Only one thing stops me buying Avon Rubber

9th February 2018 17:16

by Richard Beddard from interactive investor

All needs to do is not mess up, to prosper. It should make a good long-term investment.

Perennially on my watchlist, I've decided to add Avon Rubber to the Decision Engine. This means I've collected data going back to 2006 in my spreadsheet, read the latest annual report, and formed an opinion on the firm's profitability, how likely that profitability is to be sustained and how effectively it might be invested to grow the business. I will use these judgements to rank Avon against the other shares I follow.

Avon Rubber passes an important first test. It explains itself well, which is a good thing because I know very little about respirators and milking equipment, the products Avon manufactures. Avon provides lots of detail about these products and the trading performance of its two divisions: Protection, and milkrite | InterPuls.

Avon Protection has grown on the back of a 10-year contract with the US Department of Defence that made it the exclusive supplier of its general service respirator, the M50. The M50 is a gas mask. It protects troops against chemical and biological hazards.

Milkrite | InterPuls was formed when milkrite, part of Avon, acquired InterPuls in 2015. Milkrite is a leading supplier of clusters and liners, the equipment that attaches to a cow during milking. InterPuls added a range of equipment that automates and controls the milking process.

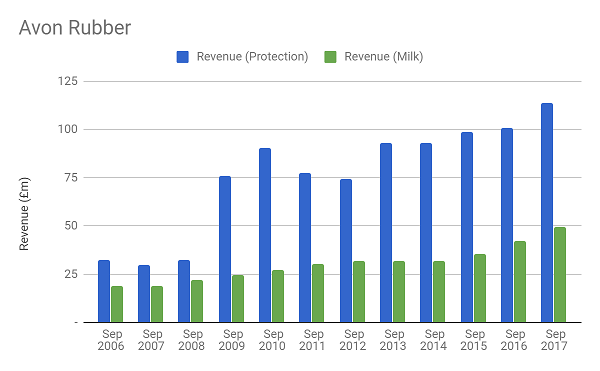

The chart above shows the dramatic impact of Avon Protection's respirator contract. The division's revenue quickly ramped up from around £30 million to £75 million, and, aided by a couple of modest acquisitions in 2015 and the weak pound in the year to September 2017, it's now over £113 million.

The contract isn't the sole source of this growth. Avon's used the kudos and money it's earned by partnering with the US military to develop a broad range of respirators. In 2017, 60% of divisional revenue came from military customers (74% of that, or £50.5 million, was from the US Department of Defence), 25% from police forces, and 15% from fire brigades.

Milkrite | InterPuls has not grown as dramatically. It's a reasonably steady grower that is susceptible to fluctuations in agricultural markets. When feed prices are falling and milk prices are rising, farmers increase capacity and require more milking equipment. That's the situation today, which, along with the weak pound and the acquisition of InterPuls, has boosted revenue growth recently.

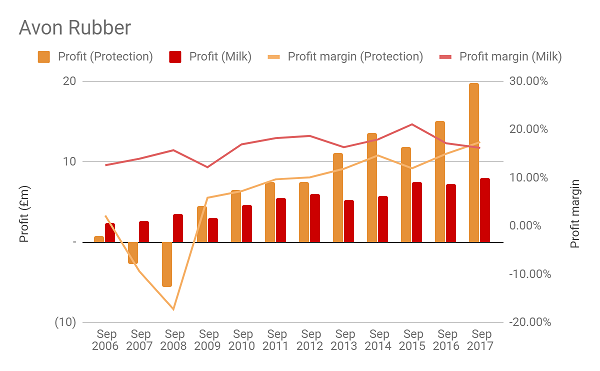

Milkrite | InterPuls has been the more profitable business, earning reasonably high and stable adjusted after-tax profit margins (red line) while growing profit modestly (red bars).

Even more than the revenue chart, the profit chart shows how the respirator contract transformed Avon Protection. Back in 2008, the first year of the contract, the division was making losses. It was spending a lot on developing and manufacturing new respirators but not earning much revenue from them, and the company was just coming out of a period of rationalisation in which it sold off a number of unrelated businesses. Today, Protection has similar profit margins to milkrite | InterPuls (orange line), and the division earns much more profit (orange bars).

