Richard Beddard: can this near-perfect firm continue to prosper?

28th October 2022 14:24

by Richard Beddard from interactive investor

Amid poor prospects for the economy, Richard Beddard considers whether this acquisitive company with a strong element of self-sufficiency can continue to thrive.

We can learn a lot about the strategies of companies from the businesses they buy.

Lighting specialist F W Thorpe (LSE:TFW) has been especially acquisitive recently, and one of its new ventures takes the company into a completely new market.

While activity like this is often risky, FW Thorpe may well be the exception that proves the rule.

Mostly, FW Thorpe makes lighting systems consisting of luminaires (fixtures) and controls that connect individual lights and adjust their intensity and sometimes their colour temperature, depending on occupancy, ambient lighting levels, and the time of day.

- Read about how to: Open a Trading Account | How to start Trading Stocks | Top UK shares

It supplies commercial and public sector customers prepared to pay more up front for products that will save them money over time through lower energy and maintenance costs.

Its biggest brand and subsidiary by far is Thorlux, and its banner product is SmartScan, a wireless lighting platform that can also monitor air quality and other environmental conditions unrelated to light.

Specialist subsidiaries make emergency lighting systems, exterior lighting, streetlights, retail and display lighting, and cleanroom lighting principally in the UK, the Netherlands, and Spain, and export further afield.

Near-perfect numbers

There is not much to worry about in the numbers this year.

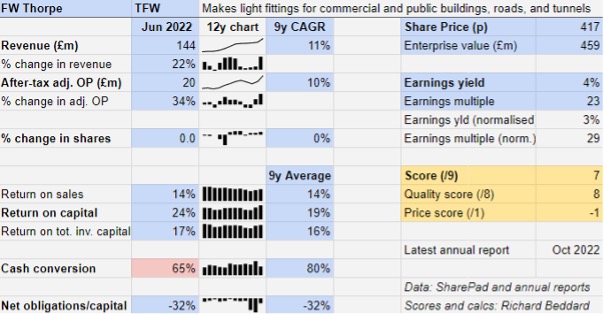

The company grew revenue and profit faster than its low double-digit historical average. Return on Capital at 24% is higher than its more than adequate average, and despite all the acquisition activity, the company retained net cash at the year end.

Ignoring the acquisitions, FW Thorpe still grew impressively. The company says revenue grew 10% and operating profit grew 20%.

Cash conversion was the only below-par statistic at 65%, although par, an average of 81%, is high by the standards of other manufacturing companies.

Mostly cash was gobbled up by working capital as FW Thorpe built up stock to meet high demand and mitigate shortages.

The company reports strong orders and coped well with microchip shortages and price inflation in steel, plastics, cardboard, energy and pay, but not all of these pressures are abating, and it expects further pay increases.

Set against these worries and apparently poor prospects for the economy is the fact that FW Thorpe’s public sector and blue-chip customers are all looking at ways to save energy costs.

Risks worth taking

Looking backwards, the company has been a near-perfect business.

Looking forwards, there are risks. For more than a decade FW Thorpe has profited as customers have switched to energy-efficient LED lighting from old-fashioned incandescent lighting systems. Much of that work has now been done.

However, the early adopters are now overrunning the anticipated lifespan of lighting fittings, which FW Thorpe says is at least 10 years. They are now potential customers for replacements.

I do not know whether the transition to the replacement cycle will be smooth, or there will be a fall in demand as first-time installations decline more quickly than replacement installations increase, but the latter option could be a threat to the company’s growth prospects.

Perhaps that explains why FW Thorpe acquired a modest £6 million 50% stake in Ratio last December, which will operate as a joint venture in a booming but increasingly competitive market.

Ratio is a Dutch manufacturer of electric vehicle (EV) chargers and other power connection and distribution products.

Using Ratio designs, FW Thorpe expects to develop and manufacture chargers at its factory in Redditch to supply the UK market. It also expects to help Ratio with product development.

