Shares for the future: will sparks fly at this small-cap?

It may be a good long-term investment, but there will be times when this company struggles to profit and does not look like it, writes analyst and happy customer Richard Beddard.

2nd August 2024 15:17

by Richard Beddard from interactive investor

The first act in the annual ritual of scoring a share is to remind myself of the previous year’s score.

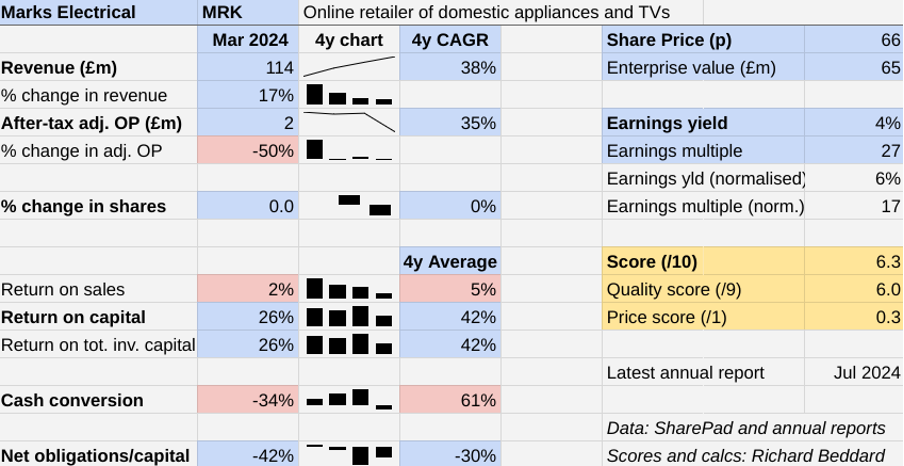

The Decision Engine scoring system has changed since last year, but I can roughly translate online domestic appliance retailer Marks Electrical Group Ordinary Shares (LSE:MRK) old score into my new vernacular.

- Invest with ii: Top UK Shares | Free Regular Investing | What is a Managed ISA?

Having floated during a pandemic boom, Marks Electrical’s track record was too short for me to be confident in its dependability. The business was very distinctive though, and although I had questions about how it might perform in a recession, its strategy seemed to be taking it in a profitable direction.

Scoring MRK: counting the cost-of-living crisis

The second act in the ritual is to put the latest numbers in my spreadsheet.

Now we have answers to the recession question. In the year to March 2024, we experienced a cost-of-living crisis. The markets for domestic appliances and consumer electronics contracted.

Marks Electrical increased pay by 10% on average, adding to its costs. People traded down to cheaper appliances, reducing its revenue per item.

Total revenue increased as Marks Electrical took market share, but after-tax operating profit tumbled by 50% or 97%, depending on how we measure it.

The Past (dependable) [1.5]

- Profitable growth: Revenue growth, profit contraction since IPO [0.5]

- Strong finances: Net cash [1]

- Through thick and thin: Insufficient data [0]

On an adjusted basis profit fell 50% and cash flowed out of the business, using up some of the company’s surplus cash.

On an unadjusted basis, profit fell 97%. The difference is the cost of a new IT system, which is not included in the adjusted figure. The company says that one-off costs (mostly consultancy fees) associated with the implementation of the system have been ignored to give a better impression of how it traded.

The spending is continuing in the current financial year, so we can expect adjustments in the next set of results too.

While Marks Electrical will not be intending to install another Enterprise Resource Planning (ERP) system any time soon, I am a bit wary of ignoring these costs. Companies have other IT systems they may need to upgrade or replace and ignoring costs can in the end make a bit of a mockery of profitability.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Olympians, the Bank of England and fine margins

Taking the more generous adjusted profit figure, Marks Electrical only made £2 million in after tax operating profit and a 2% margin, compared to 9% at the height of the pandemic and 5% in 2023.

Cash flowed out of the business because Marks Electrical earned less of it, but also because of its investment in IT, and continuing investments in its fleet and warehouse.

So Marks Electrical can do pretty averagely when times are tough, and this may be exacerbated by an important aspect of its business model

The Present (distinctive) [3]

- Discernible business: Vertically integrated online only premium retailer [1]

- With experienced people: Chief executive Mark Smithson is the founder [1]

- That creates value for customers: High service levels, competitive prices [1]

Marks Electrical’s business model focuses on bulky premium appliances, which earn it more profit for each sale but are relatively difficult to deliver.

The premium price tag allows the company to spend more on delivery, which pays for its own fleet of customised two-person delivery vehicles with specially trained drivers and installers, and free next day delivery above certain price points (to 90% of the UK population).

The fleet operates from a central hub in the middle of the country near Leicester, which means that appliances are loaded on and off lorries only once and they are less likely to arrive damaged.

Marks Electrical delivers 85% of orders itself. Only 15% of orders (mostly smaller consumer electronics products) go by courier, and that means customers are more likely to be satisfied.

As a customer, I know that the company’s close attention to our needs is also apparent in the company’s easy-to-use website and call centre, which has a policy of providing a resolution in one call.

It also keeps pricing competitive, so customers can be confident they will not overpay and receive quick and hassle-free service that extends to installation and recycling.

The architect of this highly optimised, customer focused, and vertically integrated business is Mark Smithson, Marks Electrical’s chief executive. He founded the company in 1987.

