Recent weakness is signal to buy either of these two stocks

Despite delivering solid growth and upgrading forecasts, these fierce rivals have both underperformed the wider stock market this year. That makes no sense, says investing expert Rodney Hobson who names his favourite of the two.

6th December 2023 09:21

by Rodney Hobson from interactive investor

Rival fizzy drinks makers Coca-Cola Co (NYSE:KO) and PepsiCo Inc (NASDAQ:PEP) have raised profits guidance this year after producing encouraging quarterly results, yet their share prices have tailed off lately on overblown fears surrounding health issues. This could be a time to buy.

Coca-Cola, based in Atlanta, Georgia, reported at the end of October that revenue rose by 8% year-on-year in the third quarter to 29 September, reaching almost $12 billion. Net income fared even better, up 9.2% to nearly $3.1 billion.

This “overall solid quarter,” to use the company’s own justified description, prompted chair and chief executive James Quincey to raise his organic revenue forecast for the full year to 10-11% from 8-9% previously. Counted in constant currencies, earnings per share growth will come in at 13-14%, up from the already commendable earlier forecast of 9-11%.

As nearly 10 months of the year had been completed by the time he issued the revised forecast, one must assume that barring an unlikely catastrophic Christmas the prognosis will be pretty much spot on. The upward revision should allay investors’ fears that earnings will be squeezed as worries grow over obesity and unhealthy eating habits.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

It is not just the Coke brand that makes this group the largest producer of soft drinks in the world. Its portfolio includes other top brands such as Sprite, Fanta, Schweppes and Innocent Smoothies. It is hard to see more than one turning sour at the same time, especially as Coca-Cola has taken steps to reduce the sugar and calories in its drinks.

The past few months has brought a similar story at Pepsi, where revenue rose 6.7% to $23.5 billion and net income by 14% to $3.1 billion in the three months to 9 September. While revenue expectations for the full year were left at 10%, earnings per share were indicated to come in 13% higher rather than earlier expectations of 12%.

This followed a particularly strong second quarter for Pepsi when it bounced back from a disappointing first three months, and augurs well for a successful start to 2024. However, Pepsi is more susceptible to criticism of encouraging unhealthy lifestyles as it dominates the global savoury snacks market.

Life should start to get a little easier for these two rivals after they have fared well in tough trading conditions, including rising costs. Both have managed to raise prices without affecting sales. Both will benefit from a slight weakening of the US dollar as the round of interest rates making the currency more attractive to foreign exchange traders comes to an end. This will boost sales and profit figures when translated into dollars.

Apart from a slump to $108 in the general stock market crash in early 2020, Pepsi shares rose steadily for about four years to reach $198 in May this year. They have tailed off to just below $170, where the price/earnings (PE) ratio is banking on continued growth at 28.2 but the yield compensates at 2.9%.

Source: interactive investor. Past performance is not a guide to future performance.

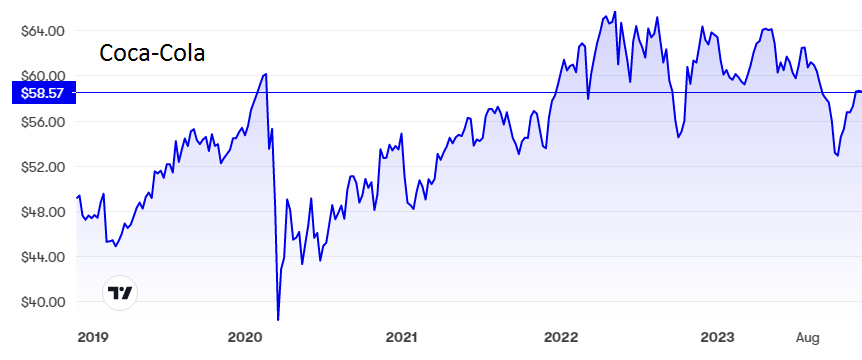

Coca-Cola shares suffered an even more dramatic slump in the first months of 2020, hitting $28, but their performance over the past couple of years has been more subdued than at Pepsi. A peak of $65 was reached in May last year but the share price is back below the pre-pandemic peak at $59. The PE at 23.7 is a little less demanding than Pepsi’s and the yield is a little higher at 3.1%.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I rate both shares as a buy after recent weakness, but Coca-Cola is surely the better option with its superior PE and yield, especially as it has raised its dividend every year for 60 years, a trend that looks extremely likely to continue.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.