Share Sleuth: taking profits from this almost-perfect firm

7th September 2022 10:42

by Richard Beddard from interactive investor

Unlike many of the other shares in the portfolio, this firm’s share price has held up well this year and is trading on a relatively high multiple of profit, which has prompted Richard Beddard to take action.

Despite having scored Solid State (LSE:SOLI) less than two weeks ago, and given the business, its profitability, risks, strategy and fairness, an almost perfect 7 out of 8, on Friday 26 August I decided to offload some of the manufacturer and distributor of electronic products and components.

To protect the portfolio from knee-jerk decisions and rushes of blood to the head, I always take myself off-site to a place of calm, such as a favourite cafe, to make these decisions. And I always sleep on them.

- Read about: Free regular investing | Opening a Stocks & Shares ISA | Cashback Offers

Thanks to the weekend, and to the bank holiday, I did not actually trade until 30 August.

At the same time, I decided to add more shares in Churchill China (LSE:CHH) to the portfolio.

Reduce Solid State

You may well ask, why sell Solid State? The company has traded well through the pandemic and come out of it with its reputation enhanced.

As far as suppliers and customers are concerned, that is a good thing. But unlike many of the other shares in the portfolio, its share price has held up well this year and it is trading on a relatively high multiple of profit.

A normalised multiple of 37 times profit means Solid State’s price score is -2. Since the maximum score for price is +1, it effectively loses three points for price.

Although I rated the business highly this year, I also reduced its score for risk from 2 out of 2 to 1 out of 2 because of the acquisition of Custom Power.

Although Solid State has made numerous successful acquisitions over the years, Custom Power is the biggest by far and this makes me cautious.

The result of these deductions was a total score of 5 out of 9.

- Shares for the future: my best long-term investment ideas

- Richard Beddard: a share to own through thick and thin

The only Share Sleuth holding with a lower rank is leisure airline Jet2 (LSE:JET2) (ranked 40), but despite the constant exhortations of the Decision Engine to liquidate the portfolio’s holding in Jet2, I have been just as stubborn in ignoring it.

To my mind, Jet2 is a ‘special situation’ (aka a gamble) that my scoring system cannot handle. Although the pandemic years have been very unkind to the leisure airline, it will, more probably than not, have a very prosperous future.

I use a formula described in the FAQ linked at the end of this article to decide what percentage of the portfolio’s total value to allocate to a holding. The lower the share’s score, the less I am supposed to own.

The Decision Engine told me the right size for the portfolio’s holding in Solid State was the minimum size for any holding, which is 2.5% of the portfolio’s total value (£4,200 at the time). The actual size was about £11,300.

On Tuesday 30 August, I reduced the portfolio’s holding in Solid State from 986 shares to 356, raising £6,996 after deducting £10.00 in lieu of broker fees. The share price was £11.12.

Add more Churchill China

Deciding what to do with the imaginary loot raised, was a slightly more vexed process.

The Decision Engine offered me four trades, and is often the case it was a choice between the old and the new.

The two highest-ranked additions were two existing holdings that are under-represented in the portfolio. They were Churchill China, the manufacturer of tableware for commercial kitchens, and James Latham (LSE:LTHM), the importer and distributor of timber. Both shares scored 8 out of 9.

But I had the option to create new holdings in Marks Electrical (LSE:MRK), an online retailer of kitchen appliances and TVs that also scored 8, and Macfarlane Group (LSE:MACF), a manufacturer and distributor of protective packaging (score 7).

Normally faced by this situation I would go for the new shares, after all the more good companies one can squeeze into a portfolio at a reasonable price the better, surely.

But I am less confident in Marks Electrical’s score than the others because it has been listed less long and I wonder how it will perform in a recession. Its unique strategy and strong growth suggests it might be able to gain market share even while the market contracts, but it is a leap of faith.

Macfarlane is more of a known quantity, but it is also 18 places below second-ranked Churchill China, which I believe is a pretty unique (in a good way) business.

Choosing between Churchill China and James Latham is much harder, and rather than agonise, I have just gone with the one ranked four places higher.

You can read more about how I scored these shares here:

On Tuesday 30 August, I doubled the size of the portfolio’s holding in Churchill China from 2.5% of its total value to 5% by adding 341 more shares at a price of £12.47.

The transaction cost £4,262 after deducting £10 in lieu of broker fees.

