Share Sleuth: two cheap shares on my radar, but there’s a problem

9th November 2022 09:21

by Richard Beddard from interactive investor

Richard Beddard sizes up two companies that are contenders for investment. However, he has not hit the buy button on either. Here, he explains why.

When I sat down to think about trades on 1 November, doing nothing was a strong possibility.

The portfolio did not have enough cash to add more shares at my minimum trade size of 2.5% of Share Sleuth’s total size. I would have had to reduce an existing holding to fund a purchase, but there were no obvious holdings to reduce.

I have not suffered a dramatic loss of confidence in the long-term prospects of any of the portfolio’s holdings. Neither is any holding so big it would make the performance of Share Sleuth too dependent on the performance of one share.

- Read about how to: Open a Trading Account | How to start Trading Stocks | Top UK shares

Trading to improve the portfolio

There is a third reason I will reduce or eliminate a holding, though, and that is when I have the opportunity to add to a holding that is “obviously” a better long term-investment.

The definition of “obviously” in this sense is a technical one. It means that my Decision Engine gives the share I want to add or the holding I want to increase, a score of two or more points more than the holding I want to eliminate, or reduce.

In this way, I can improve Share Sleuth by substituting lower-scoring shares with higher-scoring ones.

Not all the shares at the top of the Decision Engine table were available to the portfolio, as it already owns substantial holdings in some of them including top-ranked Howden Joinery Group (LSE:HWDN).

But there were five top-ranked shares that were under-represented in Share Sleuth: Anpario (LSE:ANP), Dewhurst Group (LSE:DWHT), Focusrite (LSE:TUNE), Next (LSE:NXT) and RWS Holdings (LSE:RWS).

Two names stood out: Anpario because it was the only one that scored nine, and Focusrite because it is the smallest holding in the top of the table barring Marks Electrical (LSE:MRK), which I am having second thoughts about.

- Share Sleuth: the undervalued pandemic winner I’ve been buying

- Richard Beddard: this long-term investment could become a short-term trade

- Shares for the future: four stocks on my new list have issues

Re-evaluating Anpario

Anpario is a manufacturer of natural animal feed supplements. It stands to benefit as farms reduce the use of antibiotics to promote animal growth and improve farm productivity.

I scored the company in June, giving it top marks in every category except price. The share price tumbled though, after the company warned in September that hard times for farmers and cost inflation in its own supply chain mean maintaining profit at last year’s record levels will be a challenge.

This is likely to be a temporary setback, and unlikely to impact my score, which is based on strategic factors. But as readers of last week’s Decision Engine update will know, my subconscious has been bothering me about something else: climate change.

Sources I trust tell us the easiest way we can reduce our impact on the climate is to eat less meat because meat is a very inefficient way of farming protein. This trend may be established in some European countries.

- Five shares doing their bit to save the world from climate change

- Share Sleuth: the undervalued pandemic winner I’ve been buying

If people around the world were to eat less meat, the market would contract, which would be bad news from an investment angle, but good news from an environmental one.

However, even though Anpario supplies an industry that is harmful to the environment, Anpario itself is not. Because it makes farms more productive, it improves their environmental credentials, reducing their carbon emissions.

As long as we eat meat, it is part of the solution, and Anpario’s major customers tend to be farmers of less impactful animal products such as eggs, milk and poultry.

The portfolio’s holding puts me in a dilemma that is not reflected in its very high score, so I have taken the unusual step of reducing Anpario’s score for risks (things that could stop it making more money) from 2/2 to 1/2.

That only reduces Anpario’s to 8/9 though, so it is still a contender for investment.

Re-evaluating Marks Electrical

While I am taking this opportunity to deal with issues I overlooked when I last evaluated businesses, I have also reduced Marks Electrical’s score for fairness by one to 1/2.

This seems harsh, because I have no reason to believe that its founder, Mark Smithson, would act against the interests of minority shareholders, but his ownership combined with that of other members of his family is sufficient to give him near-absolute control.

Because the share has only been listed for a year, we do not have a long track record of stewardship to fall back on, so I would rather err on the side of prudence.

The business is quite unique (in a good way) as I noted when I scored it in June.

