Richard Beddard: a share to keep tabs on

Our columnist analyses a company turning 20 years old this month, and still full of vigour.

5th March 2021 14:03

by Richard Beddard from interactive investor

Our columnist analyses a company turning 20 years old this month, and still full of vigour.

Quartix (LSE:QTX) is 20 years old this month, and every year since it was founded in 2001 the company has grown its installed base of vehicle tracking devices.

Needless to say, that period includes the great 2008-09 financial crisis and now a global pandemic.

Happy birthday, Quartix!

Founder and chief executive Andrew Walters opened the results presentation this year by reminding investors and analysts that in 2021 he and his partners set out to create a business with strong recurring subscription revenues.

Just as they are today, Quartix’s customers were SMEs (small and medium-sized enterprises) in sectors such as security, heating and plumbing, landscaping and construction. The trackers tell fleet owners, usually owner-managers, where their vans are, and how they are being driven, so they can keep tabs on the drivers.

If we take a step back, and imagine what might have been going through Walters’ mind, his vision may have started with the observation that small businesses are neglected by vehicle tracking companies because they operate small fleets, but collectively they are a large market with the same basic requirements, and their owners are decisive businesspeople, loyal to products and services that help them.

A simple policy of focusing on the collective needs of small businesses coalesced into a low-cost strategy along these lines:

- Develop a simple device from off-the-shelf components and outsource manufacturing

- Make it easy to install, either by self-employed fitters or by the owners

- Avoid developing bespoke software features and favour features that appeal to most of the customer base

- Sell directly through price comparison sites and direct marketing instead of employing an expensive field sales force

- Supply the device free of charge to take away the cash barrier to adoption

- Charge an affordable monthly subscription

- Do not tie customers into complicated long-term contracts

- Export the business model overseas

The glorious thing about such a strategy is how well it knits together, one activity reinforcing another. It is easier to outsource the manufacture of a generic device and sell it directly in multiple territories, especially if the contract is straightforward. The core of the strategy is simplicity, and simplicity keeps costs low, which is how Quartix can keep the service affordable and still make a handsome profit.

In its 20th year, the company reinforced the strategy by signing a long-term supply agreement with a manufacturer and continuing to hone its software, sales processes, and devices. It released new self-install fleet and insurance units.

- Share Sleuth: why I am not giving up on this share

- Shares for the future: a dozen good businesses

- Richard Beddard: scoring a music stock with Beatles connections

Despite international expansion, standardisation allows Quartix to serve the whole of Europe from its operations centre in a converted supermarket in Newtown in Wales, which also supports a small sales office in Chicago.

I can detect only one deviation from my depiction of the company’s strategy in the 2020 annual report. Quartix is recruiting more field salespeople, which is linked to the fact that the company is increasingly selling to somewhat larger fleets of up to 500 vehicles.

Quartix’s number crunching tells it that field sales cost more per new customer, but less per new unit installed than telephone sales, and that the cost of digital sales is increasing too.

Meanwhile, the pandemic has given the company an opportunity to recruit experienced salespeople with established networks from rivals whose subscription bases have grown less rapidly, or shrunk.

The new field salespeople are selling the standard product and targeting owner-managed businesses.

Despite a sharp reduction in new fleet subscriptions during the first lockdown, Quartix grew its subscription base by 15% in 2020.

Growth was fastest in Quartix’s newest markets. In various European markets, subscription grew rapidly from a very low base and is not yet significant. In the US, where Quartix has been trading for six years, it achieved a 30% increase in vehicle subscriptions. France, a more established market, achieved a 22% increase. In the UK, where Quartix already has a considerable market share, the subscription base improved by 8.9%.

Unit sales do not translate directly into revenue growth though, because of price competition. And, since Quartix invoices quarterly in advance, it does not recognise all of the revenue from new units immediately. Fleet revenue increased 6% in 2020.

