A shot across the bow for funds with overseas earnings

17th September 2018 10:02

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Speculation around the outcome of Brexit negotiations is gathering intensity, and the result will have a huge impact on financial markets. Saltydog analyst Douglas Chadwick explains what could happen to our investments.

In almost exactly six months the UK is due to leave the EU and so it's not surprising that pressure is mounting for some form of deal to be done. There's an EU summit next month, where both sides hope to agree an outline of future relations, and if that doesn't materialise there's another chance in December. Even so, there's not much time left, and the government has even started releasing its 'no deal' planning documents.

The uncertainty has made markets nervous, and knee-jerk reactions to any new news makes it unlikely that the recent volatility will ease.

The most recent example was when Michel Barnier said that a "Brexit deal was realistic in six to eight weeks". The pound immediately gained in value and has subsequently risen above $1.31 for the first time since the beginning of August. In the last four weeks it has strengthened by over 3%.

It's encouraging to think that a deal will be done, and we may be pleased if confidence in our currency returns, but we also need to be mindful of what could happen to our investments.

• Top-performing sectors and funds to play them

• Saltydog Portfolio: allocation to technology sector 'essential' for investors

• 10 most-bought funds in August 2018

As sterling strengthened, the FTSE 100 dropped below 7,300 – it had fallen 3% in a couple of days. This relationship is due to the fact that a high proportion of the earnings of the companies in the FTSE 100 are made overseas and, as sterling strengthens, the value of these fall when converted back into pounds.

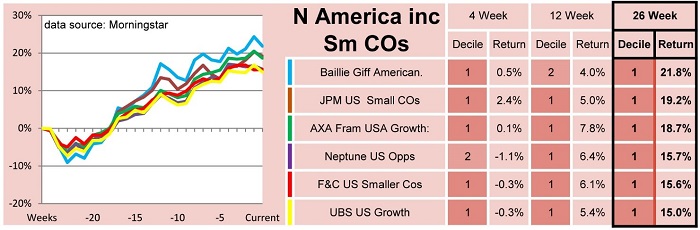

It has had an even greater effect on funds which have to invest overseas. Here's our latest table showing the performance of the leading funds in the North America and North American Smaller Companies sectors, based on their returns over the last 26 weeks. As you can see they've all fallen back in the last week.

Past performance is not a guide to future performance

It's only a minor correction, and you certainly wouldn't be unhappy if you'd been holding any of these funds for the last six months.

However, if we compare this table to the one from the previous week, the four-week cumulative return for the leading fund, Baillie Gifford American, has dropped from 5.6% to 0.5%, so it's not insignificant. Similar trends can also be seen in the Technology and Telecommunications sector and the Global sector.

What this latest movement does show is how sensitive the overseas funds are to the value of sterling, and how sensitive the value of sterling will be to the outcome of the Brexit deal.

On the evening of the referendum, when the consensus was that we would remain in the EU, the pound briefly rose above $1.50 – that's 15% higher than it is now. Go back to 2014 and it fluctuated between $1.60 and $1.70.

If the outcome of the Brexit negotiations looks as though it will be more positive than expected, we could see the pound strengthen again. If it's a dramatic rise, the opposite of what we saw in 2016, then that would be bad news for the FTSE 100 and any funds with overseas earnings and assets.

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.