The stock to own in this booming industry

These two giants of air travel have enough work to keep them busy for many years to come, and more big orders are expected. Overseas investing expert Rodney Hobson runs through the numbers and picks his favourite.

22nd November 2023 08:54

by Rodney Hobson from interactive investor

During the pandemic we learnt to live without foreign holidays and business people found they could communicate equally well over the airways as by travelling with airlines. Green protestors against fuel use were in the ascendancy.

Yet this autumn has proved to be a season for renewal of life in aircraft manufacturing, as rivals Boeing Co (NYSE:BA) and Airbus SE (EURONEXT:AIR) have been winning new orders from flag carriers seeking new, more fuel-efficient planes to thrust them into a brave new world. Their problem now is not to drum up orders but to avoid being overwhelmed by them.

Current order books for the two giant manufacturers are reckoned to be approaching 14,000, more than the previous record achieved just before the pandemic dealt a supposed death blow to air travel.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

The total of additional orders so far this year has been 2,500, easily beating last year’s tally of 2,064, with five weeks still to go. The Dubai Air Show, held in mid-November, has been particularly lucrative, with a range of orders from Europe and the Middle East.

The bulk of outstanding orders have gone to Airbus, with 8,000 planes on the order book, while Boeing is approaching 6,000. Airlines could well be tempted to get further orders in quickly, since the queue for top sellers such as Boeing’s 737 Max stretches to four years or more for the first delivery.

Boeing halved its third-quarter loss to $1.64 billion on a 13% rise in revenue to $18.1 billion despite a disappointing performance in the defence sector, where it faces stiff competition from American rivals such as Lockheed. At least the supply chain, which was a serious worry last year, has stabilized. Another positive is that the group has cash flowing in rather than out, with free cash flow for the full year forecast at $3-5 billion.

At Airbus, revenue increased 12% to €14.9 billion in the third quarter, but net earnings slipped 9% to €2.33 billion, again with the commercial aircraft side doing well as production was ramped up but defence and space falling short.

While Boeing has put two fatal crashes of its 737 Max behind it, Airbus has suffered an unexpected glitch in one of the engines powering its new fuel-efficient A300. While the cost of compensation to airlines will fall on engine manufacturer Pratt & Whitney, any disruption to A300 production will hit Airbus’s reputation and revenue.

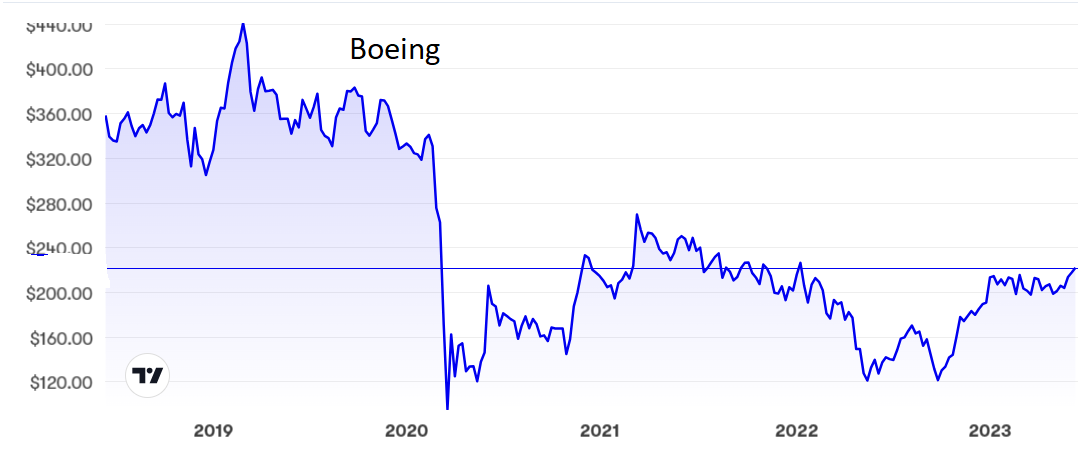

Boeing shares have not got back to pre-pandemic levels between $320 and $440 but they are well off the low of $95 hit in May 2020. They bottomed out at $120 twice last year but that floor has been left well behind and the current level is around $218. However, that is still shy of a recent peak of $240, which is likely to be reached again soon.

Source: interactive investor. Past performance is not a guide to future performance.

One drawback is that there is no dividend and, because Boeing made a loss in its last financial year, no means of calculating an historic price/earnings (PE) ratio, so great faith has to be placed in the company’s ability to make the most of its immediate rosy prospects.

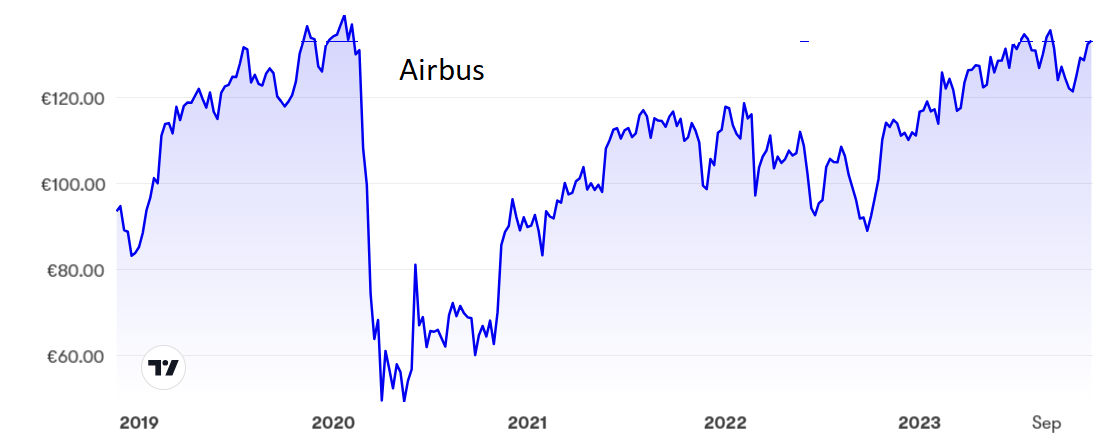

Airbus shares fell off a cliff as the pandemic struck, collapsing from €140 to €40 in pretty short order, but they have recovered further and more steadily than Boeing’s, reaching $134, where the PE is 26.2 and the yield 1.35%. These are not particularly impressive figures but at least they are far better than the non-existent ones at Boeing.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I stick to the view that I expressed in June that Airbus is clearly the better prospect, as is reflected in the superior share price performance of late. Buy Airbus below €140. Boeing is no more than a hold.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.