Focusrite

I reviewed Focusrite in January, and also gave it top marks for every factor except price. The company makes electronic audio equipment for musicians, venues and podcasters.

Since then, my subconscious has not been bothering me, even though the share price has fallen.

The company may have been even more profitable than usual during the pandemic because locked-down musicians turned to their hobby and acts sought to reach audiences online.

But Focusrite has grown as music making and distribution has digitised, and this trend seems likely to continue.

The problem with digitisation is it can leave people behind. Focusrite’s products are known for their quality, but the company also puts great emphasis on ease of use. Many of its products work out of the box, so instead of intimidating people, it is enabling them.

Since I scored Focusrite, it has bought amplifier maker Linea, a company it knows well because one of its subsidiaries is a customer. While acquisitions are often risky, Linea probably is not.

Linea is a profitable, well-established business with a good reputation, like Focusrite’s other businesses, most of them also acquired in recent years. The outlay was modest, self-funded, and two of Linea’s founders are staying on.

Focusrite’s financial year ended in August, although it will not publish the results until late November and I will not re-score it until the annual report hits the website, some time after that. However, I do not anticipate a change of heart.

Thanks to a trading update in September, we already know revenue was higher than in the previous financial year, but profit will probably be lower.

Demand is strong, but despite ongoing price increases, the increasing cost of semiconductors and other components in short supply, as well as freight, has reduced profit margins.

Maybe these words will come back to haunt me, but in 10 years’ time I think these problems will be distant memories, a blip in Focusrite’s record of profitable growth.

Kicking the can down the road

So, I have two holdings I could increase in size. Both are temporarily troubled, which creates the opportunity to buy them cheaply, but Focusrite would be easier to add because it does not come with the climate conundrum.

The problem is I do not have the money to invest in either of them.

There are plenty of companies scoring six or less to choose from and we can roughly divide these shares into two categories: businesses I am confident will grow profitably but they are relatively pricey, and businesses I am slightly less confident about, which are less pricey.

Bloomsbury Publishing (LSE:BMY), Bunzl (LSE:BNZL), Jet2 (LSE:JET2), Quartix Technologies (LSE:QTX), Solid State (LSE:SOLI) and Tristel (LSE:TSTL) fit into the first category.

I have taken profits from most of these shares over the years, and you would have to fight to prize the remaining modest holdings from my hands.

Despite their fullish share prices, over the long term I think quality is a bigger contributor to returns than price, and it is easier to hold businesses we are confident about for the long-term than speculations.

D4t4 Solutions (LSE:D4T4) and Hollywood Bowl (LSE:BOWL), though, are more speculative.

I will do some soul-searching about them this month.