The company has continued with its roll-up of European lighting manufacturers and distributors, which brings it new products, new competencies, and new markets to export the Thorlux and other ranges into.

Last October, it splurged £21 million for 63% of Zemper, a Spanish manufacturer of emergency lighting systems, but Thorpe is also committed to spending an estimated £16 million to acquire the rest of the shares. The total outlay may be £37 million.

In September, after the year-end, FW Thorpe took another step in its European expansion through the acquisition of 80% of SchahlLED, its biggest customer, a reseller of Thorlux SmartScan systems in Germany and neighbouring countries.

FW Thorpe developed the second generation of SmartScan in collaboration with SchahlLED, which supplied more than 10,000 luminaires to a lighting project in one of Europe’s biggest factories.

FW Thorpe expects to acquire the remaining 20% of the company, but so far the outlay has been £12.8 million.

Self-sufficient strategy

Acquisition activity amounting to more than two years profit after tax in less than 12 months could be reckless, but FW Thorpe has not taken on debt or raised money from shareholders.

As with past acquisitions, they will be entirely self-funded.

And FW Thorpe earns high returns on capital even if we factor in the full cost of past acquisitions. Its return on total invested capital is 17%.

Moving into new markets is also risky, but FW Thorpe has taken perhaps the least risky course, in partnership with an established business for a small initial outlay.

It has developed know-how in electronics that it can use to develop other products and designing and manufacturing chargers for the UK market in its own factories ties into the company’s strategy, which focuses on technology leadership, efficient manufacturing and growing its markets.

The increasing complexity of lighting systems differentiates them, and makes it easier for FW Thorpe to hold on to a specification as a project goes from the design phase to installation.

There is also a strong element of self-sufficiency at FW Thorpe. The company keeps all key processes in-house, which, as it has developed control systems, has made software development a competency.

Carbon neutrality

In addition to Ian and Andrew Thorpe, grandsons of the company’s founder and former executive directors, two non-executive directors are also former managers.

Even the company’s newly appointed fifth non-executive director, and first non-executive that qualifies as independent, did briefly work for the company in the past.

Of the four executive directors, one James Thorpe, is the great-grandson of the founder.

While the board lacks diversity, it has experience. This is one of the reasons why, under the previous chief executive, Andrew Thorpe, and the current co-chief executives, Mike Allcock and Craig Muncaster, it has been such a stalwart.

- 10 quality AIM small-caps that are resisting market fears

- Insider: two stocks for turbulent times get director backing

Mike Alcock, though, shows how employees can develop their careers at FW Thorpe. He joined as an apprentice in 1984.

The company also has a good environmental story to tell. The products save energy and new products are designed to be more compact, more repairable, more recyclable and include fewer components.

To offset carbon emissions, FW Thorpe has been planting trees since 2009, and a solar project completing in the current financial year will enable it to generate 40 to 50% of its own electricity.

These efforts mean FW Thorpe’s operations are already carbon neutral, and it is going after the harder-to-measure-and-mitigate emissions created by suppliers, and its products in use.

Scoring FW Thorpe

There is not much drama when it comes to scoring FW Thorpe.

Does the business make good money? [2]

+ High return on capital

+ High profit margins

+ Good cash conversion

What could stop it growing profitably? [2]

+ Very strong finances

+ Competition is strong, but FW Thorpe is stronger

? End of the LED boom

How does its strategy address the risks? [2]

+ Investment in technology to maintain leadership

+ Strong relationships with architects, consultants and end customers

+ Market growth through acquisition

Will we all benefit? [2]

+ Very experienced managers, not excessively paid

+ Staff development is a strategic pillar

+ Carbon neutral

Is the share price low relative to profit? [-1]

+ No. A share price of £4.17 values the enterprise at about £459 million, 29 times normalised profit.

It is probably the kiss of death when any pundit labels a business near-perfect, but FW Thorpe is one of the companies I measure others against.

The only negative is the perennial one: the share price.

A score of 7 out of 9 indicates FW Thorpe is a good long-term investment.

It is ranked 18 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in FW Thorpe.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.