Share Sleuth: I feel like a kid in a candy shop

2nd August 2023 09:14

by Richard Beddard from interactive investor

Richard Beddard is finding plenty of opportunities, and with enough cash to fund two trades, he's bought one new holding for Share Sleuth, viewing recent share price weakness as a chance to snap up a good-quality businesses.

A total of 26 shares of the 40 in my Decision Engine scored seven or more when I sat down in July to decide what to trade but, as usual, they were not all available for investment.

Spoiled for choice

Even so, with enough cash in the portfolio to fund two trades, I felt like a kid in a candy shop.

- Invest with ii: Top UK Shares | Free Regular Investing | Open an investment Account

Even after weeding out shares I have traded in the last year, shares that published annual reports more than six months ago, and holdings already close to their ideal sizes, there were eight shares scoring seven or eight out of nine.

Share | Holding as % of Share Sleuth | Score | Rank |

Churchill China | 5.1 | 8 | 3 |

Porvair | 3.1 | 8 | 6 |

Macfarlane | 0 | 8 | 7 |

Bunzl | 3.1 | 8 | 9 |

Quartix | 1.5 | 7 | 10 |

Advanced Medical Solutions | 0 | 7 | 14 |

Anpario | 1.3 | 7 | 16 |

PZ Cussons | 1.7 | 7 | 21 |

As usual, I was drawn to the most under-represented shares, which are Macfarlane Group (LSE:MACF), a nationwide packaging distributor with a smaller manufacturing operation, and Advanced Medical Solutions (LSE:AMS), a manufacturer of dressings, sutures and surgical adhesives. Both shares would be new additions.

There is no need to diversify the portfolio, it already has 28 holdings, which is quite sufficient, but diversification tends to be my instinct.

That is because I am confident that shares scoring 7 or more will make good long-term investments (although that does not mean my confidence will be justified in every case), but the ones that do spectacularly well are often a complete surprise to me.

I would rather not gamble, taking the view instead that the safest way to compound returns over the long term is to buy as many good-quality shares as I can reasonably follow.

Ever since the beginning in 2009, I've considered 30 as a practical maximum for a portfolio, with 10 more shares in reserve. This is why the Decision Engine compares 40 shares, the 40 I am following most closely.

Face-off: Macfarlane v AMS

On paper, Macfarlane is a better choice than AMS because it has the higher score, but I am drawn to AMS because I fear the opportunity to buy the shares may be fleeting and it is less like other shares in the portfolio than Macfarlane.

The share price is under pressure because of what appears to be a temporary lull in sales of its most significant brand, LiquiBand, to distributors. These resellers have stock to shift because AMS has effectively reduced the number of main distributors in the US, LiquiBand’s biggest market, from three to one.

It expects the privileged distributor to market the product more aggressively, and, now the stock overhang at the other distributors is close to being extinguished, sales and market share should start rising again.

Due to growth in other parts of the business, this financial year the company says it is likely to grow modestly in terms of revenue but tread water in terms of profit.

- Shares for the future: why the rule of three could be the answer

- Investors to receive £5.4bn of holiday money in August

The company has invested heavily in product development in recent years, and with new products advanced in the pipeline, AMS could quickly go from being fair value back to a premium valuation. I would like to grab hold of a small slice of the shares before it does.

Macfarlane is a smaller and much less diversified version of Bunzl, which is already in the portfolio. The shares trade on a lower multiple of profit than Bunzl (LSE:BNZL), which is good, but Bunzl has already proven its model works internationally and across much more than just protective packaging.

I very rarely buy a share hoping for a particular scenario to play out, and I make no pretence that I can time trades, so take these thoughts with a pinch of salt. Any of the eight shares up for consideration this month, should strengthen the portfolio.

I protect myself from making rash judgements, by researching companies dispassionately, and restricting myself to good-quality businesses at reasonable prices, i.e. only those shares that score seven or more.

That way, even if I make a mistake, such as being driven by the fear of missing out, it is unlikely to be a bad mistake.

Even if AMS' return to profit growth takes longer than the company imagines, I believe it is one of those good-quality businesses.

Adding AMS

As usual, I slept on my decision.

Then, on Wednesday 19 June I added 1,965 AMS shares to the portfolio. The total cost of the trade including £10 in lieu of broker fees was £4,503.56, which was 2.5% of the Share Sleuth’s total value and within a whisker of the minimum trade size that day.

