Stockwatch: are interest rates really coming down soon?

A belief that interest rate cuts are imminent and that central banks can achieve a Goldilocks scenario for the economy, underpin this stock market rally. Analyst Edmond Jackson assesses the likelihood of possible outcomes.

28th March 2024 10:20

by Edmond Jackson from interactive investor

Investors have given an enthusiastic welcome to the Bank of England governor saying “we are on the way” to interest rate cuts, after they were just recently left unchanged at 5.25%, a 16-year high.

He added that last month’s drop in inflation to 3.4% was “very encouraging and good news” and rate cuts could come before inflation hits a 2% target.

This has created speculation of a cut as soon as May, further boosting animal spirits. Some rather parabolic curves on shares since last autumn continue to extend.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Last Wednesday, I joined an investment webinar at which consensus was presented for interest rates to settle around 3% in the second half of this year. If that is the scenario that shares are roughly pricing for, is it a fair one? Otherwise, there could be a classic disconnect between expectations and reality.

It started when the US Federal Reserve ‘pivoted’ last November

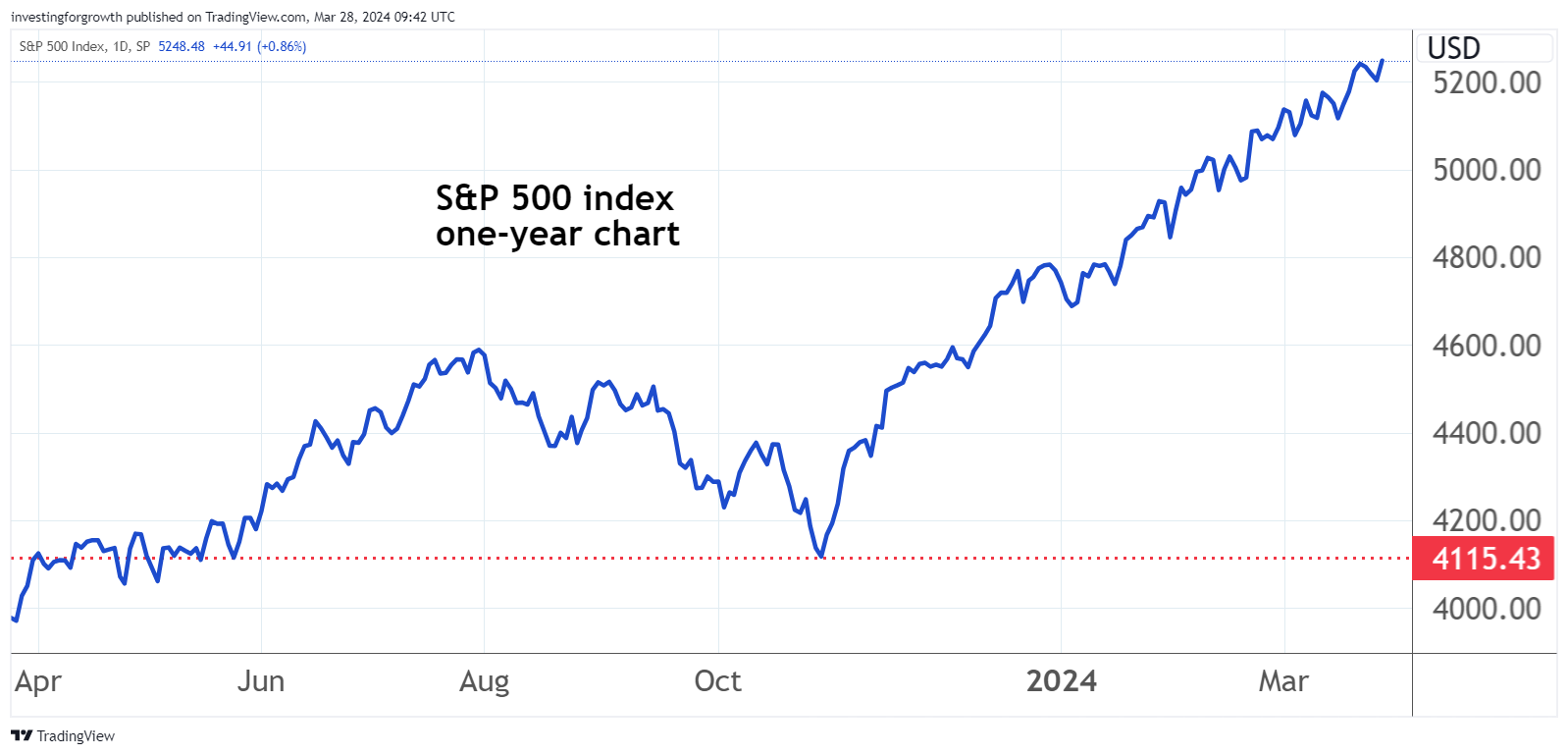

Global equities have rallied, led by the S&P 500 rising 26% in a pretty much straight-upwards line after the Fed changed its narrative on interest rates - from needing to keep them elevated (to achieve 2% inflation) to anticipating cuts.