The Future (directed) [1.5]

- Addressing challenges:Recessions, competition [0.5]

- With coherent actions: Vertical integration, brand advertising [0.5]

- That reward all stakeholders fairly: Employee focus. Mark Smithson owns 74% [0.5]

Demand for domestic appliances is more consistent than you might think. Things would have to be pretty bad to consider dispensing with a washing machine when it breaks down, for example. Marks Electrical said last year that 80% of revenue was from so-called “distressed” purchases.

However, the company’s focus on premium domestic appliances, normally a strength, becomes a weakness when people trade down to cheaper products. This is because it earns less revenue per item, but the cost of delivery is fairly fixed.

Mark Smithson says margin fluctuations, “present us with an opportunity to learn,” but it is difficult for a company that so obviously wants to do better than competitors such as Curry’s and AO World to also do things on the cheap.

For example, Marks Electricals says finding efficiencies in distribution and installation is a priority in the current year, when higher pay and a new in-house installation team contributed to a 53% increase in distribution costs last year.

- Stockwatch: a recovering finance stock at a discount

- Lloyds Bank shares downgraded as NatWest tipped to top £4

The company does not want to skimp on services that elevates it above competitors, but can it afford them when it is forced to sell less profitable products?

That said, 24% of customers returned to buy another product within a year (compared to 25% in 2023) generating a good level of repeat business in an improbable sector. While the company keeps customers happy, revenue growth seems assured.

Marks Electrical still has a small share of the Major Domestic Appliance market (2.8% of the whole market, and 5.3% of online sales), and the opportunity, now it has sufficient resources, to make itself better known through national and local advertising campaigns.

It has also ended its relationship with Euronics, a collective buying organisation, preferring to deal directly with suppliers.

Mark Smithson comes across as a typical founder, championing customers and nurturing employees, but his 74% shareholding is off putting. It gives him near total control of the business, and whether or not it remains listed.

The price (discounted?) [0.3]

- A little. A share price of 66p values the enterprise at about £65 million, 17 times normalised profit.

A score of 6.3 out of 10 indicates that Marks Electrical may be a good long-term investment, but there will be times like now when it struggles to profit and does not look like it.

Marks Electrical is ranked 27 out of 40 shares in my Decision Engine.

18 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Solid State (LSE:SOLI), Latham (James) (LSE:LTHM) and Games Workshop Group (LSE:GAW) have all published annual reports and are due to be re-scored.

I have moved PZ Cussons (LSE:PZC) to the bottom of the table pending the publication of its annual report in September. The collapse in the value of the Nigerian currency and the impact on the company’s finances and strategy mean I no longer have faith in the score.

0 | Company | * | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 9.8 | ||

2 | Designs recording equipment, loudspeakers, and instruments for musicians | 9.0 | ||

3 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

4 | Supplies kitchens to small builders | 8.3 | ||

5 | Distributor of protective packaging | 8.3 | ||

6 | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.1 | ||

7 | Manufactures/retails Warhammer models, licences stories/characters | 7.7 | ||

8 | Whiz bang manufacturer of automated machine tools and robots | 7.7 | ||

9 | Manufactures filters and filtration systems for fluids and molten metals | 7.7 | ||

10 | Imports and distributes timber and timber products | 7.7 | ||

11 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.5 | ||

12 | Surveys and distributes public opinion online | 7.4 | ||

13 | Distributes essential everyday items consumed by organisations | 7.4 | ||

14 | Manufacturer of scientific equipment for industry and academia | 7.3 | ||

15 | Sources, processes and develops flavours esp. for soft drinks | 7.3 | ||

16 | Translates documents and localises software and content for businesses | 7.0 | ||

17 | Manufactures natural animal feed additives | 7.0 | ||

18 | Sells hardware and software to businesses and the public sector | 7.0 | ||

19 | Online marketplace for motor vehicles | 6.9 | ||

20 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 6.8 | ||

21 | Manufactures vinyl flooring for commercial and public spaces | 6.7 | ||

22 | Sells promotional materials like branded mugs and tee shirts direct | 6.7 | ||

23 | Retails clothes and homewares | 6.6 | ||

24 | Manufactures specialist paper, packaging and high-tech materials | 6.5 | ||

25 | Operates tenpin bowling and indoor crazy golf centres | 6.4 | ||

26 | Repair and maintenance of rail, road, water, nuclear infrastructure | 6.3 | ||

27 | Marks Electrical | Online retailer of domestic appliances and TVs | 6.3 | |

28 | Manufactures rugged computers, battery packs, radios. Distributes electronics | 6.3 | ||

29 | Flies holidaymakers to Europe, sells package holidays | 6.2 | ||

30 | Acquires and operates small scientific instrument manufacturers | 5.9 | ||

31 | Manufactures sports watches and instrumentation | 5.8 | ||

32 | Manufactures military technology, does research and consultancy | 5.7 | ||

33 | Supplies vehicle tracking systems to small fleets and insurers | 5.6 | ||

34 | Publishes books, and digital collections for academics and professionals | 5.5 | ||

35 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | ||

36 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 5.5 | ||

37 | Manufactures disinfectants for simple medical instruments and surfaces | 5.4 | ||

38 | Makes marketing and fraud prevention software, sells it as a service | 5.3 | ||

39 | Runs a network of self-employed lawyers | 4.5 | ||

v Frozen v | ||||

? | Develops and manufactures hygiene, baby, and beauty brands | 7.5 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.