Stockopedia: 10 stocks that brokers are backing to grow fast

Want to spot the stocks on the move in the months ahead? We lay out the momentum investing strategy.

17th February 2021 14:55

by Ben Hobson from Stockopedia

Want to spot the stocks on the move in the months ahead? We lay out the momentum investing strategy.

Momentum is a stock-market concept that gets thrown around a lot - usually when it comes to describing bullish conditions with prices on the up. There’s a glimmer of truth in that, but momentum as a predictable driver of returns actually has solid academic backing. Moreover, many traders will tell you it’s one of the most powerful forces at work in the market.

To varying degrees, a whole host of investment strategies use price momentum. Buying stocks that are trending higher is an important factor. While the past is no guarantee, it can often be a guide to what comes next. And from an academic viewpoint, strong trends do indeed tend to persist.

But prices aren’t the only place to find momentum in stocks. Momentum in fundamentals - which is sometimes called ‘earnings momentum’ - is another important way of predicting the future direction of a share. Looking for signs of accelerating earnings growth is a key feature of some trading strategies because companies that are doing well tend to keep doing well over the near- to medium-term. That, in turn, reflects in their share prices.

Last autumn, we explored a screen here that endeavours to capture the idea of earnings momentum. But rather than digging into financial summaries on a stock-by-stock basis, it looks for companies that are attracting the biggest upgrades to their earnings forecasts from their analysts. These are the stocks that, on average, brokers have the biggest confidence in.

- Stockopedia: strategies to diversify your portfolio and manage risk

- Stockopedia: 10 micro-cap value plays with momentum behind them

- Stockopedia: 10 large-cap dividend shares set to grow payouts

By its nature, the earnings upgrade momentum strategy only really finds lots of ideas when the economy and companies have an optimistic near-term outlook. After all, finding stocks that are forecast to grow fast in very poor and unpredictable economic conditions is hard to do.

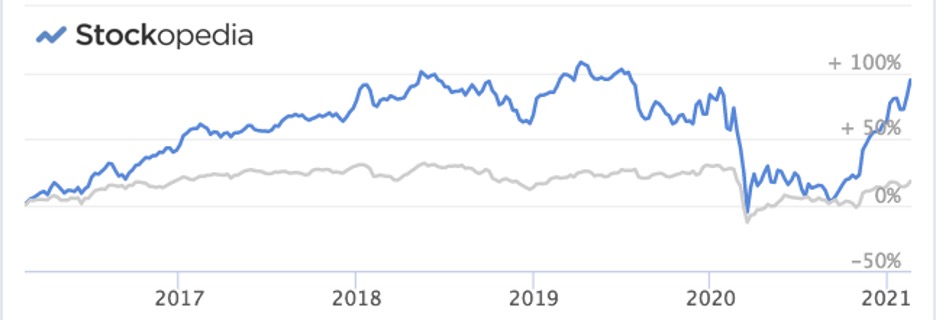

A year on from the collapse that came with the coronavirus crisis, the number of companies passing the earnings upgrade momentum screen is growing. What’s interesting is that it offers a sense of trends in the market. These are the early clues to companies and sectors that may be poised to do well. And you can see from the chart below how well this strategy has recovered in recent months.

Past performance is not a guide to future performance.

Right now, mining remains the biggest theme in this screen. Stocks involved in both industrial and precious metals are seeing strong upgrades to their earnings forecasts. But it’s also here that you see the impact of solid operational performances at companies such as Royal Mail (LSE:RMG), Barratt Developments (LSE:BDEV) and online retailer ASOS (LSE:ASC). An interesting addition is the package holiday group TUI (LSE:TUI), which appears to be winning over analysts despite the uncertainty of the holiday season this year.

Name | Mkt Cap £m | % 1m EPS Upgrade FY1 | % 1m EPS Upgrade FY2 | # 1m Upgrades | Sector |

4,785 | 40.1 | 43.0 | 2 | Industrials | |

2,014 | 10.2 | 24.5 | 4 | Basic materials | |

3,969 | - | 21.2 | 4 | Consumer cyclicals | |

1,970 | 7.43 | 20.2 | 3 | Basic materials | |

38,419 | 1.94 | 13.8 | 4 | Basic materials | |

101,299 | - | 12.0 | 7 | Basic materials | |

2,068 | 5.78 | 7.00 | 2 | Technology | |

114,308 | 4.39 | 7.00 | 3 | Basic materials | |

7,067 | 7.32 | 5.86 | 14 | Consumer cyclicals | |

5,559 | 6.59 | 5.82 | 2 | Consumer cyclicals |

It’s important to note that predicting the future in uncertain times is fraught with risk. But the earnings upgrade momentum strategy offers an interesting view on some of the stocks and sectors that City analysts believe might be poised to benefit in the months ahead. It’s a way of capturing momentum in action to see which stocks are on the move.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.