Powe! Can this fund's knock-out performance continue?

23rd December 2015 12:00

by Lindsay Vincent from interactive investor

Investment managers, apart from the occasional hedge fund misfit, tend not to do death or glory; but some choose to live closer to the divide between success and failure than their rivals.

To do this, they need large measures of self-belief and not a little courage. Members of this brigade of the bold run highly concentrated portfolios, rather than adhering to the more customary practice of spreading risk across a large number of diversified investments.

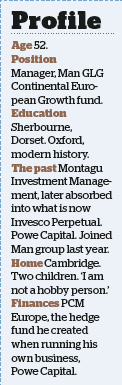

The band includes individuals such as Rory Powe, manager of - a fund with just 34 holdings. Boldness has been his friend. On taking over the fund on 1 October 2014, his first move was to slash the number of inherited stocks from 200 to 10. On 2 October be bought another 20 stocks and set up his stall with just 30 initial holdings.

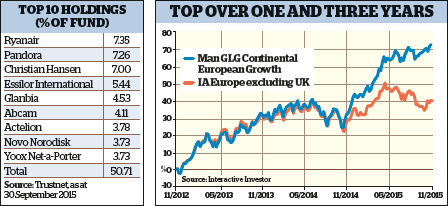

The current tally is 34, and he avers that it is unlikely to ever exceed 40. Can a man beat a machine? The question is pertinent because of the way the fund was previously managed. In Powe's case, the answer so far is yes. For most months in the past year, Powe has beaten every man, woman and computer trading system in sight.

In the 12 months to the end November his fund rose in value by one-third, making it the top performer in its 101-strong peer group. It has also topped the three-year performance tables.

Man beats machine

His predecessors employed computer-driven trend data to support their systematic approach to wealth creation, and those who programmed the machines were not exactly mugs.

In the one- and three-year periods before Powe took over, the fund's performance figures placed it in the second quartile. But in the three months immediately prior to the arrival of Powe and his machete, it had slipped into the third quartile.

Powe approaches investment with singular intensity. "I am not a hobby person," he confesses. Even at weekends, he says, his mind dwells on investment concerns. This diligence might appear to be at odds with his criteria for ownership, for he is no churn 'em, burn 'em manager; more buy, sit and watch like a hawk.

"When I buy a stock, the intention is to own it for at least three years, and in many cases five years. The best I will own for more than five years," he says. Moreover, Powe places decent bets on his best ideas. The top 10 holdings account, by value, for some 50% of his £200 million fund.

, led by the cuddly Michael O'Leary, is one of those holdings; it needs no introduction, but few will be familiar with many of the other companies he invests in. Powe, initially through his hedge fund, has owned the airline stock for 10 years. "The best ideas I just hold, as long as [firms] don't diversify from their core competence.

"They must stick to their knitting," he says. "I got hurt by the tech sell-off in 2000, and I learned to stick to proven winners. I have made more than my fair share of mistakes, so when I cut, I cut aggressively."

Europe's strongest companies

Geographically, the largest destination for his money is Denmark, followed by Ireland and Germany, but there is no regional bias. He would buy a company in Slovenia if he thought it was warranted. "This fund is looking to invest in Europe's strongest companies, and on the whole I am pretty uncompromising in applying that approach," he says.

This means he favours companies with strong market positions that are profitable, in-cash and have "a valuation that's defensible". He says: "My view is that global growth will be unexciting and European growth even more unexciting." He believes there are the beginnings of a recovery now in Italy and Spain, and possibly even in France; but overall, the momentum underwhelms him.

Powe's approach, then, is to "look for companies that can do well in a difficult economy". This does not mean "long defensive bond proxies" such as telecoms and energy businesses, but companies with competitive positions and pricing power, plus those that offer consumers value for money in these difficult times.

He offers Ryanair as an example, and XXL, a sports goods company listed in Oslo in 2014, as another. Bruised, perhaps, by his nasty attack of tech woes at the beginning of the millennium, Powe says he ignores most initial public offerings, partly because they are time-consuming, though he also admits to "cynicism".

However, once listed, he does follow companies for positive signs, like a fisherman scanning the horizon for feeding seabirds. In the case of XXL, Powe noted that company executives were buying after the firm's flotation, so he went to Oslo to find out more.

The operation, with six different departments that cater for four seasons, was inspired by Ikea. Thus, once you enter XXL, there is no escape before the checkouts. XXL now has a 25% market share, a low cost base and a robust consumer base that treats its great outdoors as a backyard.

Right now, falling oil prices mean , among other institutions, has placed the Norwegian economy on its watch list. Moreover, economic deterioration recently prompted the country's sovereign fund, the world's largest equity investor, to become a net seller of global equities.

Funds raised have been recycled to aid the beleaguered economy. In general, however, Powe regards the macro view as not much more than "a need to be very aware of what's going on".

Key investments in Denmark

He sure knows what's going on in cheese and yoghurt, something that passes most of us by. One of his largest investments is , the Danish supplier of cultures and enzymes.

This enterprise, which is benefiting from changing diets and structural changes in the dairy world, has 45% of the world market. The US firm DuPont Nutrition and Health has another 30%, and much of the balance is with DSM, a French outfit. But Powe bristles at suggestions that this is a cartel. "It is a very competitive market," he responds.

Christian Hansen has the world's largest "library" of culture strains - some 20,000 - grown in an enormous new 100,000 hectolitre vat. This represents the equivalent of 10 million litres of milk, enough to meet the UK's demand for milk for three days.

Powe envisages a possible rally in unloved, under-owned sectors

By Powe's reckoning, the cost of these cultures amounts to "less than 1% of the cost of dairy goods sold". This could explain the lack of interest from competition authorities in a market where demand is growing by between 7 and 10% a year.

Another key investment is also Danish. is a remarkable business producing jewellery - trinkets, really - that has a global presence. It trades from some 9,500 outlets throughout the world, 160 of which are in the UK.

Remarkably, two-thirds of revenues come from charm bracelets. The average selling price is £45. The target market is women aged between 25 and 45. Pandora originally sold bracelets, but it has now expanded into items such as rings, necklaces and earrings.

In Powe's words: "Pandora should be viewed as a producer of emotional attachments." The company has profit margins that would get the juices of any accountant flowing: its gross profit margin is 70% - a legacy, in part, of the company's huge workforce in Thailand.

The body beautiful

Powe also invests in another company catering for the body beautiful. is an Irish producer of sports nutrition proteins derived from dairy products - in this case whey.

Red Bull it is not. It cannot be bought in supermarkets but only in gymnasiums (another business on the up across the world). Its main product is sold under the name Optimum Nutrition, which is a powder that is mixed into a milkshake that bodybuilders consume like children might a soft drink. "Good stuff," Powe reckons.

His main foothold in technology is , a German online operation loosely comparable with Linkedin, that global irritation for millions of "professionals".

"Xing is an online social site for German white-collar workers," says Powe. It has eight million names in its system, 800,000 of which are paying subscribers. This provides them with access to the recruitment site - a site with an edge, since it permits professionals such as lawyers, medical people and those who are simply wealthy to see who is hiring whom.

In effect, it's a provider of talking points. Currently, Powe's main worry is other people - an everyday concern for folk who live or die by scoring points off the opposition. He envisages a possible rally in "unloved, under-owned sectors, causing a rotational switch away from the names favoured by the fund".

Put another way, the trend drivers in computers are deciding where next to spread their programmed funds. Today, for many, investment has come to this.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.