Richard Beddard: a high-ranking stock defending national security

Our columnist likes this complex company and the tremendously experienced management team that run it. He thinks the shares are good value too.

13th October 2023 16:02

by Richard Beddard from interactive investor

The big financial achievement reported in this year’s Cohort (LSE:CHRT) annual report is record revenue for the year to April 2023. Perhaps the organisation of the company’s businesses into two operating segments tells us more about how the business is developing though.

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

Cohort is a gaggle of six specialist defence technology firms, which is now reporting as two divisions, each containing three subsidiaries. The Communications and Intelligence division provides hardware and software for collecting, processing and communicating information. Its products and services include radio equipment for boats and armies, and electronic warfare data management, tools, training and support.

The Sensors and Effectors division makes sonar, radar and visual systems for detecting, identifying, tracking and targeting threats.

In reality, any attempt to summarise the businesses glosses over a wide variety of specialist products and services. They range from ear defenders for soldiers to cyber-security consultancy, and related products and services for military and civilian customers, transport authorities and the NHS, for example.

The company supplies Ministries of Defence in the main, and also their suppliers, defence contractors and systems integrators.

Moving with the times...

When Cohort floated in 2006, it operated only one business, a training company SCS, which was subsequently wound down in 2016. Some of its activities were redistributed to Cohort’s early acquisitions, principally MASS, an electronic warfare and cyber-security expert, and SEA, which makes maritime and land systems.

While these companies still do training and consultancy, mostly for the UK Ministry of Defence, Cohort’s strategy in recent years has been to reduce its dependency on UK military spending by growing exports.

It has acquired exporters like Chess, which makes visual tracking and targeting systems, and overseas businesses, like EID, which is headquartered in Portugal and makes communications systems, and ELAC, a German manufacturer of sonar systems.

The product focus was driven in part by changes at the UK MOD which, in response to funding problems, brought more training in house, but hardware and software is also easier to export than research, training and consultancy.

Brings mixed results...

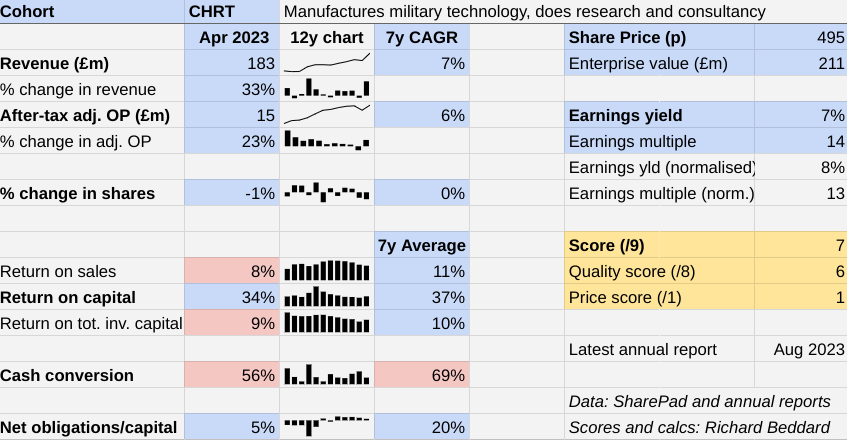

The results of this strategy, though, have been mixed. While Cohort has reduced its dependence on the UK MOD to around 50% of revenue and grown revenue at a compound annual growth rate of 7%, profit has barely grown since Cohort made its first overseas acquisition, EID, in 2016.

