A share to buy, another to sell and one to hold

2nd November 2022 07:51

by Rodney Hobson from interactive investor

There's so much going on in financial markets right now, and overseas investing expert Rodney Hobson sees very different outcomes for this trio of stocks, each one a household name.

Dear, oh dear, this is not what aerospace group Boeing Co (NYSE:BA) needed as the commercial airline sector struggles to recover from the pandemic. The defence division, which you might expect to be doing reasonably well while the world is alive to the threats posed by Russia and China, has knocked a giant hole in the profit figure.

The problem is that rising costs are hitting all parts of the business, but much of the aerospace and defence side is stuck with fixed-price sales, so margins are being squeezed relentlessly. High manufacturing and supply chain costs mean the division lost $2.8 billion in the current quarter. To add insult to injury, there are technical problems with the replacement for Air Force One – the plane that carries the President of the United States – and also with Boeing’s military refuelling tanker.

- Find out about: US Earnings Season | Top US Stocks | Interactive investor Offers

The commercial aircraft side is still struggling to recover from the grounding of the 737 Max planes after two fatal crashes, followed by the global shutdown during the pandemic that saw non-essential flying reduced to near zero. Just a few weeks ago the Securities & Exchange Commission fined Boeing $200 million for issuing misleading assurances over the safety of the 737 Max after the crashes in a further blow to the company’s reputation.

Boeing is behind schedule with aircraft production and needs to deliver 44 new 737 Max planes a month in the final quarter to meet 2022 production targets. It managed 29 in the third quarter.

Deliveries of the 787 Dreamliners resumed only in August after production defects were fixed.

Total revenue did rise 4% to nearly $16 billion in the three months to the end of September, but that fell short of analysts’ expectations. Far worse was the massive $3.31 billion net loss.

Chief executive Dave Calhoun had plenty of fine words about “important strides in our turnaround” and “mitigating risks and delivering for our customers and their important missions”. However, the figures speak for themselves.

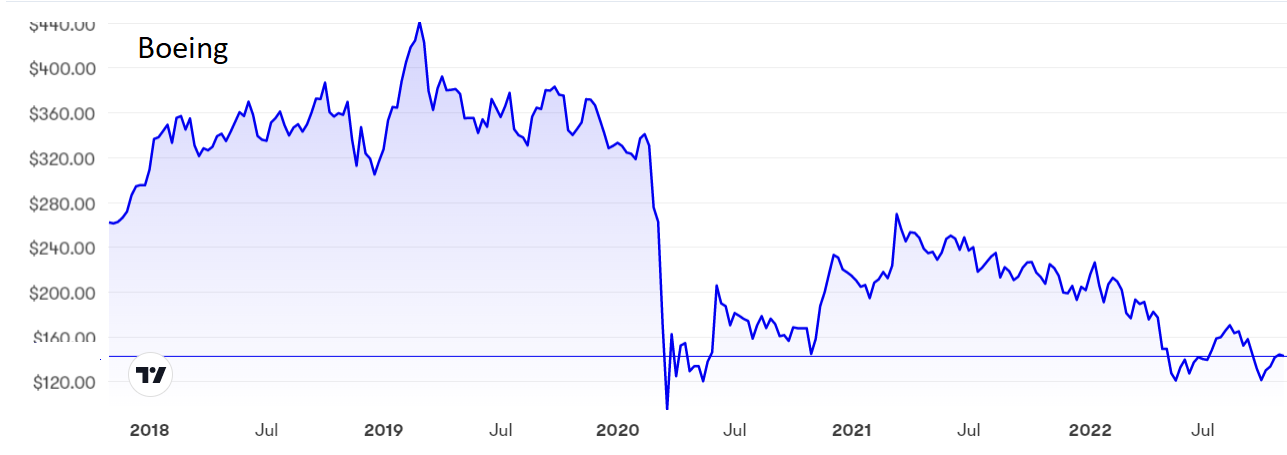

Boeing shares fell 3.4% on the day of the announcement and are now bouncing along at $143 compared with $440 in March 2019. So far, $120 has proved to be a floor but if that breaks it is hard to see where the next support will come.

Source: interactive investor Past performance is not a guide to future performance

Back on the ground, life is hardly any easier for motor manufacturer Ford Motor Co (NYSE:F), which swung from a profit of $1.9 billion in the previous third quarter to a loss of $930 million this time. The swing is fully accounted for by a rise in costs from $34.34 billion to $38.9 billion.

As with Boeing, it is little comfort to see revenue rise, in Ford’s case by 10.4% to $39.4 billion, despite shortages caused by disruptions to the supply chain that forced the company to cough up an extra $1 billion to keep production rolling.

Ford still expects earnings to rise for the year as a whole, but there is clearly scope for further disappointment given that the computer chips shortage has eased but not gone away entirely. After all, its guidance for the third quarter had profits of $1.4-1.7 billion.

Mercifully, Ford has completed its move out of Russia with the sale of its 49% stake in Sollers Ford after suspending operations in March when the invasion of Ukraine began. It has not said how much if anything it raised from the disposal but, given the fact that other Western manufacturers have also been extricating themselves from Russia, it was in no position to drive a hard bargain.

Ford is rightly switching increasingly to all-electric vehicles but again this comes at a cost, and with some risk. It has stopped production of its highly successful Fiesta range, and other well-known models will also be consigned to the scrapheap next year.

Ford currently sells only two electric vehicles in Europe, so the switch will be disruptive and will occupy much management energy at a time when minds need to be fully focused on a range of issues.

The stock has almost halved in value since mid-January, when it topped $25, and a rally in July petered out at $16. The yield of 3.4% offers some comfort but the price/earnings (PE) ratio of only 5.9 shows how cautious the market is about immediate prospects.

Source: interactive investor Past performance is not a guide to future performance

One company that has got the knack of squeezing out higher profits from lower revenue is pharmaceutical group Pfizer Inc (NYSE:PFE), which did well in the pandemic and is still thriving according to third-quarter figures.

With the strong dollar affecting translation of overseas sales, revenue fell 6% to $22.64 billion in the three months to the end of September compared with an exceptionally successful third quarter last year. However, a sharp fall in the cost of sales meant that net income rose 6% to $8.61 billion.

Pfizer edged up its revenue and profits guidance for the full year, and with good reason. An amendment to the supply agreement with the European Commission for the Covid-19 vaccine means doses scheduled for the summer will now be delivered in the fourth quarter.

The shares slipped from nearly $60 in mid-December to a low of $42, but they are on the rise again at $48, where the PE is an undemanding 9.23, while the yield is a satisfactory 3.35%.

Source: interactive investor Past performance is not a guide to future performance

Hobson’s choice: Boeing has too many unresolved problems. I have warned investors off twice this year and see no reason to remove the sell advice.

I advised selling Ford at $18 last November but relented at the beginning of August at around $15. That switch proved premature and, in light of recent problems, I feel that Ford is at best a hold. Prospective buyers should wait for a better opportunity.

I have drawn attention to the attractions of Pfizer several times, initially when the stock was below $35, and the buy recommendation still stands.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.