Shares for the future: what I think about when I think about investing

It’s been a busy year for columnist Richard Beddard. He’s changed his stock scoring system while tracking 40 of the UK’s most interesting companies. Here, he explains his philosophy and how he does it.

29th December 2023 12:20

by Richard Beddard from interactive investor

Season’s Greetings!

First off, if you are here for the monthly Decision Engine update, it is at the end of this article. If you are wondering what that is, read on...

Since I made many changes to the way I score, rank and decide which shares to buy and sell in 2023, my final article of the year is an update of my last guide, which was itself a rewrite.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

I cover about 40 shares. Most weeks I score a share and we publish the breakdown.

The scores go into my Decision Engine spreadsheet and once a month we publish its output, which is a list of shares ranked by these scores. The article is titled: “Shares for the future”.

Also, once a month, I allow myself to make a single trade in the model Share Sleuth portfolio, which I have been running for interactive investor and previously Money Observer since 2009.

Either I reduce or eliminate a low-scoring holding, add a new high-scoring holding, add to an existing high scoring holding, or do nothing. These decisions, you see, are guided by the Decision Engine.

We publish this decision and report on the performance of the portfolio in an article entitled “Share Sleuth”.

Performance has been good over the long term. At the time of writing, Share Sleuth has grown by over 500% since 2009 while an index tracking fund would have grown by about 150% over the same period.

But my mixture of judgement and algorithms has not protected Share Sleuth from volatility. Twice it has declined in value by about 40%, much like the wider market.

Now, let us get into the nitty gritty.

What I think about when I think about investing

The task we set ourselves when we try to make money in the stock market is mind-boggling.

There are thousands of companies listed in London employing millions of people. Each business is unique, and buffeted by unpredictable external forces.

We think we can work out the best opportunities and avoid the booby traps, but we cannot compute all the permutations.

Having a philosophy and a strategy for implementing it reduces the problem of what to invest into a manageable size. My philosophy underpins the scoring and ranking system I call my Decision Engine and the model Share Sleuth portfolio.

Invest in people

For our purposes, a business is a group of people organised to make a profit. The idea I keep coming back to is that we invest in people.

The biggest business in the Share Sleuth portfolio is Garmin Ltd (NYSE:GRMN). Garmin has nearly 20,000 people working for it and an enterprise value of $23 billion.

At the other end of the scale is Anpario (LSE:ANP), a manufacturer of animal feed additives. It has an enterprise value of £50 million and employs just over 100 people.

Size means nothing if the people are badly organised. But if I have picked wisely, the Share Sleuth portfolio consists of perhaps 100,000 people organised into between 20 and 30 money-making machines.

They are specialists. In aggregate, I believe they should adapt to our changing economic circumstances and prosper over the long-term.

Investors often focus on how much to pay for a share, but it is a secondary factor. If the people are not right, the price is irrelevant.

Trust them to make money

When we buy a share, we are buying the right to a share of the surplus income, or profit, produced by these people. We expect they will be successful, and the money returned to us over many years will be far in excess of the money we put in.

Trusting them to make money requires us to understand how they make it, how they plan to make more in future, and what could stop them.

The best source of this knowledge is the annual report because that is where companies are legally required to explain themselves.

In the best annual reports, I find coherence: a business building on its strengths and addressing its weaknesses.

Through thick and thin

The investments companies make to grow their profits take years or even decades to mature and, as we have been reminded in recent years, bad things get in the way.

Instinct tells us to react in these situations. We can solve the problem of a pandemic, or a recession, or a trade war, by trading.

The advantage we have in these situations is speed, but if our instincts are wrong we will be making the wrong decisions very fast.

Good businesses may take longer to react, but they know a lot more than we do and so they are more likely to make the right decisions.

They will also have already made good decisions. They will have strong finances, warm relationships with employees, customers and suppliers, and products customers need.

These things help them to profit, even in difficult circumstances.

- Stockwatch: my top share tips in 2023 and what I’ll do with them now

- Top share picks for 2024: FTSE 100 stocks among nine to own

For everyone

As well as making us money, the companies we invest in shape the world we live in.

Good businesses solve problems and make life better for people, they entertain us, they provide employment and make us wealthier.

Bad businesses cause problems and tarnish our lives. They bully staff, harm customers, gouge suppliers, stifle innovation, pollute the environment and lie to shareholders.

That is reprehensible, but it is also unsustainable. It breeds resentment, attracts the attention of regulators and lawyers, and makes life more hazardous for us.

My philosophy is: “To invest in people and trust them to make money through thick and thin for everyone.”

It guided me to invent a method of scoring and ranking shares, my Decision Engine.

In turn, the Decision Engine guides my trades in the Share Sleuth portfolio.