- Q3 results preview: profit expectations and an upgrade for UK stocks

- Merryn Somerset Webb: a commodities supercycle like never before

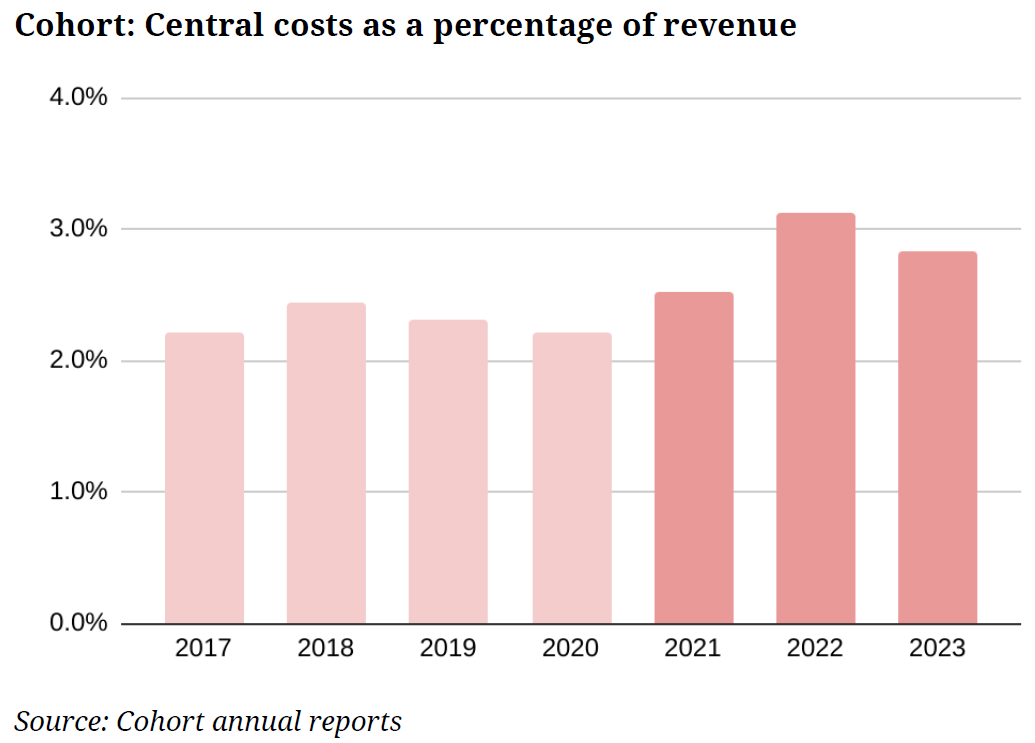

Central costs are rising as a proportion of revenue as the company has to deal with different commercial, legal and financial jurisdictions, fund a new Long Term Incentive Plan, and encourage its largely autonomous subsidiaries to work more closely together, by sharing customers, expertise, and collaborating on projects.

It looks as though more manufacturing, and more subsidiaries, are creating a more complex, capital-intensive business, and this is reflected in lower profit margins and maybe lower cash conversion as Cohort ties up more money in working capital.

It also brings into question whether the acquisitions were worth it. While its operations are still highly profitable, Cohort’s Return on Total Invested Capital (ROTIC) is only 9%. ROTIC includes the unamortised cost of goodwill and other acquired intangible assets, and if it does not improve, it is barely adequate.

CORRECTION: due to a spreadsheet error, this article stated that Cohort's profit has barely grown since 2016 and the accompanying table also shows a 0% seven year growth rate. In fact adjusted operating profit after tax has grown at a compound annual growth rate of 6%. Sorry for the error. New table now included.

Depressed profit margins in 2023 were largely due to circumstances at the three recent acquisitions, exporter Chess, and Cohort’s two overseas businesses, EID and ELAC. Under new management, Chess, acquired in 2018 has been terminating unprofitable contracts and, although the company has reported a “much better” financial performance than in 2022, it is still not as profitable as Cohort believes it will be.

At EID, delays to orders from the Portuguese Navy in 2022 continued in 2023 and caused the company to make a loss. ELAC is experiencing lower margins during the design phase of a major project to supply solar systems on new submarines for the Italian Navy. The

implication is that margins will improve once production starts in the current financial year.

It looks as though momentum is positive in all three businesses, but we cannot assume the company will necessarily generate higher returns on capital in future. It will in some years, but most of its businesses experience lumpy orders and large contracts, and the cessation of either can impact the performance of the group.

The immediate outlook though is positive as inefficiencies at EID, Chess and ELAC resolve. A record order book includes £200 million of revenue for 2024, which implies considerable growth since the company earned £183 million in 2023, and Cohort should still win more orders deliverable this year.

The investment in capital expenditure and expansion in working capital to support this growth will eat into cash flow for the second year running, though.

Which may be less visible in future...

The division of the business into two segments may simplify reporting what is becoming an increasingly complex group, but since Cohort’s businesses operate semi-autonomously, their performance is still relevant.

Autonomy, Cohort says, gives customers and employees the best of both worlds. The subsidiaries can take all but the biggest decisions swiftly, without having to gain head office approval, but customers can be confident they will be around for many years to deliver long-term contracts because of Cohort’s financial strength.

- Stockwatch: are these three shares canaries in the coalmine?

- ii investment performance review: Q3 2023

Between 2018 and 2022, the last year each business featured in Cohort’s segmental report, one subsidiary, MASS, has earned £42 million of adjusted operating profit from £195 million of revenue, an average operating profit margin of 22% before central costs. It contributed 42% of adjusted operating profit from 30% of total revenue.

Incredibly, MASS cost Cohort just £13 million. The challenge facing the company now is to grow its other acquisitions, so we can marvel at them too.

Scoring Cohort

Despite its complexity and the mixed results from recent acquisitions, I like Cohort.

It has tremendously experienced management, seasoned in the UK defence industry before floating Cohort in 2006. Chairman, Nick Prest, who owns a significant shareholding, was one of the company’s two founders. They brought in two former colleagues who remain as chief executive and chief financial officer.

It can take time to integrate acquisitions effectively and perhaps, in the more warlike times we are living through, Cohort can find a way to get the best out of its businesses.

Reassuringly, Cohort identifies its relationships with customers, employees, and suppliers as principal risks. It believes its decentralised approach can give them responsible and rewarding careers and encourages employees to own shares.

Does the business make good money? [2]

+ High ROC, but declining

? Profit margin coming under pressure

+ Weak cash conversion may be a blip

What could stop it growing profitably? [1]

+ Strong finances

? Collaboration between subsidiaries

? Overpaying for acquisitions

How does its strategy address the risks? [1]

? International expansion

? Product focus

? Increasing complexity

Will we all benefit? [2]

+ Very experienced management

+ Rewarding careers

+ Contributes to national security

Is the share price low relative to profit? [1]

+ Yes. A share price of 495p values the enterprise at £210 million, about 13 times normalised profit.

A score of 7 out of 9 indicates Cohort probably is a good long-term investment.

It is ranked 26 out of 40 stocks in my Decision Engine.

Richard owns shares in Cohort.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.