Richard Beddard: this AIM firm has a buzz about it

24th September 2021 15:39

by Richard Beddard from interactive investor

Our columnist runs a small-cap tech stock through his Decision Engine to see if it’s a good long-term bet.

This year Solid State (LSE:SOLI) is celebrating its 50th birthday, and it has been profitable and cash generative in every one of those years.

Much to celebrate on 50th birthday

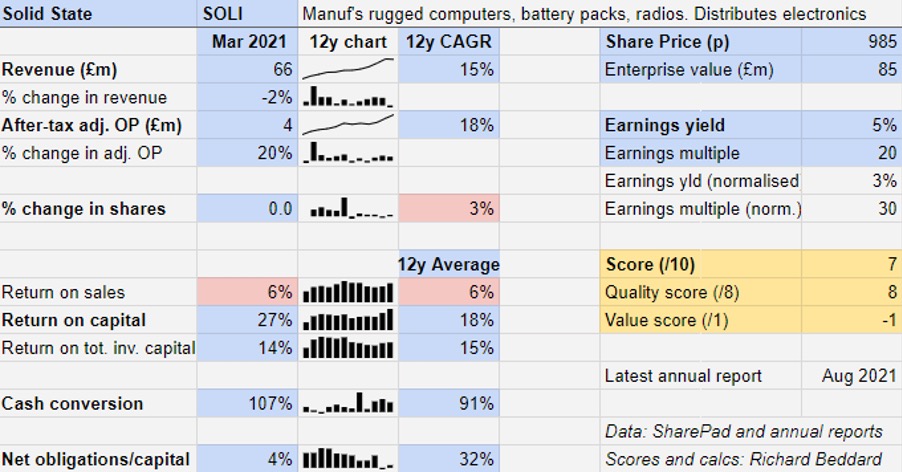

The year to March 2021, coinciding with the first year of the pandemic, was the company’s most profitable of a highly profitable decade. Solid State earned a 27% return on capital.

Past performance is no guide to future performance.

Although revenue declined 2%, profit increased 20% and revenue should grow again in the year to March 2022 as demand for electronic components and equipment rebounds.

The company reports record order intake in the first quarter of the new year and it is confident it has stocked up sufficiently to take advantage of shortages and improve margins somewhat without gouging customers. It may be able to pick up business from less well-prepared rivals.

The manufacturing side of the business, Steatite, specialises in making rugged computers, battery packs, communications equipment and antennae. I was once told its naval computer servers can survive 30-G, also known as a torpedo strike, and computers and monitors ruggedised by Steatite are also used for bomb disposal and football’s Video Assistant Referee (VAR) system.

In March, Solid State acquired Active Silicon, a manufacturer of imaging products used in many of the markets Solid State already serves, including security and defence, medical and transportation applications.

Active Silicon increases the computing capabilities of Steatite. For example, it has recently been selected to supply an underground rail computing solution that includes Active Silicon printed circuit board designs.

The Value Added Supplies side of the business comprises Solid State Supplies, which distributes semiconductors and electronic components; Pacer, which distributes opto-electronic components (displays, sensors and LEDs for example); and Willow Technologies, acquired earlier this year.

Willow is a value-added distributor of electro-mechanical components such as switches and sensors with a US manufacturing subsidiary.

Willow increases Solid State's presence in attractive markets, such as Electric Vehicles (EVs) and green tech, as well as some of Solid State’s more traditional markets, and brings with it own-brands and patents that may be applied to other products in the group.

Strategic adjustments

Solid State supplies technology other companies cannot, or do not want to, because it is complex, hazardous, or because data in it must be kept secure. Safety, security and reliability are important to Solid State’s thousands of customers and the know-how and accreditations required to meet their needs reduces the field of competitors.

Increasingly Solid State’s strategy emphasises own-brand products, which earn higher margins and can be sold through other distributors in, for example, European markets the company does not currently supply.

- Don’t be shy, ask ii...when should I sell and lock in profits?

- Your guide to interactive investor’s five Model Portfolios

International growth is another new strategic focus. Following the acquisition of Active Silicon and Willow, Solid State has a significant manufacturing and distribution base in the US and may benefit as customers there and in the UK source components closer to home.

It restlessly develops and acquires new technology, capabilities, software and components, which means it can manufacture more complex products, and supply more components for projects manufactured by third parties.

The fourth part of its strategy is leadership and skills training to ensure it remains “a trusted partner”.

Barriers to profitable growth

Value Added Supplies earns lower profit margins than the manufacturing division but the company is trying to remedy that by providing services, for example pre-configuring components ready for customers’ production lines, and sourcing and storing obsolete products on behalf of customers who still use them.

The group earns very healthy returns on capital after including the original unamortised cost of the acquisitions in the capital base (Return on Total Invested Capital (ROTIC) is 14%. This measure suggests Solid State has bought decent businesses at inoffensive prices.

What is more, it generally does not have to resort to external funding to finance acquisitions. It funded Active Silicon and Willow from its own cash flow, ending the year with very low net financial obligations, lower than it started the year with (assisted also by cash conservation measures during the pandemic).

I do wonder, though, if Solid State’s strength, the bespoke nature of much of its work, could also be a weakness insofar as it is difficult to scale.

Perhaps that explains why the company’s biggest acquisitions, Pacer in 2018 and Willow this year, have been distributors, where the customisation element is lower and it is easier to share costs and cross-sell components.

To my mind, this brings two of Solid State’s goals into conflict: growth and higher profit margins since the easier business to grow is also the less profitable one.

Perhaps it is also why the company’s long-standing chief executive Gary Marsh has also intimated a forthcoming acquisition might not be an addition to either of its two divisions, but a third standalone business.

- Shortlist of AIM’s best companies in 2021 revealed

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Solid State took this approach once before, when it bought Steatite in 2002 and became a manufacturer as well as a distributor. That worked out very well.

Each time the company buys a standalone division, though, it becomes more complicated.

Solid State has also developed a taste for higher-quality businesses. Its stock-in-trade has often been businesses that are under-achieving, which it subsequently raises to the level of the group by sharing costs (for example, warehousing), and providing funding where this has been inadequate, for example the acquisition of stock in greater quantity at more favourable terms.

Willow and Active Silicon are more profitable businesses with brands, patents and new capabilities, the kind of business that attracts a higher price.

I think that Solid State has been improving the quality of its own businesses for many years now, so it knows what it is paying for and how much to pay for it.

Scoring Solid State

I like Solid State. Its mission is straightforwardly to be relevant to customers: “To remain at the forefront of electronics technology, delivering reliable, high quality products and services; adding value at every opportunity, from enquiry to order fulfilment; consistently meeting customer and partner expectations.”

Does the business make good money? [2]

+ High and improving Return on Capital

+ Strong cash conversion

? Yet to improve profit margins

What could stop it growing profitably? [2]

+ Strong finances, acquisitions self-financed

+ Competition limited by complexity and security requirements

? Bespoke nature of the business may limit growth

How does its strategy address the risks? [2]

+ Specialises in difficult niches

+ Investment in own brands and custom products

? International expansion, particularly US

Will we all benefit? [2]

+ Experienced chief executive Gary Marsh is significant shareholder

+ Core element of strategy is to invest in people and know-how

+ Explains itself well to investors

Is the share price low relative to profit? [-1]

− A share price of £10.25 values the enterprise at £88 million, about 21 times adjusted profit. 2021 was an exceptionally profitable year though.

A score of 7/9 suggests Solid State is a good long-term investment.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Solid State.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.