New Covid-19 poll: bullish investors pick up bargains

interactive investor’s latest survey shows investors have become more optimistic. Here are the stats.

20th April 2020 15:31

by Myron Jobson from interactive investor

interactive investor’s latest survey shows investors have become more optimistic. Here are the stats.

The latest interactive investor poll to gauge investor sentiment amid the Covid-19 pandemic found that more than half of investors are taking the plunge to scoop up potential bargains - despite the stock market having made up at least some of its losses over the past three weeks.

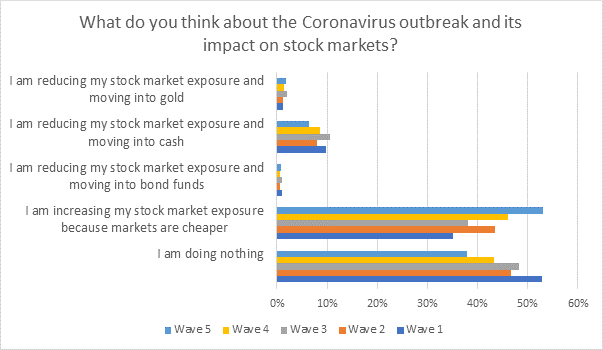

The Wave 5 poll of 3,423 investors conducted between 1 April to the morning of 20 April 2020 revealed an 18-percentage point uptick in the number of investors increasing their stock market exposure “because markets are cheaper” - to 53% from 35% in Wave 1 (28 February – 2 March) and up from 46% in Wave 4 (25 March – 1 April).

Fewer investors than ever are saying they are doing nothing (38% compared to 43% in Wave 4 and 53% in Wave 1).

Lee Wild, Head of Equity Strategy, interactive investor, says: “The recent stock market rebound and the increasingly bullish approach among our survey respondents, reflects a burgeoning sense of cautious optimism among many investors. However, there are still many unknowns.

“We are still none the wiser about the parameter and economic impact of the Covid-19 outbreak and, while there are signs to suggest that Europe has passed the worst of the outbreak and the US is approaching its peak, it is impossible to predict when life will return to normal. The sad truth is the global population may still be vulnerable to a second wave of infections, and this is something that investors should factor in before taking the plunge.

“In our view, markets won’t experience a sustained rally from current levels until there are real positive developments in the race to find a vaccine - but we are told that this could be over a year away. Until then, investors should strap in for bouts of considerable market volatility as the pandemic plays out.”

UK remains favoured region

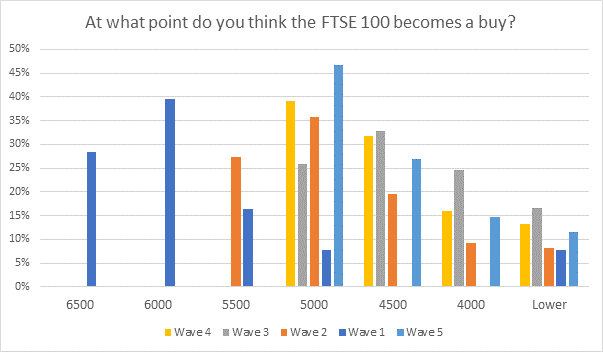

Many investors are all too aware that the market could fall further still. Some 54% of investors are waiting for the FTSE 100 to reach 4,500 or lower before buying the dip. Of them, 12% are waiting for below 4,000.

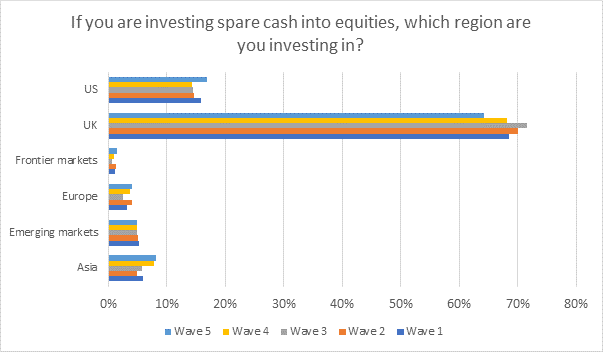

The UK remains the most favoured region for those increasing their stock market exposure (64%), followed by the US (17%) and this was very similar across past instalments of the research.

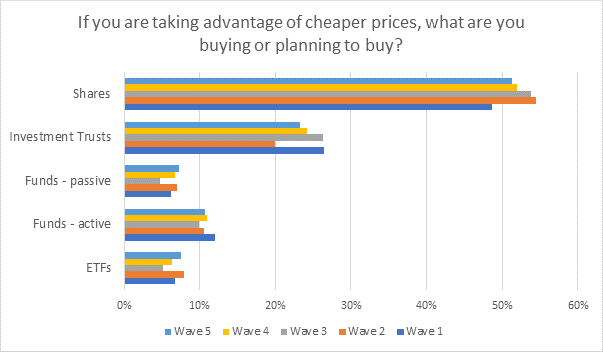

Investors are still tending to favour direct shares to take advantage of buying opportunities (51% up from 49% in Wave 1), followed by investment trusts (23%, down from 26% in Wave 1).

Some 11% of investors are looking at active funds, and 7% passive funds, and 7% are looking at ETFs.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.