Hidden growth

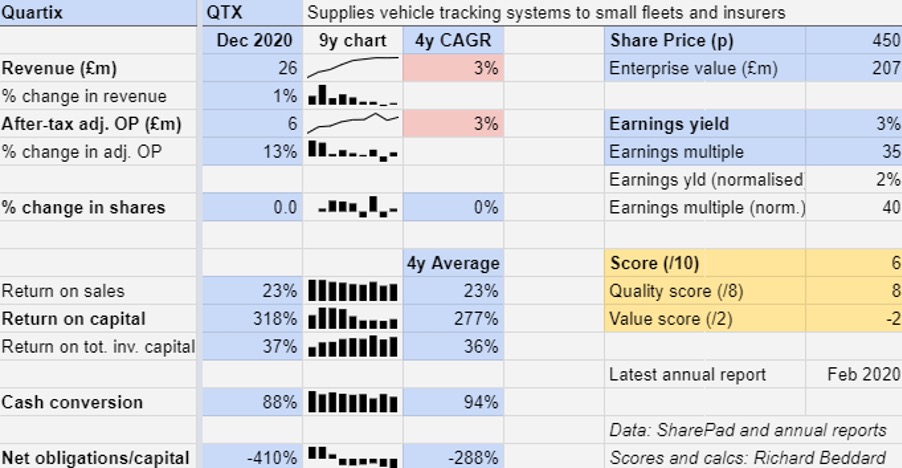

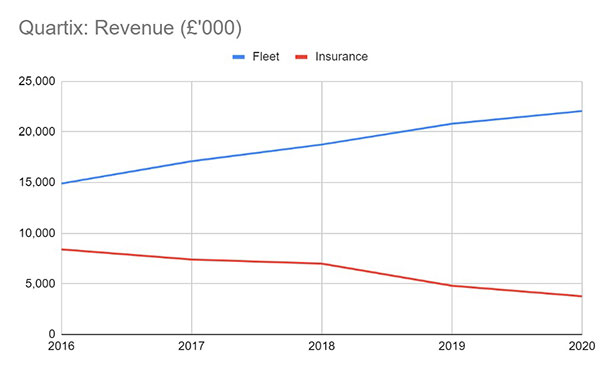

In recent years, the relentless growth in fleet subscriptions to nearly 174,000 units has not been evident in revenue and profit growth, which has been slight:

The most significant reason for this is the contraction in sales to insurance firms. Insurers fit trackers in the cars of new drivers, who usually remain for only one year, denying Quartix the long stream of revenue it gets from fleet sales. For this reason Quartix is limiting sales to insurance companies to those from which it can generate an adequate return.

Once Insurance sales fall to zero, or stabilise, Quartix’s growth rate will be more like the growth in fleet sales, which is compounding at an annual growth rate of more than 10%:

Source: Quartix annual report

In 2020, insurance sales fell nearly 22% to £3.8 million, less than 15% of the total (compared to 36% in 2016) and contributing 17% of total profit. This was not just a result of policy, fewer driving tests due to lockdowns meant fewer new drivers.

Investment drags on profit. Quartix’s biggest fleet costs relate to sales and marketing. These are deducted from profit immediately in the expectation of recurring revenue for many years. Since the company expenses research and development, it also reduces profit now in the expectation of more profit in future.

- Deliveroo IPO: will it encourage more UK flotations?

- Stockopedia: 10 fast-moving mid-caps leading the market

There is one wrinkle in this year’s figures. Profit excludes a £1.6 million provision against the cost of replacing US tracking devices with new 4G versions due to the “sunsetting” of the US 3G mobile network in 2020. The company is replacing the trackers free of charge to avoid losing customers.

Quartix says this is a one-off cost, but it also discloses that between 2025 and 2030 most UK and European mobile operators are planning to sunset their 2G networks, which it currently uses.

The pace of change is likely to be much slower though, giving Quartix more time to prepare, and it is possible a 2G network of some sort will remain to service smart meters, which are still being rolled-out.

Even so, Quartix says it is taking technological and commercial steps to mitigate the cost of transition.

Scoring Quartix

I like Quartix. It is focused, owner-managed, and in the past traders may have underestimated its growth potential because it has been masked by falling insurance sales and heavy investment. The company explains itself very well to shareholders.

Does the business make good money? [2]

+ High return on capital

+ High profit margin

+ Good cash conversion

What could stop it growing profitably? [2]

+ Competition

+ Recession

? Sunsetting of 2G networks, autonomous vehicles

How does its strategy address the risks? [2]

+ Focus on small businesses

+ Low-cost business model

+ International growth

Will we all benefit? [2]

+ Run by founder, who has a majority shareholding

+ Executives not excessively paid, staff get nearly-free shares

+ Customer focused team culture, good Trustpilot reviews

Is the share price low relative to profit? [-2]

− A share price of 450p values the enterprise at about 35 times adjusted profit

A score of six out of 10 means Quartix probably is a good long-term investment but the share price detracts from the investment case. Quartix is ranked 16 out of 39 potential long-term investments in my Decision Engine.

Adios Renishaw?

Earlier this week, engineering firm Renishaw (LSE:RSW), a constituent of my Decision Engine, put itself up for sale. Its octogenarian founders want to sell their holdings, which amount to more than 50% of the company.

They have been tremendous stewards, listing at a valuation of £44 million in 1983 and bowing out at a current market capitalisation of about £4.5 billion. Including reinvested dividends, The Times calculates it is a 200-bagger.

But the end will be bittersweet for long-term investors. We have done well out of Renishaw, but it is the kind of business I hoped to hold indefinitely and which would ultimately pay for my retirement.

Sir David McMurtry, co-founder, inventor of the first touch trigger probe, and chairman, says he is looking for a buyer that will honour Renishaw’s heritage and continue to invest for the long term, so employees and customers still benefit from his legacy.

Shareholders, though, will probably find a hole in their portfolios where Renishaw was. It will be difficult to fill.

I have not felt so disappointed about a takeover since Softbank bought chip designer Arm, and I am not alone. The morning Renishaw announced the sale process, I received a note from a reader and shareholder. It was entitled “Another one bites the dust?”.

Richard owns shares in Quartix and Renishaw.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.