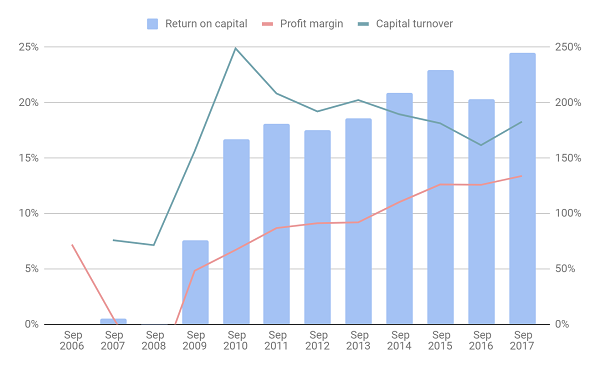

Both businesses have strong market positions. Self evidently Avon has been the dominant supplier of gas masks to the US military, and the US is also milkrite's biggest market where it manufactures 64% of all liners, some for other equipment suppliers but most under its own brand. And this, excepting the period around 2008 when costs were relatively high and revenues relatively low, may explain why Avon is so profitable. In 2017 return on capital almost hit 25%:

Avon thinks it can grow profit at a rate of about 3% a year just by being businesslike, making manufacturing more and more efficient, and increasing its distribution networks so it's supplying more customers. It thinks it can improve on that growth rate by developing new products in the Protection division and new services in the milkrite | InterPulse division.

Historically, it's sold milking equipment to farms, but recently it's begun leasing it, which is attractive to farmers because it means they don't have to buy equipment they might not always use and Avon maintains it. Avon thinks it can improve on the combined growth of being businesslike and innovative, by spending the cash left over after dividends and investments on acquisitions that will give it new products to sell to current customers, and new customers to sell its current products.

This strategy is not particularly revolutionary. What makes Avon interesting, though, is it's working from a position of strength. After decades of technical innovation its products probably do offer the best combination of performance and value. Its salesforce and agents probably do reach more farmers than the competition, and it probably does have a very close relationship with armed forces around the world, and in particular two of the biggest military spenders, the US and the UK. All it must do to stay ahead of the competition and prosper, is not mess up.

In terms of being businesslike and developing winning products, it has proved itself, so the biggest risk lies in acquisitions, where it has much less experience and where the uncertainties are greater.

If you add 10 years to 2008, you will identify another risk. This, 2018, is the year that Avon's exclusive contract to supply gas masks to the US military expires. The company expects any decline in sales of the M50 to be replaced by orders for new, more specialised respiratory systems, and new orders from the British Ministry of Defence. But it means the growth rates of the last 10 years are unlikely to be repeated over the next few years.

One more risk. Because Avon's a venerable company, it operates a defined benefit pension scheme. The total obligation, how big actuaries calculate the fund needs to be to provide pensions in future, is significant, and so is the deficit, £44 million, which is the actuaries' calculation of how much the business will have to pay into the fund if it's to meet its obligations. I don't think it threatens the viability of the firm, which has very little conventional debt, but it might limit how much Avon can spend on acquisitions.

I think these are minor concerns, and Avon will prosper in the long-run. It's at the high end of the middle order in the Decision Engine's ranking and not an outright 'buy'. That's because of the valuation. Even though Avon had a smooth ride in 2017 and profitability may be higher than normal, the share price values the enterprise at about 19 times adjusted profit for the year.

Using Avon's average return on capital of 20% over the last eight years to iron out the favourable kink in profit in 2017, values the shares on 24 times the resulting 'normalised' profit.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

ii publishes information and ideas which are of interest to investors. Any recommendation made in this article is based on the views of the writer, which do not take into account your circumstances. This is not a personal recommendation. If you are in any doubt as to the action you should take, please consult an authorised investment adviser. ii do not, under any circumstances, accept liability for losses suffered by readers as a result of their investment decisions.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Members of ii staff may hold shares in companies included in these portfolios, which could create a conflict of interests. Any member of staff intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. We will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, staff involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.