Richard Beddard: scoring two businesses choosing to invest

Investors have a conundrum – is ‘jam tomorrow’ worth sacrificing ‘jam today’?

15th January 2021 08:56

by Richard Beddard from interactive investor

Investors have a conundrum – is ‘jam tomorrow’ worth sacrificing ‘jam today’?

When a company invests heavily it presents a conundrum for investors. The company sacrifices profit and cash flow today for the uncertain promise of even more profit tomorrow.

If the investment pays off, the company will be worth more, perhaps much more. Today I am scoring two businesses making the choice to invest.

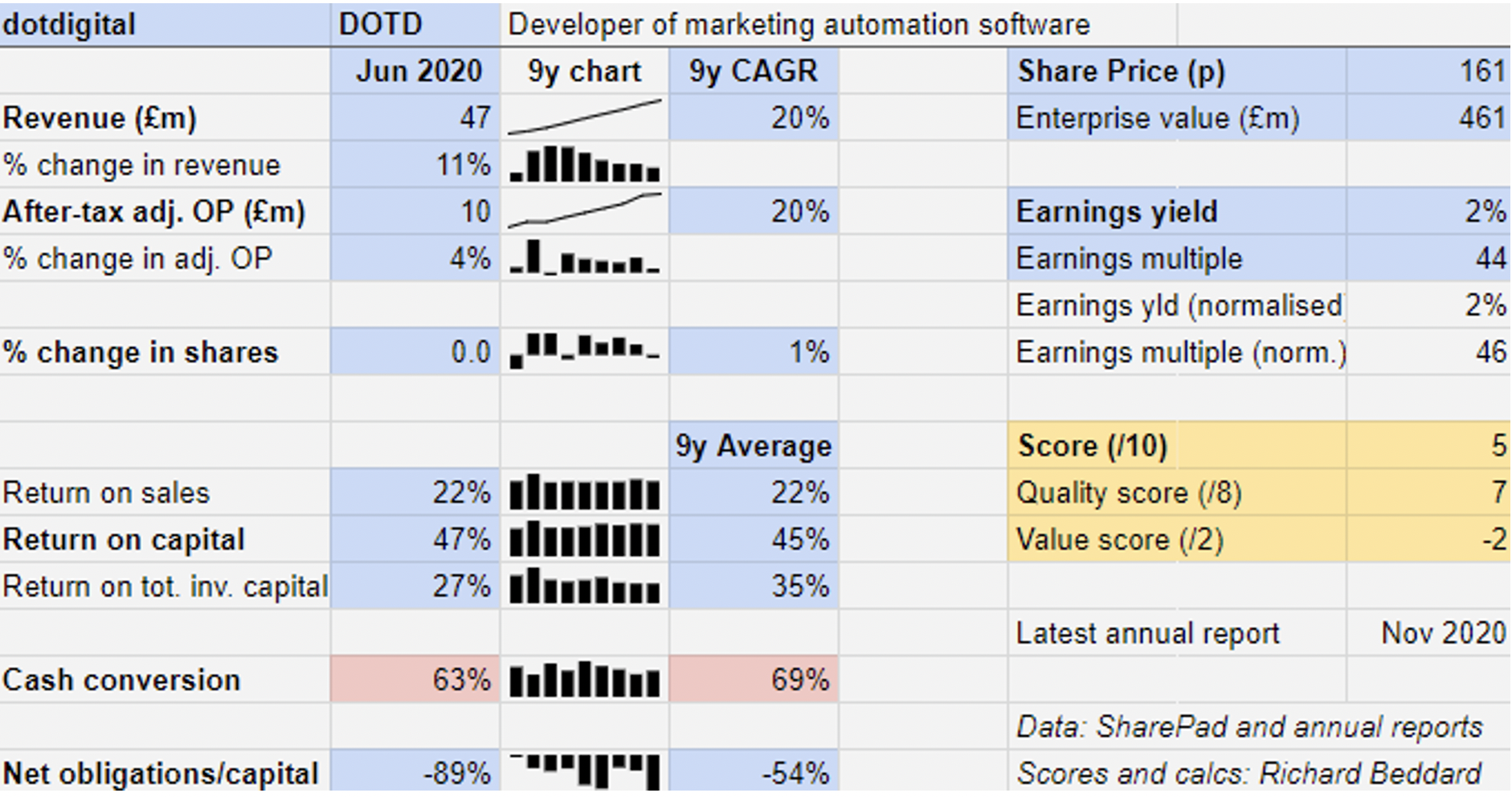

First up, dotdigital (LSE:DOTD), a marketing software platform that integrates with customers’ e-commerce systems to send out personalised messages based on what they tell it about us.

Right message, right time

Dotdigital is a one product company. Originally it sold dotmailer, an email marketing platform, but it acquired an SMS capability in 2017 and rebadged the platform ‘Engagement Cloud’.

While email remains the biggest channel, SMS messaging is growing faster. Engagement Cloud also supports web chat and social media interactions.