Scoring and ranking shares

The Decision Engine’s scoring system cobbles together an assessment of the business with an assessment of the share price.

A business can score a maximum of 9 points in 3 categories that seek to establish its dependability, its distinctiveness and the degree to which it has control of its direction.

The Past (dependable) [3]

● Profitable growth

● Strong finances

● Through thick and thin

The Present (distinctive) [3]

● Discernible business

● With experienced people

● That creates value for customers

The Future (directed) [3]

● Addressing challenges

● With coherent actions

● That reward all stakeholders fairly

In each category I award a maximum of 1 point for each of three sub-factors. These factors are unique to each business, so it is not possible to itemise them further.

The only way to see my reasoning is to read the breakdowns of the scores for each share on my author page. Links to the latest scores for all 40 shares are provided in the Decision Engine table of each “Shares for the future” article.

Unlike the other scores, the price score is calculated differently. It has less weight than them in aggregate, but it is the single most important factor.

A share price can receive a maximum score of 1. It can also receive a negative score, and the maximum negative score is -3.

The price (discounted?) [-3 to +1]

The price score uses a souped-up version of everybody’s favourite Price/Earnings (PE) ratio.

Unlike the other scores, it is calculated automatically and re-calculated every day using the previous day’s closing share prices.

My spreadsheet uses enterprise value (the value of equity and debt) instead of the more common market capitalisation (the value of equity) to put a price on the business.

It also normalises profit by determining how much the company would have earned if it had achieved an average return on the capital it employed in the last full financial year.

- AIM share tips review 2023: two big winners and hope for the rest

- Stockwatch: four share tips to keep hold of

By dividing this average profit figure into price (enterprise value), we get a normalised earnings yield. We can translate it into a PE ratio using its reciprocal because the PE is simply price divided by profit.

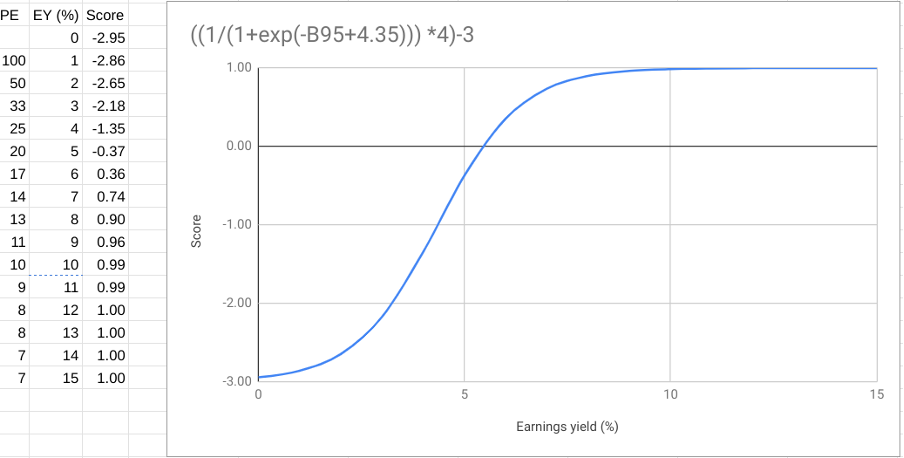

The Decision Engine uses a sigmoid function to turn the earnings yield into a score. The sigmoid function produces an S-shaped curve, with the earnings yield on one axis, and the score on the other.

The table on the left of the chart shows the more common PE ratio for each earnings yield, and the score.

Any share with a PE of less than 10 (an earnings yield of more than 10%) is rewarded with a maximum price score of 1. Between a PE of 17 and a PE 20 (an earnings yield of 5) shares get a score of around 0. As the PE rises and the earnings yield falls, shares are penalised by up to a maximum of three points.

The highest possible score for a great business (maximum score 9) with a low share price (maximum score 1) is, therefore 10.

Generally, I consider a score of 7 or more to be good value, a score of between 5 and 7 to be fair value and scores of less than 5 to be poor value over the long-term.

Deciding how many shares to hold

Scoring shares does not just help me decide which shares to hold, it also helps me decide how much of a share to hold in the Share Sleuth portfolio.

The Decision Engine achieves this with a simple formula that calculates the ideal holding size (ihs) of a share.

ihs = score - (10 - score)

The lower the score, the smaller the holding:

Score | Ideal holding size (%) |

10 | 10 |

9 | 8 |

8 | 6 |

7 | 4 |

6 | 2 |

5 | 0 |

Generally, I will only trade a share if its value is sufficiently far from the ideal holding size, a value I call the minimum trade size. The minimum trade size is 2.5% of the portfolio’s total value.

