A solid defensive stock built for recovery

23rd November 2022 08:31

by Rodney Hobson from interactive investor

A long-time fan of this huge energy supplier, overseas investing expert Rodney Hobson believes it still offers good value, an attractive dividend yield and portfolio diversification.

From mid-September to the middle of October was a torrid time for American energy suppliers. However, the selling was overdone, and it is now possible to buy solid defensive stocks for recovery.

Profits at Duke Energy Corp (NYSE:DUK) really took off last year, with earnings up 27% as the United States bounced back strongly from pandemic shutdowns. That rate of growth could not possibly continue, but high single figures are certainly still possible, indeed likely.

- Read about: Free regular investing | Opening a Stocks & Shares ISA | Cashback Offers

The North Carolina-based company has two strands: it supplies regulated electricity to 8.2 million customer and natural gas to 1.6 million customers across six adjoining states; and it has developed a renewable energy arm.

Third-quarter results were a little disappointing. Although revenue of $7.97 billion, an improvement of 14.6%, beat analysts’ forecasts, adjusted earnings per share at $1.78 on net income virtually unchanged at $1.4 billion, fell a little short of expectations. The figures were distorted by higher depreciation and amortisation costs, lower returns on investments and higher interest rates. The rising cost of fuel used to generate electricity was another factor, and one that is not going away any time soon.

Duke has now trimmed its forecast earnings per share for the full year to come at just below previous guidance of $5.30-5.60, but the new figure strips out the proposed sale of renewable energy operations. It expects $5.55-$5.75 to be achieved next year and it has stuck to its projection of longer-term earnings per share growth at 5-7%. Given the current volatile climate for energy, investors should treat these projections with caution.

- Energy crisis drives global dividends to new record

- Nasdaq’s record high one year on: will 2023 be a year to celebrate?

The mood of investors has not been helped by directors selling shares over the past 12 months. The biggest single sale was at $98.57 by chairman Lynn Good, who parted with nearly 2 million shares, hardly a vote of confidence.

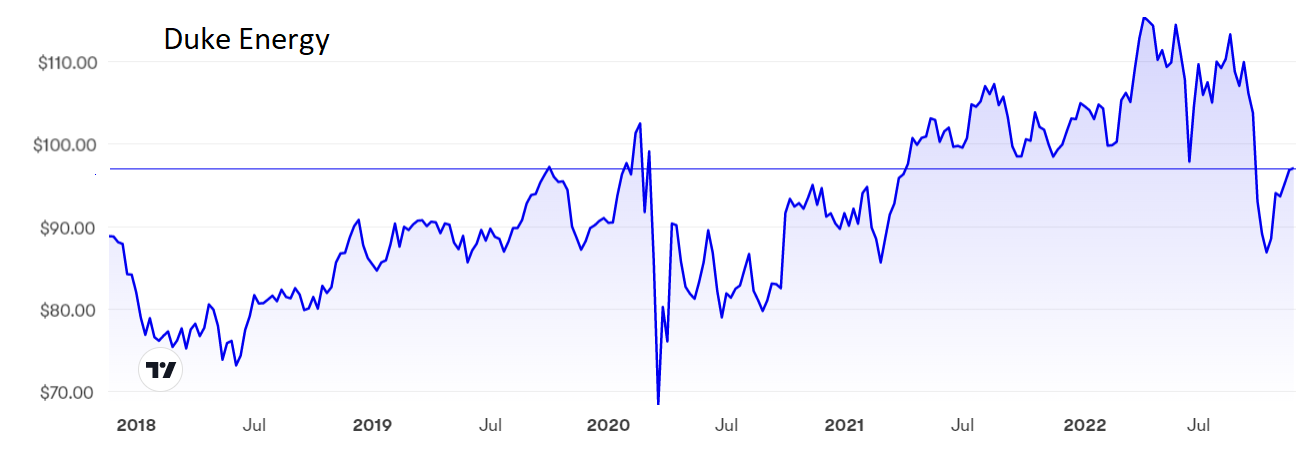

Source: interactive investor. Past performance is not a guide to future performance.

Given that Duke polished its green credentials by building up its renewable energy resources it may seem strange that these operations have been put up for sale, but the move does make a lot of sense. Renewables were the poorest part of the group in the latest quarter as fewer projects were pressed into service because of the impact of earlier supply chain shortages. Also, they represent less than 10% of revenue, so a sale will allow management to concentrate on the main regulated energy business.

The sale should easily raise $5 billion, which will reduce debt and strengthen the balance sheet at a time when borrowing is set to become increasingly expensive. This is not a fire sale and Duke can stick out for a decent price, which could soon be forthcoming. The hope is to complete the sale by the end of next June.

Duke will still qualify for substantial tax incentives through the US Inflation Reduction Act, as it spends $145 billion over the next 10 years to expand and modernise its power and natural gas operations to reduce emissions.

Nuclear plants in North and South Carolina will qualify for "several hundred million dollars a year beginning in 2024" and solar power could add another £1 billion a year in due course.

Duke shares peaked at $115 last year, but the rot really set in around mid-September with a slump from $110 to $85 in exactly one month. They have been edging back up over the past six weeks to stand at $98, where the price/earnings ratio of 19.7 still reflects last year’s stellar growth and looks a little challenging as the company faces tougher challenges.

However, the yield of 4.1% will offer more than adequate compensation if the latest share price rise peters out, as is admittedly possible.

Hobson’s choice: I have been a long-term fan of Duke Energy as a defensive stock and renew my buy rating, especially while the shares remain below $100.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.