Dotdigital’s mantra is to send the right message to the right customer through the right channel at the right time.

- Share Sleuth: the 10 trades I made in 2020

- Shares for the future: how the Decision Engine fared in 2020

It has 4,000 customers, mostly middle-sized businesses like DHL and Jet2 (LSE:JET2), which spend as much as £60,000 a month, though the average is £1,100.

So far, product innovation and international expansion has been a recipe for high levels of profitability and growth:

Dotdigital expects double-digit revenue growth in the year to June 2021, but profit may be flat implying a reduction in profit margin. The company says this reflects higher levels of investment after two years of caution due to the introduction of General Data Protection Regulation (GDPR) in 2018 and the onset of the pandemic.

Prosperity depends in part on the success of large e-commerce platforms that Engagement Cloud is bundled or integrated with. Three of them, Magento, Shopify (NYSE:SHOP) and Big Commerce, give dotdigital access to about 60% of the middle-sized customers it favours.

The dependency is a risk, but the relationships are also a strength. Customers acquired through partnerships tend to be stickier and spend more on sophisticated marketing than customers that use dotdigital on its own.

The partnerships themselves are sticky too, as the partners collaborate to integrate the software and market it.

Scoring dotdigital

I like the idea of investing in dotdigital. Tink Taylor, the company’s founder and recently retired chairman, is an industry luminary and still owns a 10% stake in the business. It says it treats staff like family and promotes from within, and this is reciprocated by glowing reviews on recruitment sites.

While he considers buying other companies for their technology or talent, chief executive Milan Patel says he will only do this when it makes financial sense.

High valuations mean that is rarely the case, which means dotdigital is self-reliant. It employs as many software engineers to develop the product as it does salespeople to sell it.

Does the business make good money? [2]

+ Sustained double digit revenue and profit growth

+ Very high return on capital

+ Suppressed cash flow reflects investment likely to generate future returns

What could stop it growing profitably? [1]

? Competitive market

? Dependence on e-commerce platforms, particularly Magento

? Abuse of platform by spamming customers

How does its strategy address the risks? [2]

+ Product development improves competitiveness

+ Collaboration cements partnerships

+ New partnerships reduce dependency on existing ones

Will we all benefit? [2]

+ Founder Tink Taylor still involved and owns 10% of shares

+ Company and chief executive rated highly on recruitment sites

+ Responsive to investor queries. Informative annual report

Is the share price low relative to profit? [-2]

− No. The enterprise is valued at over 45x adjusted profit.

The pandemic has put businesses such as dotdigital in the spotlight as customers increasingly seek to do business online, but the resulting share price reduces its allure.

A score of 5/10 does not preclude it from long-term investment, but dotdigital is ranked 28 out of 38 companies by my Decision Engine.

