Richard Beddard: is this impressive company a bargain?

This highly respected AIM company has generated significant long-term gains for investors and can now be bought for a third less than its peak price. Here’s how our columnist marks the business out of 10.

8th December 2023 12:51

by Richard Beddard from interactive investor

When it comes to profitability, James Halstead (LSE:JHD) has few peers. When it comes to growth, it appears to be challenged.

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

Simplicity itself

The first paragraph by chief executive Mark Halstead in this year’s annual report explains that flooring can be a very simple business:

“We create a floor covering fit for purpose, we manufacture in volume and efficiently, we present the product to wholesalers, architects and end-users then sell the product, collect payment, make a profit and repeat the process.”

Simple, perhaps, but not easy.

These words, particularly the bit about presenting the product, are doing a lot of work.

Flooring schools and hospitals

James Halstead manufactures sheet vinyl flooring in the UK and sources Luxury Vinyl Tiles from manufacturers in China, Taiwan and other places.

Every year the company highlights glamorous flooring projects in its annual report. In the year to June 2023, it floored The Media Centre for the Paris Olympics, The Centre for Autism Research, Deloitte’s new headquarters in Milan, and the Van der Valk Hotel in Sneek, a tiny city in the Netherlands.

The company floors offices, cafes, care homes, factories and ships. Mostly though, we tread on its vinyl in hospitals, schools and shops. The strong element of repair, renewal and refurbishment has provided James Halstead with steady business.

These customers require quality, durability and availability, and James Halstead still lives by its founder’s motto: “Quality is when the customer comes back, not the product.”

Selling salt and oil

Vinyl is a pretty generic product. Innovation is important in some markets, to increase slip resistance, improve acoustics, or withstand chemical spills for example, but the product is unlikely to be the deciding factor in a sale. Other makes of vinyl flooring are available, and they are made from the same mixture of salt and oil. PVC as we know it.

- Share Sleuth: weighing up the old and new, here’s what I picked

- Shares for the future: the 31 companies I think are good value

- Five outperforming AIM shares that could keep rising

James Halstead is so profitable because it is an efficient manufacturer of sheet vinyl, and because it is so well established in the supply chain.

It sells the product to distributors who buy in bulk and sell it on to end customers. But the company also employs salespeople around the world to support them. They provide technical and design support to the distributors and specifiers like architects and designers. This activity builds relationships, encourages repeat business and burnishes its brands.

The biggest of these brands is Polyflor. In Europe it sells Objectflor and Karndean, brands it acquired towards the end of the last century.

The importance of strong relationships was evident last year, when rising inflation drove down the profitability of sales in the months between quotation and installation. With costs rising so fast, James Halstead was sometimes able to renegotiate prices.

Even in normal times, a supplier can lose the specification as priorities change. Other high quality British manufacturers like lighting company FW Thorpe, also put a big effort into holding onto often hard-won specifications.

Although PVC is made from abundant raw materials, salt and ethylene, the supply of ethylene is not as secure as we might think. James Halstead gets it from European refineries, which historically have sourced much of their oil from Russia.

Following the Russian invasion of Ukraine, James Halstead was so concerned that the ethylene supply might dry up or energy would be rationed, it stockpiled raw materials and vinyl to ensure supply.

Europe has found alternative sources of supply, but there remains a risk while the geopolitical situation is so unstable.

Slow growth conundrum

Vinyl flooring is a competitive industry, but James Halstead’s results are mostly impressive. It routinely earns more than a 30% return on capital, it has a growing cash pile, and pays out substantial dividends.

