An outstanding dividend payer going cheap

Shares in the oil majors have collapsed, but this cheap high-yielder offers valuable diversification.

11th March 2020 09:56

by Rodney Hobson from interactive investor

Shares in the oil majors have collapsed, but this cheap high-yielder offers valuable diversification.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

The collapse in the oil price has left oil explorers and producers badly exposed, none more so than US giant Chevron Corp (NYSE:CVX). A lot of bad news is now in the share price and investors who seek to exploit special situations could consider whether the bottom has been reached.

It was bad enough for oil companies when they were facing a possible global recession in the wake of the coronavirus crisis. Any slowdown will obviously reduce the demand for oil, and it takes time for explorers and refiners to react by reducing output. With heavy fixed costs, oil companies suffer disproportionately as each dollar off the value of a barrel of crude flows pretty much straight through to the bottom line.

Chevron is an integrated energy company with exploration, production and refining operations across the globe: production in every continent except Antarctica and refineries in the United States, South Africa and Asia capable of handling 2 million barrels of oil a day. It is the second-largest oil company in the US, producing the equivalent of 3 million barrels of oil a day, including 7.2 million cubic feet of gas.

- This is what coronavirus could do to company profits

- Want to buy and sell international shares? It’s easy to do. Here’s how

Unlike many US companies that plough cash back into the business or indulge in share buy-backs, Chevron has been an outstanding dividend payer, having increased its annual payout for more than 30 years.

Up to the end of February it was forecasting that it would generate about $30 billion in cash this year, cash that would fund an 8% dividend increase and $4 billion worth of share repurchases. The plan was to improve investor returns even further, to the tune of $75-80 billion over the next five years.

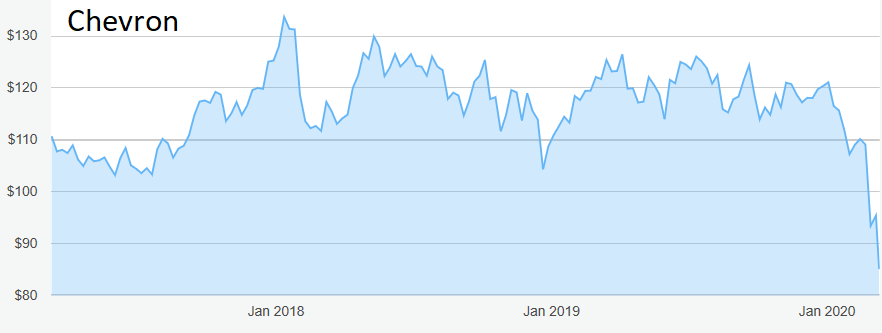

Source: interactive investor Past performance is not a guide to future performance

Unfortunately, this was all predicated on a Brent Crude price of $60 a barrel, almost double the level plumbed after the weekend spat between Saudi Arabia and Russia.

Oil prices were already falling in anticipation of reduced demand during the coronavirus crisis, but OPEC and other major producers were expected to agree to reduce output to ameliorate the effects. The problem, as OPEC has found several times in the past, is that some oil producing countries, particularly those desperate to earn foreign currency, actually try to step up production to increase earnings, thus exacerbating the situation.

In this case Russia refused to reduce its output and Saudi Arabia retaliated by slashing its prices by up to $7 a barrel to teach Russia an expensive lesson. Crude prices fell to their lowest level since January 2016. Oil company share prices crashed.

- Get exposure to the world’s biggest companies via these ii Super 60 recommended funds

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

The challenge for investors is to spot the bottom or at least something in the right general area. The situation will get back to normal at some stage – crude prices have already started to recover – and despite the campaigns against fossil fuel and the development of electric cars the world is still heavily dependent on oil for the foreseeable future.

Even as the crisis was breaking, Chevron chairman and chief executive Michael Wirth was extolling the company’s strong portfolio and promising to “grow cash flow and increase returns without relying on rising oil prices”. It is reducing costs and trying to improve margins and make investments more efficient.

However, recent events may delay plans to increase production by 3% a year until 2024. Much depends on whether the Saudis and Russians reach a compromise or whether the adversaries remain stubborn.

Chevron shares have slumped from a peak of $121.43 at the start of this year to just above $80, but they could be bottoming out, having recovered to $85. If this does not prove to be a dead cat bounce, there could be another $10 to come in pretty short order.

Hobson’s choice: Chevron will recover in time, although the short term could be a test of nerves. Buy up to $93.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.