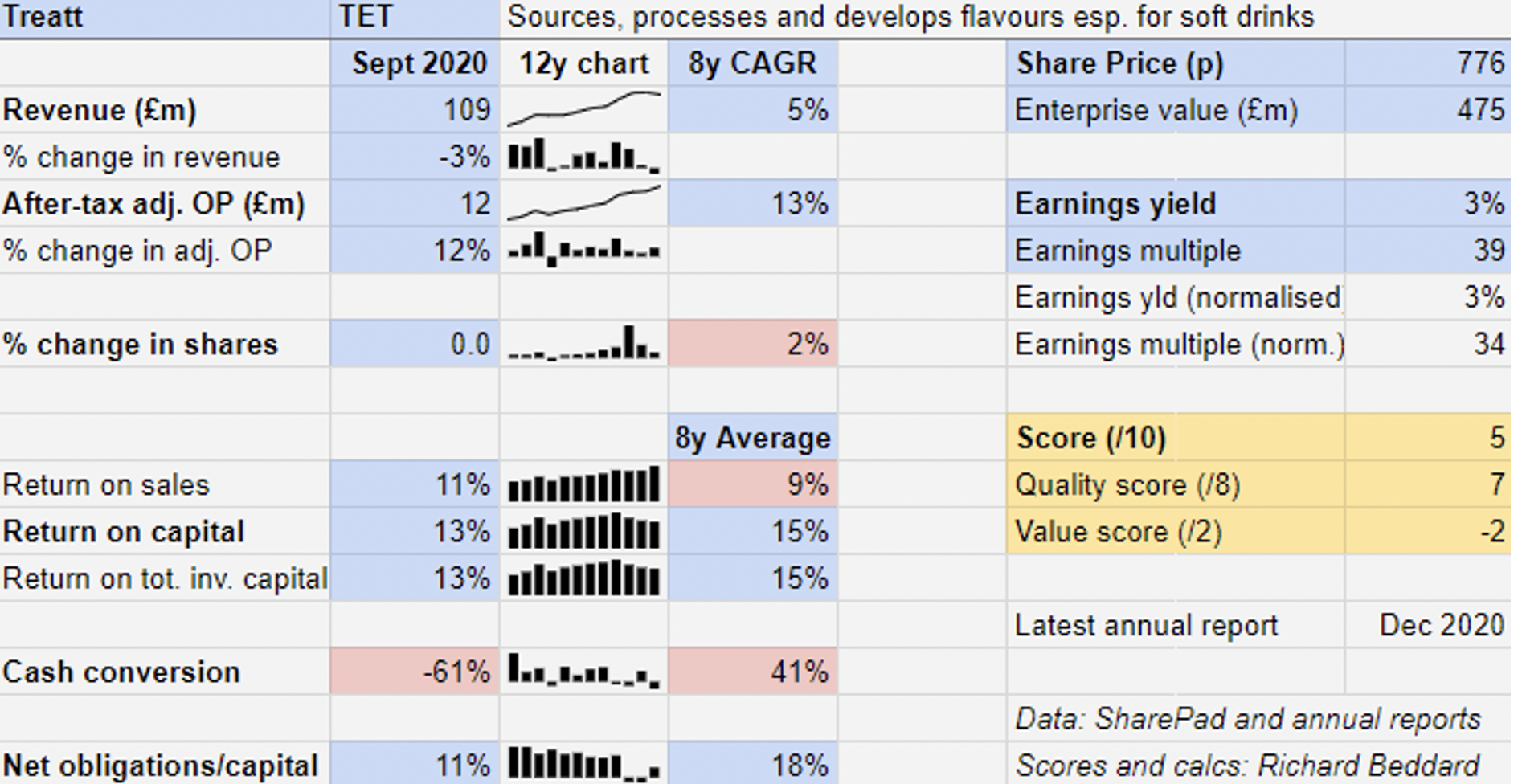

When red lines can be good signs

There are more red lines in my summary of Treatt (LSE:TET)’s finances: Return on capital has declined over the last three years, the share count has increased, and cash conversion is low. They tell the same story, but it is not a sorry one.

Treatt refines essential oils and extracts, principally citrus oils, and turns them into flavours for the global beverage industry and fragrances for cleaning products. For a decade or more, Treatt has been inventing new and more unusual flavours like botanicals, tea, and flavours that improve the taste of low-sugar beverages.

The 3% decline in revenue in the year to September 2020 was mostly because of a 50% decline in orange oil prices the previous year. Citrus oils are a commodity and still make up about 50% of Treatt’s revenue, but a 25% increase in citrus volumes and growing sales of higher value products more than compensated for low commodity prices, lifting profit 12%.

- Richard Beddard: what do we really need to know to invest?

Find out more about interactive investor SIPP and pensions here

By producing unique ingredients in collaboration with customers Treatt has lifted its profit margin to about 11%. Return on capital has also increased over the years, although this trend has reversed.

This reversal is due to investment, which has bloated capital employed, the denominator of the return on capital calculation. The company increased the capacity of its modern facility in Florida last year and is in the throes of relocating its Bury St Edmunds headquarters to a purpose-built site.

Return on capital will remain depressed until the company has relocated and is reaping the full benefit of its investment, which includes modern laboratories and equipment upgrades as well as bringing everything into one site.

Most of the increase in the share count happened three years ago, the result of a placing to raise funds to pay for this ‘once in a generation’ investment programme.

And truly woeful looking cash conversion in 2020 is also due to the investment because this is the year in which the £33 million relocation project went into full swing.

Building work completed before the year-end on budget but not on schedule due to the pandemic. Treatt will not move into its new home until the middle of 2021, once it is fitted out with new and improved equipment like new automated warehousing and computer-controlled stills.

Treatt is splurging, which is risky, but it has earned the right to do so as it has shown it can improve profitability.

More so, it needs to splurge if it is to fulfil its promise. The old headquarters, spread out on a trading estate, is dated and inefficient.

Scoring Treatt

Treatt is one of my favourite businesses. Its biggest asset is not a component of its balance sheet, it is the company’s culture. This has been nurtured by chief executive Daemonn Reeve who took charge in 2012. The company fills a large proportion of vacancies internally, gives employees free shares, and works to ensure “an emotional attachment to the business”.

Does the business make good money? [2]

+ Return on capital is acceptable despite heavy investment

+ Profit margin is growing

? Weak cash conversion due to investment and large inventories

What could stop it growing profitably? [1]

? Customers sourcing directly and processing in-house

? Competition from international flavour houses

? Commodity citrus oils susceptible to price fluctuations

How does its strategy address the risks? [2]

+ Developing innovative processes and flavours

+ Sells direct to the end customer

+ Invests to meet growing demand

Will we all benefit? [2]

+ Experienced management

+ Employee-first culture

+ Responsive to investors

Is the share price low relative to profit? [-2]

− No. Treatt’s enterprise value is nearly 40x adjusted profit.

Investors are prepared to pay for growth yet to be achieved, and, like dotdigital, a score of five out of 10 puts Treatt well down my Decision Engine table, in 24th position out of 38 companies.

I hold the shares in the Share Sleuth portfolio in the expectation of decent long-term returns, but I am unlikely to add new shares with the price this high.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.