 | 82.4 | 43.7 | 8.3 | -34.7 | 37.7 |

| Normalised EPS (p) | 23.6 | 46.6 | 48.0 | 83.4 | 47.2 | 8.2 | -34.6 | 37.8 |

| Earnings per share growth (%) | -46.5 | 97.1 | 3.2 | 73.6 | -43.4 | -82.7 | ||

| Return on capital (%) | 0.4 | 0.5 | 0.4 | 0.9 | 0.4 | 0.2 | -0.7 | 0.5 |

| Operating cashflow/share (p) | 153 | 249 | 177 | 200 | -82.8 | 7.4 | 508 | -99.6 |

| Capex/share (p) | 6.0 | 5.7 | 5.0 | 4.0 | 4.6 | 3.6 | 3.2 | 12.8 |

| Free cashflow/share (p) | 147 | 243 | 172 | 196 | -87.4 | 3.8 | 505 | -112 |

| Dividend per share (p) | 30.7 | 36.1 | 39.5 | 20.4 | 27.6 | 29.0 | 31.0 | 33.4 |

| Covered by earnings (x) | 0.6 | 1.3 | 1.3 | 4.0 | 1.6 | 0.3 | -1.1 | 1.1 |

| Cash (£m) | 29,834 | 13,377 | 8,355 | 11,171 | 10,345 | 12,485 | 22,505 | 17,273 |

| Net debt (£m) | -17,858 | -2,360 | 2,359 | -190 | 780 | -5,141 | -14,435 | -9,906 |

| Net assets (£m) | 16,803 | 16,969 | 16,558 | 17,008 | 19,354 | 16,238 | 9,704 | 9,082 |

| Net assets/share (p) | 544 | 557 | 559 | 571 | 649 | 569 | 348 | 334 |

Source: historic company REFS and company accounts.

Yet this is a very well-established – indeed market-leading company – its performance numbers are good and its stock trades on a modest PE plus relatively high yield.

I think it partly reflects recent history of UK insurers being rated modestly as a proxy for post-Brexit Britain with low productivity/GDP.

For those like Aviva and Legal & General Group (LSE:LGEN) - more oriented to life insurance and investment management than car/home policies such as from Direct Line Insurance Group (LSE:DLG) – this was a somewhat flawed view given resilient performance over the Covid years amid renewed demand for annuities.

Such insurers – with major investment management operations – did, however, enjoy support from massive monetary stimulus boosting financial asset values.

So yes, as monetary policy has tightened and just lately a sense of “higher interest rates for longer” (to thwart inflation) has manifested, this would help explain profit-taking.

Strong yields show fears continue to be priced in

You could normally expect a yield above, say, 6% to reflect a particularly cyclical or unreliable business. True, insurance can involve exceptional events such as storms/floods generating payouts, and false claims have been a problem in motor, but such are not the activities that Aviva or Legal & General major on.

There was concern that Aviva had become sprawled with international interests, but a new CEO from mid-2020 sold them down – achieving significantly higher valuations than the group shares traded on – and re-focused.

- Insider: directors spend £1.4m on two FTSE 100 stocks

- Shares for the future: a business priced for perfection

Yet at around 470p, the prospective dividend yield is 7.5%, rising to 8.0% assuming a dividend of around 37.5p in respect of this year, rising to 38p for 2025, and covered 1.3 times by earnings both years. Aviva’s operational cash flow record is lumpy (see table) but this is a fundamentally low-capital expenditure business conducive to shareholder returns.

This strong yield profile was chiefly why I made a “buy” case for Aviva at 342p in March 2020, when markets were clobbered by Covid. I said it was “one of the best UK stocks for income, which will eventually kick in to support price”. With 27.6p a share eventually being paid in respect of 2020, it proved an 8% yield – and if forecasts are achieved then a yield over 11% for 2025 for those who bought back then.

The chart since then exemplifies mean-reversion, as the market in due course respected Aviva’s yield was over-generous for the business’s risk, hence the stock rose:

Source: TradingView. Past performance is not a guide to future performance.

If you stretch that to a 10-year time scale then both for Aviva and Legal & General, you see profoundly sideways-volatile charts – helping explain why the market continues to exact high yields by way of stock pricing. At 248p, Legal & General’s prospective yield is close to 9%, albeit only just covered by earnings.

Interestingly, Aviva had risen by nearly 40% since March 2020 whereas at the same time Legal & General was at the same price at 248p (though proceeded to hit a 165p low). I think this chiefly reflects the new CEO’s actions from late 2020.

Why income investors should stay attuned to Aviva

Admittedly, the 2023 results were very good for a near £13 billion company in relatively mature markets. Operating profit rose 9% on insurance premiums (sales) up 13% with a similar advance in operating value for assets in support of insurance, wealth and retirement. Protection and health insurance rose 16%. Can such momentum be sustained in the medium term?

- DIY Investor Diary: why I’m ‘all in’ on this volatile gilt

- Insider: Rolls-Royce and Glencore among four FTSE 100 deals

Yet with £750 million cost savings being achieved a year early, management asserted confidence in generating surplus capital, raising dividend guidance and embarking on a £300 million buyback programme – “taking the total amount of capital returns and dividends paid to shareholders over £9 billion over the last three years. Our preference remains to return surplus capital regularly and sustainably to shareholders.”

While the cash cost of the dividend was guided up “mid-single digits” (per cent) it will be modestly enhanced also in per share terms by reducing shares in issue. Thus, expect around near 10% dividend growth as consensus for 2025.

First-quarter 2024 results broadly affirm momentum

There was little to imply a slowdown, despite the stock being priced as if expecting such in due course.

General insurance premiums rose 16% to £2.7 billion although protection and health eased to 5% growth – if much smaller in context at £106 million. Reflecting confident times for investing, wealth management saw a 15% jump in net flows to £2.7 billion and retirement was also up strongly, by 13% to £1.7 billion.

The CEO proclaimed “clear competitive advantages – in our brand, scale and diverse business.” Strategic acquisitions continue in Canada, the Lloyds London market, and “the attractive UK protection market” broadening distribution.

Operating profit of £2 billion by 2026 is targeted, relative to near £1.8 billion last year, although £3.9 billion was achieved in 2019 and near £2.4 billion in 2017 (see table).

Still moderately attractive for total shareholder return

A sceptical view could be that recent stock weakness shows the market is going to remain essentially wary of insurers, PE multiples being unlikely to advance (much) into the teens.

Yet this plays to income-oriented investors given it prices the stock attractively in yield terms, especially for such a well-established business that is relatively less cyclical.

- Stockwatch: is this an existential crisis for GSK?

- ii view: dividend star British American Tobacco on track in 2024

While a slump in financial markets will always hit the value of insurers’ portfolios, demographics imply persistent demand for retirement savings products.

Aviva’s prospective yield is no less than it was in March 2020, yet its operations are better-streamlined and cost-effective.

With a Labour government being perceived as centrist and with a cautious fiscal approach, the UK stock market may benefit, hence it worth being positioned now in financials which are set to benefit. I therefore retain a “buy” stance.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.