Small-caps – why it might be time to consider an allocation

7th June 2023 09:16

by Insights team from Aberdeen

No one invests in small-caps during an economic downturn, right? Here’s why it might be time for a rethink.

Many risk-averse investors often avoid smaller companies during a recession. They then return to the asset class when the economy returns to growth. However, we believe this long-held strategy is incorrect. For, dig a little deeper into the data and a surprising conclusion presents itself: the time to start allocating capital to small caps in economic downturns is usually sooner than investors think.

Smaller companies outperform earlier than expected

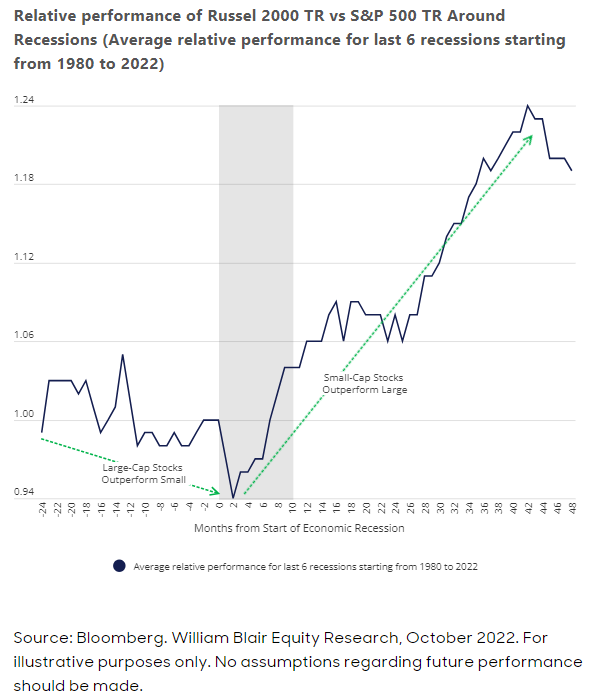

Let’s look at the performance of smaller and larger companies in different economic scenarios. Chart 1 shows the relative average performance of US small caps versus large caps, before, during and after recessions (dating back to the 1980s). Of course, each recession is different, with different mechanisms at play. Nonetheless, three factors stand out.

Firstly, larger companies tend to outperform their smaller rivals before, and at the start of, recessions. This makes sense. In economic slumps, risk-averse investors typically favour safer assets. In the equities space, this means more mature, well-established larger companies. Their markets are often less volatile and earnings more stable. By contrast, investors view smaller companies as riskier investments. Many businesses aren’t as entrenched as bigger firms. Earnings and profit margins can therefore come under pressure in times of upheaval.

Secondly, these factors are turned on their head when we exit a recession. In recovery periods, smaller companies usually outperform their larger rivals. By their very nature, small caps are nimbler and able to react faster than large caps to changes in the business environment. Smaller firms can therefore take advantage of the new opportunities a growing economy offers. The consequent rise in investor risk appetite also helps smaller companies.

So far, so predictable. But the third point is not widely known: smaller companies have historically started outperforming large caps soon after a recession starts. As you can see from Chart 1, this rebound can begin as early as three-to-six months into a recession. That’s because the market tends to price in an economic recovery before it happens. Yet this phenomenon is not part of the traditional small/large-cap narrative. We believe this disconnect creates opportunities for active investors.

Smaller Companies in a recession

Interesting data from William Blair on US Small vs US Large

A potentially attractive entry point

Valuations are also attractive. In Europe, smaller companies have historically traded at an average premium valuation of c.8%1 to large caps thanks to their superior growth and earnings potential. Following last year’s poor showing, European smaller companies currently trade at a discount to their larger peers of c.20%. Given the potential rebound as we exit downturns, this could represent an attractive entry point for long-term investors.

A similar dynamic is at play in the US. Here, the valuation discount of small caps relative to large caps is as wide as it has been in more than 40 years. We believe this creates excellent long-term opportunities. Indeed, after US small caps reached a similar level of ‘cheapness’ in early 2001, small-cap stocks materially outperformed larger caps over the subsequent three-, five- and 10-year periods2.