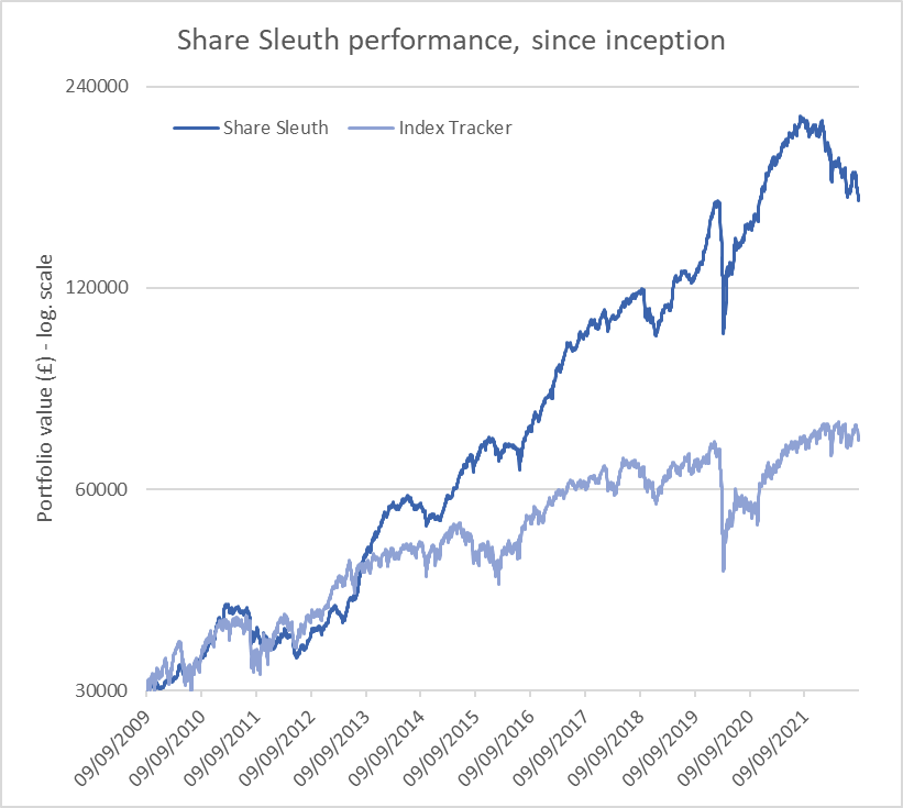

Share Sleuth performance

I check the Share Sleuth portfolio’s performance only once a month when I write this article and, not for the first time this year, it is an unpleasant experience.

Past performance is not a guide to future performance.

I do not know for how long sentiment will trample the prices of good businesses, all I know is that I will not be selling any of the shares in the portfolio unless one of three things happens.

Either I decide that a particular share is no longer a share in a good business or, as in the case of Solid State this month, the portfolio holds more of an individual share than it should.

The third reason happens rarely, but I may find an investment so good that I feel I must remove or reduce an existing holding to finance it even though neither of the first two reasons apply.

At the close on Monday 5 September, the Share Sleuth portfolio was worth £162,100, 440% more than the £30,000 of pretend money I started with in September 2009.

In comparison, the same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £71,355, an increase of 138%.

After the trades and dividends paid by Bloomsbury Publishing (LSE:BMY), D4t4 Solutions (LSE:D4T4), Dewhurst Group (LSE:DWHT), James Latham (LSE:LTHM), Porvair (LSE:PRV), Treatt (LSE:TET), and Tristel (LSE:TSTL), the cash balance is £5,597.

That is enough to fund a new investment in September, should I choose to make one.

James Latham is a good candidate and, ever the bridesmaid, Marks Electrical will be in the running again too.

| Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

| Cash | 5,597 | ||||

| Shares | 156,503 | ||||

| Since 9 September 2009 | 30,000 | 162,100 | 440 | ||

| Companies | Shares | Cost (£) | Value (£) | Return (%) | |

| ANP | Anpario | 1,124 | 4,057 | 6,463 | 59 |

| BMY | Bloomsbury | 1,681 | 5,915 | 6,539 | 11 |

| BNZL | Bunzl | 201 | 4,714 | 5,660 | 20 |

| BOWL | Hollywood Bowl | 1,615 | 3,628 | 2,729 | -25 |

| CHH | Churchill China | 682 | 8,013 | 7,400 | -8 |

| CHRT | Cohort | 1,600 | 3,747 | 8,160 | 118 |

| D4T4 | D4t4 | 1,528 | 3,509 | 3,644 | 4 |

| DWHT | Dewhurst | 532 | 1,754 | 5,666 | 223 |

| FOUR | 4Imprint | 190 | 3,688 | 6,726 | 82 |

| GAW | Games Workshop | 148 | 4,709 | 10,286 | 118 |

| GDWN | Goodwin | 266 | 6,646 | 7,315 | 10 |

| GRMN | Garmin | 53 | 4,413 | 4,055 | -8 |

| HWDN | Howden Joinery | 2,020 | 12,718 | 11,175 | -12 |

| JDG | Judges Scientific | 85 | 2,082 | 6,435 | 209 |

| JET2 | Jet2 | 456 | 250 | 3,921 | 1,468 |

| LTHM | James Latham | 400 | 5,238 | 4,620 | -12 |

| NXT | Next | 106 | 6,071 | 6,398 | 5 |

| PRV | Porvair | 906 | 4,999 | 5,046 | 1 |

| PZC | PZ Cussons | 1,870 | 3,878 | 3,602 | -7 |

| QTX | Quartix | 1,085 | 2,798 | 3,635 | 30 |

| RSW | Renishaw | 92 | 1,739 | 3,220 | 85 |

| RWS | RWS | 1,000 | 4,696 | 3,396 | -28 |

| SOLI | Solid State | 356 | 1,028 | 4,005 | 290 |

| TET | Treatt | 763 | 1,082 | 4,120 | 281 |

| TFW | Thorpe (F W) | 2,000 | 2,207 | 7,150 | 224 |

| TSTL | Tristel | 750 | 268 | 2,438 | 809 |

| TUNE | Focusrite | 400 | 4,530 | 3,260 | -28 |

| VCT | Victrex | 292 | 6,432 | 4,976 | -23 |

| XPP | XP Power | 240 | 4,589 | 4,464 | -3 |

Table notes:

August: Reduced Solid State. Added to Churchill China.

Costs include £10 broker fee, and 0.5% stamp duty where appropriate.

Cash earns no interest.

Dividends and sale proceeds are credited to the cash balance.

£30,000 invested on 9 September 2009 would be worth £162,100 today.

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £71,355 today.

Objective: To beat the index tracker handsomely over five-year periods.

Source: SharePad, 5 September 2022.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in all the shares in the Share Sleuth portfolio.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.