Source: TradingView. Past performance is not a guide to future performance.

A relief rally was followed by a resumption of the artificial intelligence (AI) sector rally, where debate rages as to whether prices such as for NVIDIA Corp (NASDAQ:NVDA) constitute a bubble. Also, whether soaring asset prices represent an “easing” of monetary policy already, given many Americans are back spending like there’s no tomorrow.

The US situation is thus mixed: affluent people, constituting some 40% of consumer spending, out enjoying themselves, while another segment defaults on its car loans. The delayed effects of interest rates going higher 12 to 18 months ago, continue to bear down on US businesses and banks with stretched balance sheets.

Overall debt default rates are edging up. S&P Global Ratings expect the US speculative-grade, corporate default rate to reach 4.75% by December 2024, from 4.5% in December “however this may include a peak default rate earlier in the year...”

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Nvidia is AI gold-rush winner, and two ‘weatherproof’ stocks

Monetary policy is effectively both loose and tight currently. Can it get inflation down to 2%? Otherwise, “higher interest rates for longer” becomes the more credible scenario.

We see this quite similarly in the UK. Restaurants and pubs are busy despite high costs of eating/drinking out. Plenty of people I know are holidaying, not necessarily for Easter. A builder has cited to me a definite upturn in site sales and homes for refurbishment.

US employment data was strong in January and February, helping inflation measures pick up. It surprised me when the last Fed meeting kept the “lower rates ahead” narrative alive, helping shares continue to soar – this last week’s profit-taking being easily absorbed.

But it is contorted policy, how a central bank has allowed if not encouraged exuberance, resulting in financial conditions that are neutralising some of the effects of previous rate rises.

Here, just as 3.4% consumer price inflation is announced, a 9.8% hike in the National Living Wage is poised to kick in. The effect I think could be part-inflationary as businesses which can, pass on costs, but in competitive service industries, for example, some margin erosion will be accepted. Anyway, it seems to exemplify how properly grinding inflation down to 2% will get harder.

Yet stock sentiment indicators point firmly to ‘greed’

The US bristles with this kind of data. Media organisation CNN’s Fear & Greed Index incorporates seven barometers of market sentiment and is in “greed” territory. Then there is the AAII Investor Sentiment Survey, which shows around 46% of investors are bullish versus an historic average around 37%.

Similarly, the Charles Schwab Trader Sentiment Survey has soared to 53% – the highest level of bullishness since this survey launched in 2021 – against 32% in the fourth quarter of 2023.

- Three UK banks about to pay shareholders over £6bn

- How to build a £1 million pension and ISA portfolio

The Investors Intelligence bull-bear ratio, which fell to a cyclical low of 0.57 during October 2022 (and reliably checked the post-2008 crisis market low) has risen to 4.20, the highest since end-2017.

It certainly offers something to think about. Warren Buffett has a famous adage: “Be fearful when others are greedy, and vice versa.”

What could be reassuring is that we are still at a relatively early stage in the cycle where high interest rates to tackle inflation do ease. The question is when?

What if the Fed does not cut rates this year?

Recently, Torsten Stok, chief economist at Apollo Global Management (a US asset manager best known for private equity takeovers) has indeed asserted this. Yet share prices have continued to rise, as if fear of missing out is taking over.

You could ask, why are central banks so wedded to this 2% inflation target anyway? Yes, apart from high inflation enabling debtors to enjoy their loans reducing in effective value, we would all prefer sound money. But with UK inflation edging below 4%, at least one economist has said the Bank of England should cut rates now or turn us back to recession. I suspect this is why the governor’s narrative has turned “dovish” lately.

The 2% target originated in 1989 when New Zealand wanted to codify the independence of its central bank and, in an off-hand remark, one official mooted “zero to 1%” inflation, which was knocked down by another – suggesting 2% so as to avoid an unnecessary rod of public expectations.

- Stockwatch: can you trust this 7% yield from a utility?

- Interest rates held again: how does the UK compare to other nations?

Some might ask, how relevant is that now, should we not learn to live with moderate inflation and go for growth, to cope? But the invidious dilemma with ingraining inflation is that people less well-off usually coming off worse.

With stock prices soaring, a possible crunch point approaches. Will US inflation measures pick up further, thus discrediting what the Fed is doing, and force its governor into a change of narrative?

Inflationary risk is ultimately a reminder to investors about how shares in well-established companies with relatively resilient pricing power for goods and services, are your best defence.

If an argument for “disconnect” between share prices and economic reality has substance, then be steeled for a market drop. I suspect it would end up being bought, therefore long-term investors ought not worry this Easter.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.