Share Sleuth performance

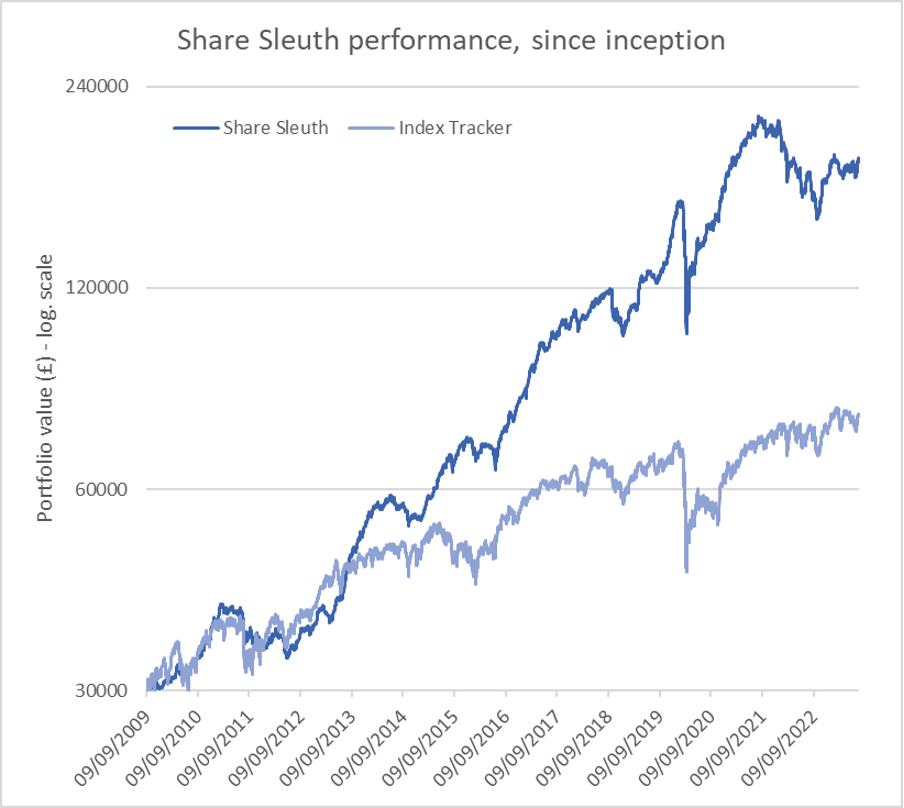

At the close on Friday 28 July 2023, Share Sleuth was worth £186,985, 523% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £77,614, an increase of 159%.

After the trade, and dividends paid during the month by Anpario (LSE:ANP), Bunzl, Judges Scientific (LSE:JDG), RWS Holdings (LSE:RWS) and XP Power (LSE:XPP), Share Sleuth’s cash pile is £5,540.

The minimum trade size, 2.5% of the portfolio’s value, is £4,675.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 5,540 | ||||

Shares | 181,445 | ||||

Since 9 September 2009 | 30,000 | 186,985 | 523 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 2,304 | -43 |

BMY | Bloomsbury | 1,681 | 5,915 | 7,178 | 21 |

AMS | Advanced Medical Solutions | 1,965 | 4,503 | 4,775 | 6 |

BNZL | Bunzl | 201 | 4,714 | 5,815 | 23 |

CHH | Churchill China | 682 | 8,013 | 9,957 | 24 |

CHRT | Cohort | 1,600 | 3,747 | 8,320 | 122 |

D4T4 | D4t4 | 1,528 | 3,509 | 2,789 | -21 |

DWHT | Dewhurst | 532 | 1,754 | 4,841 | 176 |

FOUR | 4Imprint | 190 | 3,688 | 8,465 | 130 |

GAW | Games Workshop | 100 | 4,571 | 11,700 | 156 |

GDWN | Goodwin | 266 | 6,646 | 12,702 | 91 |

GRMN | Garmin | 53 | 4,413 | 4,314 | -2 |

HWDN | Howden Joinery | 2,020 | 12,718 | 14,948 | 18 |

JDG | Judges Scientific | 34 | 833 | 3,223 | 287 |

JET2 | Jet2 | 456 | 250 | 5,121 | 1,948 |

LTHM | James Latham | 750 | 9,235 | 9,750 | 6 |

NXT | Next | 106 | 6,071 | 7,492 | 23 |

PRV | Porvair | 906 | 4,999 | 5,780 | 16 |

PZC | PZ Cussons | 1,870 | 3,878 | 3,145 | -19 |

QTX | Quartix | 1,085 | 2,798 | 2,550 | -9 |

RSW | Renishaw | 92 | 1,739 | 3,536 | 103 |

RWS | RWS | 2,790 | 9,199 | 7,416 | -19 |

SOLI | Solid State | 356 | 1,028 | 4,717 | 359 |

TET | Treatt | 763 | 1,082 | 4,898 | 353 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 7,500 | 240 |

TSTL | Tristel | 750 | 268 | 2,681 | 899 |

TUNE | Focusrite | 1,050 | 9,123 | 5,985 | -34 |

VCT | Victrex | 292 | 6,432 | 4,503 | -30 |

XPP | XP Power | 240 | 4,589 | 5,040 | 10 |

Notes | |||||

July: Added new holding in Advanced Medical Solutions | |||||

Costs include £10 broker fee, and 0.5% stamp duty where appropriate | |||||

Cash earns no interest | |||||

Dividends and sale proceeds are credited to the cash balance | |||||

£30,000 invested on 9 September 2009 would be worth £186,985 today | |||||

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £77,614 today | |||||

Objective: To beat the index tracker handsomely over five-year periods | |||||

Source: SharePad, 31 July 2023 | |||||

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in all the shares in the Share Sleuth portfolio.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.