Share Sleuth: weighing up the old and new, here’s what I picked

In the latest Share Sleuth update, Richard Beddard explains how he decided which stock to give his spare cash, weighing up an existing holding and a potential new holding.

6th December 2023 09:19

by Richard Beddard from interactive investor

Welcome to this month’s corporate Squid Game, where only the last share standing is our trade.

This month, it boils down to a choice between the old and the new, but I get ahead of myself.

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

From 31 to two candidates for investment

I sat down to make this month’s trade on Tuesday 28 November. The portfolio had £5,970 of spare cash, enough to fund a trade because the portfolio’s minimum trade size is set at 2.5% of its total value (£4,444 on the day).

With 31 shares scoring 7 or more out of 10 according to my Decision Engine, there was no shortage of candidates.

As usual, I followed the guidance of the Decision Engine, which helps me decide which of the highest-scoring shares to invest in. It has been revamped, but the basic principle remains the same. A share’s score determines the ideal holding size.

I can only add more shares to the portfolio if a holding is smaller than the ideal holding size minus the minimum trade size. And I do not normally trade a share if I have not already traded it since I last scored it, and I am not about to re-score it.

- Shares for the future: the 31 companies I think are good value

- How to beat the market: low-risk dividends and how to find them

Re-scorings happen once a year, soon after a company publishes its annual report.

Focusrite (LSE:TUNE) was the highest-scoring share that day, but I traded the shares last February and I will re-score it soon because it has just published its annual report. Hence, it is currently unavailable to the portfolio.

The second-highest scoring share is also ineligible. The value of the portfolio’s holding in Howden Joinery Group (LSE:HWDN) was £16,218. That was 8.2% of the portfolio’s total value. Howdens is the portfolio’s biggest holding. Even though its score rounds up to 10 out of 10, it would have only have taken shares worth £1,718 to bring the holding up to its ideal size of £16,218 or 9.1% of the portfolio’s total value. That is way below the minimum trade size.

Macfarlane versus Renishaw

The next available share was Macfarlane Group (LSE:MACF). It manufactures and distributes protective packaging, the kind that wraps goods in transit.

According to my spreadsheet, Macfarlane is my seventh-best idea. It scores 9 out of 10. The portfolio has no holding in Macfarlane, and I last scored the business in June.

A couple of things hold me back from pulling the trigger.

The first relates to the company itself. I worry that I might have been a little too kind to the firm when I scored it.

Macfarlane is an acquisitive business. Its returns are probably best judged in terms of total invested capital. This measure includes goodwill and acquired intangible assets at their cost values.

It is only in recent years that Macfarlane’s ROTIC (return on total invested capital) has exceeded my 10% benchmark. These years were influenced by the Covid 19 pandemic, which was generally good for business.

- Stockwatch: betting on return to FTSE 100 for this mid-cap share

- Wild’s Winter Portfolios 2023: one of the best starts ever

Macfarlane should publish its annual report in March, and I would like to score it again in a more normal year before committing to holding the share.

The second reason for prevaricating relates to the Share Sleuth portfolio. It contains 28 holdings, which is more than enough.

I am being more disciplined about reinvesting in my best ideas and since the Decision Engine contains three existing portfolio constituents that also scored 9 and were available to trade, I considered them as well.

They were: Porvair (LSE:PRV), which makes filters and laboratory equipment; Renishaw (LSE:RSW), which makes machine tools; And flavour processor Treatt (LSE:TET).

I have gone with the most under-represented of the three, Renishaw. Before the trade, the portfolio’s holding was worth £2,922 - only 1.6% of the portfolio’s total value. Its ideal holding size was £9,873, or 7.2 % of the portfolio.

In making this decision, I must confess to an element of expectation. Renishaw has gone through a mini-slump due to reduced demand from semiconductor manufacturers, which is notoriously cyclical.

Although Renishaw is to my mind a high-quality business, its results, and its share price, can be volatile. Buying shares when the price has been low and selling some of them when it has been high, has benefitted the portfolio in the past. Perhaps it might again.

The current share price reflects the fact that Renishaw’s recent performance, while still good, has been below par. But with a cyclical rebound on the cards, and governments and companies pumping money into the semiconductor industry because of its strategic importance, a recovery seems likely.

The B’s indicate buys, or additions to the portfolio, and the S indicates a sell, in this case the reduction of the portfolio’s holding, not the elimination of it. Past performance is not a guide to future performance.

Not for the first time, Macfarlane is the bridesmaid.

Adding more Renishaw

Unusually, I did not sleep on this decision. It has been in the back of my mind since I scored Renishaw in November.

On Tuesday 28 November, I added 142 Renishaw shares to the Share Sleuth Portfolio at a price of £31.38 per share. The total cost was £4,488.24 after deducting £10 in lieu of fees and £22.28 in lieu of stamp duty.

The portfolio’s Renishaw holding had grown to 4.2% of its total size.