Performance

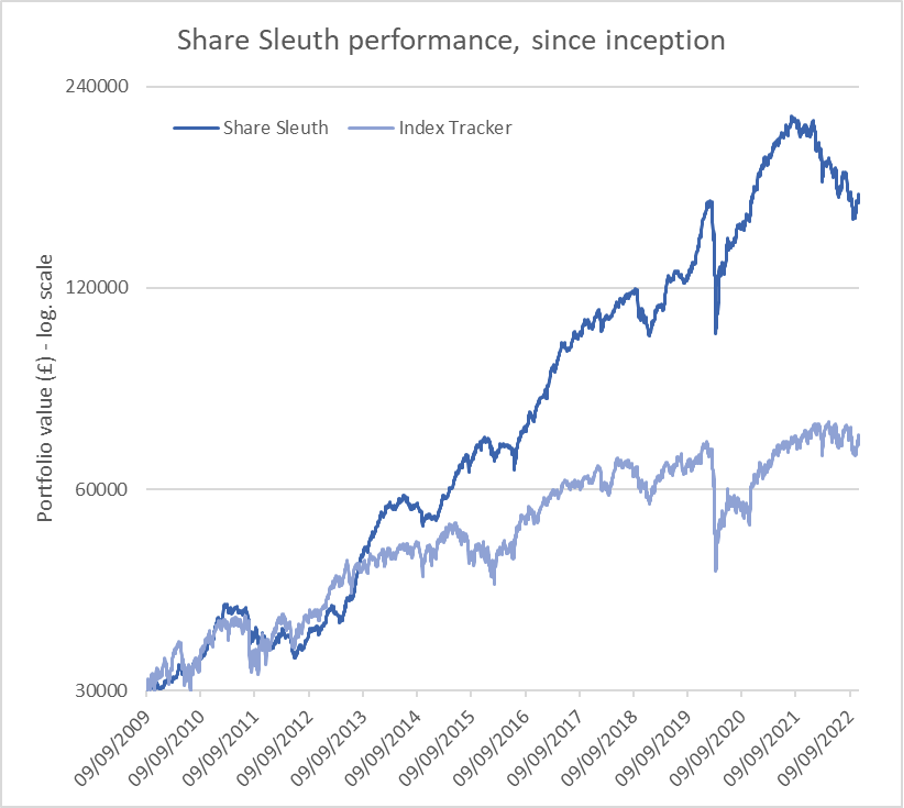

At the close on Monday 7 November, the Share Sleuth portfolio was worth £165,226, 451% more than the £30,000 of pretend money I started with in September 2009.

In comparison, the same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £72,283, an increase of 161%.

After dividends paid by Churchill China (LSE:CHH), Cohort (LSE:CHRT), D4t4, Games Workshop (LSE:GAW), Judges Scientific (LSE:JDG), Solid State (LSE:SOLI) and XP Power (LSE:XPP), the cash balance is £2,399.

That is insufficient to fund a purchase at my minimum trade size of 2.5% of the portfolio’s total value (about £4,150).

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 2,399 | ||||

Shares | 162,828 | ||||

Since 9 September 2009 | 30,000 | 165,226 | 451 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 4,271 | 5 |

BMY | Bloomsbury | 1,681 | 5,915 | 7,565 | 28 |

BNZL | Bunzl | 201 | 4,714 | 5,831 | 24 |

BOWL | Hollywood Bowl | 1,615 | 3,628 | 3,230 | -11 |

CHH | Churchill China | 682 | 8,013 | 8,593 | 7 |

CHRT | Cohort | 1,600 | 3,747 | 6,544 | 75 |

D4T4 | D4t4 | 1,528 | 3,509 | 3,973 | 13 |

DWHT | Dewhurst | 532 | 1,754 | 5,879 | 235 |

FOUR | 4Imprint | 190 | 3,688 | 7,258 | 97 |

GAW | Games Workshop | 148 | 4,709 | 9,472 | 101 |

GDWN | Goodwin | 266 | 6,646 | 8,326 | 25 |

GRMN | Garmin | 53 | 4,413 | 4,011 | -9 |

HWDN | Howden Joinery | 2,020 | 12,718 | 11,106 | -13 |

JDG | Judges Scientific | 85 | 2,082 | 6,460 | 210 |

JET2 | Jet2 | 456 | 250 | 4,135 | 1,554 |

LTHM | James Latham | 750 | 9,235 | 9,825 | 6 |

NXT | Next | 106 | 6,071 | 5,573 | -8 |

PRV | Porvair | 906 | 4,999 | 4,757 | -5 |

PZC | PZ Cussons | 1,870 | 3,878 | 3,759 | -3 |

QTX | Quartix | 1,085 | 2,798 | 3,418 | 22 |

RSW | Renishaw | 92 | 1,739 | 3,327 | 91 |

RWS | RWS | 1,000 | 4,696 | 3,180 | -32 |

SOLI | Solid State | 356 | 1,028 | 4,343 | 323 |

TET | Treatt | 763 | 1,082 | 4,914 | 354 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 8,580 | 289 |

TSTL | Tristel | 750 | 268 | 2,306 | 760 |

TUNE | Focusrite | 400 | 4,530 | 2,592 | -43 |

VCT | Victrex | 292 | 6,432 | 5,008 | -22 |

XPP | XP Power | 240 | 4,589 | 4,594 | 0 |

Table notes:

October: No new trades

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £165,226 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £72,283 today

Objective: To beat the index tracker handsomely over five-year periods

Source: SharePad, 7 November 2022

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in all the shares in the Share Sleuth portfolio.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.