What about today’s high inflation, high interest-rate environment?

As we highlighted, every downturn has its own characteristics. This time is no different. Today, elevated inflation is a major factor (although it remains benign in much of Asia). Developed market central banks have responded by aggressively hiking rates. As a result, inflation is retreating from its summer highs, particularly in the US. However, it remains well above many central banks’ targeted rates, notably in the UK and Europe. For example, eurozone inflation came in at 7% in April, compared to ECB’s 2% target. Further interest rate rises are therefore possible.

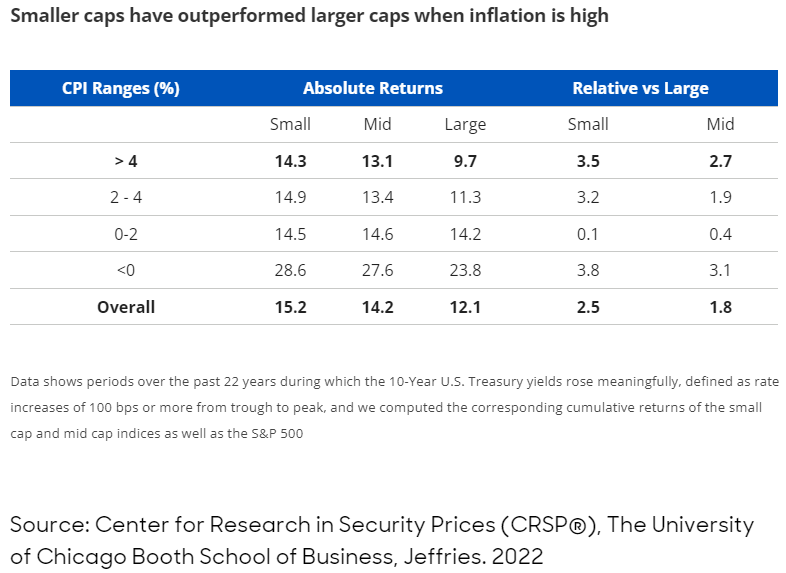

Nonetheless, we believe high inflation shouldn’t worry small-cap investors. Indeed, smaller companies have historically outperformed large caps in periods of elevated inflation (see table below – past performance does not predict future returns). That’s because many smaller companies operate in niche industries or areas of the market with few players. They’re also often a critical link in complex supply chains or wider manufacturing processes. As a result, they can dictate higher prices despite their size, allowing them to pass on costs to protect their margins. They also have the agility to change where they source goods and materials, further helping to control costs.

What about elevated interest rates? Many assume that higher rates hurt small caps more than larger caps. That’s because many small caps are starting out and have weaker balance sheets and lower profit margins. This is the case for some businesses. However, as anyone watching the headlines knows, several larger companies have also been found wanting in the world of higher interest rates. In short, durability frequently comes down to the quality of the company.

The importance of quality

That’s why we focus on high-quality firms, irrespective of the macroeconomic backdrop. That is, those with low leverage, strong profitability and consistent earnings. True, quality has underperformed in 2022 as many investors rotated into value stocks. But with the economy deteriorating, we believe investors will increasingly favour companies with robust business models, pricing power, healthy balance sheets and unique growth drivers.

Final thoughts…

So is now a good time to start considering smaller companies? Given the challenging economic backdrop, the traditional answer would be a resounding ‘no’. However, as we have shown, smaller companies might be more resilient in the current inflationary climate than many assume. Indeed, small caps have outperformed their larger peers since the start of the year. Using history as a guide, we can also see that smaller companies start to rebound quicker during economic downturns than is widely assumed. With valuations depressed, investors could therefore pick up great long-term opportunities at a discount.

- Bloomberg, long-term price earnings ratio, valuation of MSCI Europe Small Cap to MSCI Europe, 01 Jan 2008 to 31 Mar 2023.

- Source: FactSet, Bloomberg, abrdn, 31 March 2023.

ii is an abrdn business.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.