The risks of value investing in emerging markets

Investor due diligence is crucial when searching for an emerging market strategy.

3rd June 2021 10:35

by Briegel Leitao from ii contributor

Investor due diligence is crucial when searching for an emerging market strategy, particularly one that subscribes to value.

After a prolonged period of relative underperformance, the value factor has experienced a long-awaited resurgence. Growth and value factors have historically jostled for position in equity markets and have been contesting investor flows for decades. Proponents of value investing rely on time-tested metrics such as price-to-book to identify undervalued stocks, while growth managers focus more on the upside potential and improving economic fundamentals.

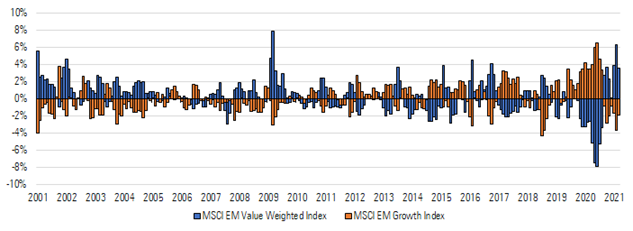

Exhibit 1. The resurgence of Value in Emerging Markets, 3m Rolling Returns, Relative to MSCI Emerging Markets Index

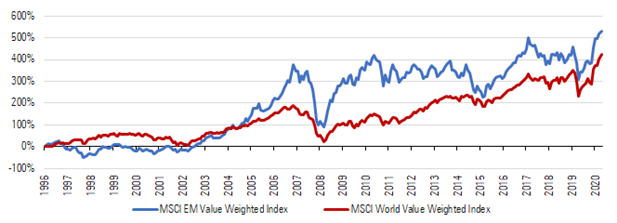

In practicality, the viability of style strategies differs depending on the efficiency of the underlying equity market, and emerging markets often come with much higher levels of information asymmetry than their developed market counterparts. These asymmetries have their root in the relative lack of coverage that emerging market equities receive, making undervalued opportunities much more plentiful. The outcome of this has been emerging market value strategies historically fetching higher returns than their developed counterparts.

Exhibit 2. Long-term Cumulative Returns, EM Value Versus Global Value

Exhibit 1, however, shows a changing trend in the last 10 years, with the emerging market growth premium steadily becoming longer and larger. While many economic factors can explain this, from quantitative easing to the rising Asian middle-class consumer, one indicator that seems to prevail is the widening disparity between booming growth sectors such as consumer and technology, and challenging value sectors such as energy that continue to face headwinds and weigh on returns.

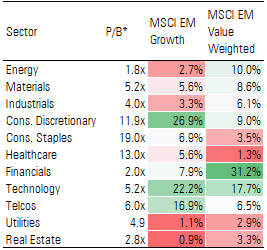

Exhibit 3. Average Emerging Market Value and Growth Sector Splits

The sectors that these investment styles bias themselves towards contrast heavily in terms of the companies that underpin them. The reversal of value’s dominance in emerging markets also seems to come in tandem with growth’s improving ability to consistently rotate into higher-quality stocks. Here, quality refers to metrics that capture desirable portfolio qualities such as profitability and balance sheet stability. These metrics are indicators of a portfolio’s ability to deliver stable long-term returns.

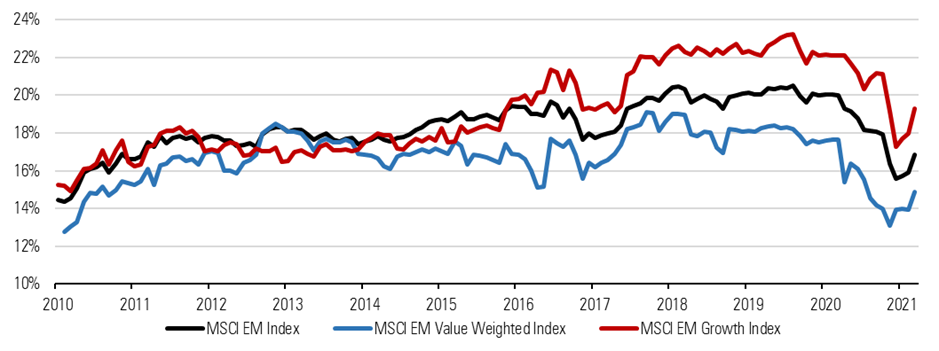

Exhibit 4. Average Portfolio Profitability, Net Margin (%)

Exhibit 4 shows average portfolio profitability for the MSCI Emerging Markets Growth Index and the MSCI Emerging Markets Value Weighted Index, with the two indices being used as proxies for generic growth and value strategies respectively.

- How to invest in emerging markets using ETFs: a beginner’s guide

- European stocks have outperformed and there’s plenty of upside

- Diversifying your portfolio is easy with these ii Super 60 recommended funds

In contrast to growth portfolios, emerging market value portfolios increasingly fall short on quality indicators and tend to hold companies whose revenue growth prospects are relatively low, or are judged by the market to face sector or stock-specific risks. These risks vary in nature, ranging from increased corporate governance concerns to larger industry headwinds that potentially challenge the revenue streams of the companies within them. In this context, the resulting discount that these sorts of companies tend to receive becomes much more understandable.

Do the risks make value in EM unviable?

Not quite. Whether active or passive, investor due diligence is crucial when searching for an emerging market strategy, particularly one that subscribes to the low-value mindset. By forming robust investment processes that account for deteriorating fundamentals, portfolios can help to control the extra downside risks associated with low valuation companies. As well as sound fundamentals, oftentimes the difference between understanding a mis-priced opportunity and falling for a value trap is a sound investment thesis.

Passive funds in the emerging markets space have yet to successfully build quality metrics into their strategies, while active managers have the advantage of local analysts that can closely monitor domestic firms and may offer an edge by gauging a company’s prospects for recovery.

Briegel Leitao is an associate analyst, manager research, passive strategies, at Morningstar.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.