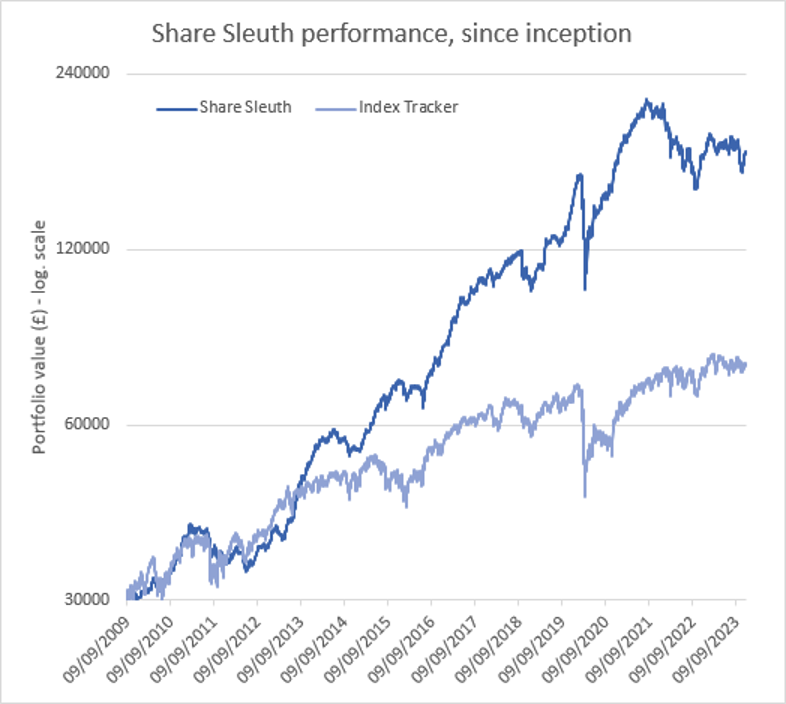

Share Sleuth performance

At the close on Friday 1 December, Share Sleuth was worth £175,618, 485% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £76,262, an increase of 154%.

Past performance is not a guide to future performance.

After dividends paid during the month from Advanced Medical Solutions Group (LSE:AMS), Anpario (LSE:ANP), Bloomsbury Publishing (LSE:BMY), Thorpe (F W) (LSE:TFW), Howden Joinery Group (LSE:HWDN), and PZ Cussons (LSE:PZC), Share Sleuth’s cash pile is £1,613.

The minimum trade size, 2.5% of the portfolio’s value, is £4,425.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 1,613 | ||||

Shares | 174,005 | ||||

Since 9 September 2009 | 30,000 | 175,618 | 485 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 2,922 | -28 |

BMY | Bloomsbury | 1,681 | 5,915 | 7,060 | 19 |

AMS | Advanced Medical Solutions | 1,965 | 4,503 | 4,009 | -11 |

BNZL | Bunzl | 201 | 4,714 | 6,022 | 28 |

CHH | Churchill China | 1,058 | 12,223 | 12,167 | 0 |

CHRT | Cohort | 1,600 | 3,747 | 8,224 | 119 |

CLBS | Celebrus | 1,528 | 3,509 | 2,789 | -21 |

DWHT | Dewhurst | 532 | 1,754 | 3,990 | 128 |

FOUR | 4Imprint | 190 | 3,688 | 8,237 | 123 |

GAW | Games Workshop | 100 | 4,571 | 10,720 | 135 |

GDWN | Goodwin | 266 | 6,646 | 13,406 | 102 |

GRMN | Garmin | 53 | 4,413 | 5,170 | 17 |

HWDN | Howden Joinery | 2,020 | 12,718 | 14,908 | 17 |

JDG | Judges Scientific | 34 | 833 | 3,080 | 270 |

JET2 | Jet2 | 456 | 250 | 5,581 | 2,133 |

LTHM | James Latham | 750 | 9,235 | 7,763 | -16 |

PRV | Porvair | 906 | 4,999 | 5,345 | 7 |

PZC | PZ Cussons | 1,870 | 3,878 | 2,753 | -29 |

QTX | Quartix | 3,285 | 7,296 | 5,092 | -30 |

RSW | Renishaw | 234 | 6,227 | 7,338 | 18 |

RWS | RWS | 2,790 | 9,199 | 6,852 | -26 |

SOLI | Solid State | 356 | 1,028 | 4,913 | 378 |

TET | Treatt | 763 | 1,082 | 3,548 | 228 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 6,580 | 198 |

TSTL | Tristel | 750 | 268 | 3,450 | 1,186 |

TUNE | Focusrite | 1,050 | 9,123 | 4,935 | -46 |

VCT | Victrex | 292 | 6,432 | 4,272 | -34 |

XPP | XP Power | 240 | 4,589 | 2,880 | -37 |

Notes

November: Added more Renishaw

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £76,262 today

Objective: To beat the index tracker handsomely over five-year periods

Source: SharePad, Close on Friday 1 December 2023.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Renishaw and Macfarlane, and all the shares in the Share Sleuth portfolio.

More information about Richard’s investment philosophy.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.