In other words, if a share’s score is 8 and its ideal holding size is 6%, I can add to the holding if currently it accounts for less than 3.5% of the portfolio’s total value. By doing so I would not breach the ideal holding size.

If the current holding were worth more than 8.5% of the portfolio’s total value, then really I should reduce it back down or towards its ideal size of 6%.

Even if I believe a business is so good it warrants a score of 9 out of 9 for dependability, distinctiveness and direction, the amount of shares the Share Sleuth portfolio should hold is limited by the price score.

If the price is sky-high, the share’s maximum score is 6 (9-3), and its ideal holding size is only 2%.

Decision Engine as of end December 2023

As I mentioned, we publish a new “Shares for the future” update every month. This article is one of them, it just happens to contain a guide to everything about it as well!

Just remember that if you want to see up-to-date scores in future, you will have to come back and find the latest “Shares for the future” article on my author page.

Since the last update a month ago, Focusrite (LSE:TUNE) and James Halstead (LSE:JHD) have been through the scoring process. To see how I scored them, please click on the share’s name in the table below.

Softcat (LSE:SCT), Tracsis (LSE:TRCS), Treatt (LSE:TET) and YouGov (LSE:YOU) have all published annual reports and are due to be re-scored.

When the facts change, my opinion might change, but I do not re-score a share until the company publishes its next annual report. This protects me from knee-jerk decisions, ensures I have as much information as possible, and keeps me focused on evaluating one firm at a time.

This month I need to mention two companies that may well be downgraded next time I score them. Management and strategic changes at Quartix Technologies (LSE:QTX) are giving me the heebie-jeebies, and I do not feel very confident about XP Power Ltd (LSE:XPP)’s handling of the multiple challenges it has faced, some of them self-inflicted.

Hotel Chocolat Group (LSE:HOTC) is on its way out because it is being taken over by Mars. The next company I score will be its replacement.

0 | Company | Description | Score |

1 | Supplies vehicle tracking systems to small fleets and insurers | 10 | |

2 | Supplies kitchens to small builders | 9 | |

3 | Designs recording equipment, loudspeakers, and instruments for musicians | 9 | |

4 | Manufactures pushbuttons and other components for lifts and ATMs | 9 | |

5 | Translates documents and localises software and content for businesses | 9 | |

6 | Manufactures tableware for restaurants and eateries | 9 | |

7 | Distributor of protective packaging | 9 | |

8 | Sources, processes and develops flavours esp. for soft drinks | 9 | |

9 | Manufactures filters and filtration systems for fluids and molten metals | 9 | |

10 | Manufacturer of scientific equipment for industry and academia | 9 | |

11 | Whiz bang manufacturer of automated machine tools and robots | 8 | |

12 | Manufactures/retails Warhammer models, licenses stories/characters | 8 | |

13 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 8 | |

14 | Sells hardware and software to businesses and the public sector | 8 | |

15 | Makes light fittings for commercial and public buildings, roads, and tunnels | 8 | |

16 | Manufactures natural animal feed additives | 8 | |

17 | Imports and distributes timber and timber products | 8 | |

18 | Manufactures power adapters for industrial and healthcare equipment | 8 | |

19 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 8 | |

20 | Manufactures military technology, does research and consultancy | 8 | |

21 | Distributes essential everyday items consumed by organisations | 8 | |

22 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 7 | |

23 | Develops and manufactures hygiene, baby, and beauty brands | 7 | |

24 | Makes marketing and fraud prevention software, sells it as a service | 7 | |

25 | Online marketplace for motor vehicles | 7 | |

26 | Publishes books, and digital collections for academics and professionals | 7 | |

27 | Manufactures vinyl flooring for commercial and public spaces | 7 | |

28 | Sells promotional materials like branded mugs and tee shirts direct | 7 | |

29 | Flies holidaymakers to Europe, sells package holidays | 7 | |

30 | Online retailer of domestic appliances and TVs | 7 | |

31 | Manufactures rugged computers, battery packs, radios. Distributes electronics | 7 | |

32 | Manufactures sports watches and instrumentation | 6 | |

33 | Collects and analyses market research and opinion polls through online panels | 6 | |

34 | Retails clothes and homewares | 5 | |

35 | Operates tenpin bowling and indoor crazy golf centres | 5 | |

36 | Supplies software and services to the transport industry | 5 | |

37 | Manufactures specialist paper, packaging and high-tech materials | 5 | |

38 | Manufactures disinfectants for simple medical instruments and surfaces | 5 | |

39 | Acquires and operates small scientific instrument manufacturers | 5 | |

40 | Chocolate maker and retailer | 2 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports.

Shares marked with an asterisk* are more speculative.

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns many of the shares in the Decision Engine, and all of the shares in the Share Sleuth portfolio.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.