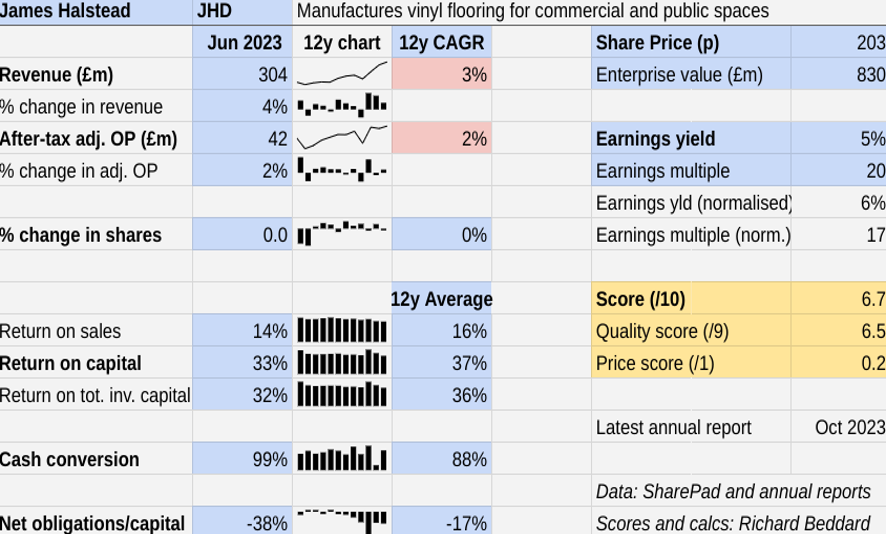

The only blot is growth, which is pedestrian. The company has grown revenue at 3% compound annual growth rate (CAGR) over the last 12 years, and adjusted profit at 2% CAGR.

Vinyl flooring remains a popular choice, but I think the further overseas James Halstead exports and the further it strays from its core hospital, schools and retail markets, the more difficult it may be to secure profitable business.

The company earns 39% of profit in the UK and a very similar proportion in Europe and Scandinavia. It is easy to imagine supplying these markets with sheet vinyl from its two efficient UK factories is very cost effective. Shipping products further afield may be less so. I also wonder about the economics of LVT, which is a less integrated business.

- A windfall for Lloyds Bank shareholders and Barclays stock for sale

- How to beat the market: five value stocks that make the grade

The company says its commercial ranges, where sheet vinyl may be more applicable, are more profitable than its heavy domestic ranges. The Asia-Pacific region has experienced high transport costs and shipping delays during and after the pandemic, perhaps highlighting the challenges of operating at distance.

To be honest, I am clutching at straws because James Halstead says little more about these things in the annual report than I have written here. When I have asked for more information, it has largely rebuffed my questions.

In the past, it has explained that competitors read the annual report very carefully. It seems James Halstead does not want to give anything away.

By the numbers

James Halstead marginally surpassed its long run rate of growth in 2023, growing revenue by 4% and adjusted profit by 2%.

This is a decent achievement. Last winter it was still wrestling with high energy and transportation costs and strike action from factory workers. Later in the year, these costs subsided and demand, particularly overseas, increased.

The current year should be positive too. At the AGM last week, James Halstead reported that its results in the first five months of the year were better than the comparative period in 2023, and it expects an improved profit for the full year.

Scoring James Halstead

Even though vinyl flooring is a petrochemical product, James Halstead has long pioneered sustainable policies: recycling materials, leaving a small manufacturing footprint, and working through trade bodies to move the industry forwards.

With rival Altro, it has been operating a collection and recycling service for commercial vinyl flooring since 2009, and its manufacturing process recycles rainwater for cooling.

Unusually, it has not set targets to reduce emissions, believing the problem of climate change will not be resolved by chasing one single statistic.

The directors are tremendously experienced, as are many of the company’s employees.

“Our goals are simple”, it says, “and we avoid overstretching our capabilities.”

It is obviously a good policy, but if going for more than 2 or 3% growth would overstretch James Halstead, that stops it being in the top rank of long-term investments.

The absence of strong growth or much information about how the company intends to grow, means I cannot be confident the company will achieve it.

The Past (dependable) [2]

● Profitable growth: Highly profitable, growing slowly [0.5]

● Strong finances: Super strong [1]

● Through thick and thin: Profitability is stable [0.5]

The Present (distinctive) [3]

● Discernible business: Volume manufacture for repeat customers [1]

● With experienced people: Very, at all levels [1]

● That creates value for customers: Quality, durability, availability [1]

The Future (directed) [1.5]

● Addressing challenges: Not enough information to judge [0.5]

● With coherent actions: Actions mostly preserve business [0.5]

● That reward all stakeholders fairly: Maybe [0.5]

The price (discounted?) [0.2]

+ Perhaps. A share price of 203p values the enterprise at about 830 million, about 17 times normalised profit.

James Halstead is a tough nut to crack. A score of 6.7 out of 10 indicates it is fairly valued.

It is ranked 29 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

More information about Richard’s investment philosophy.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.