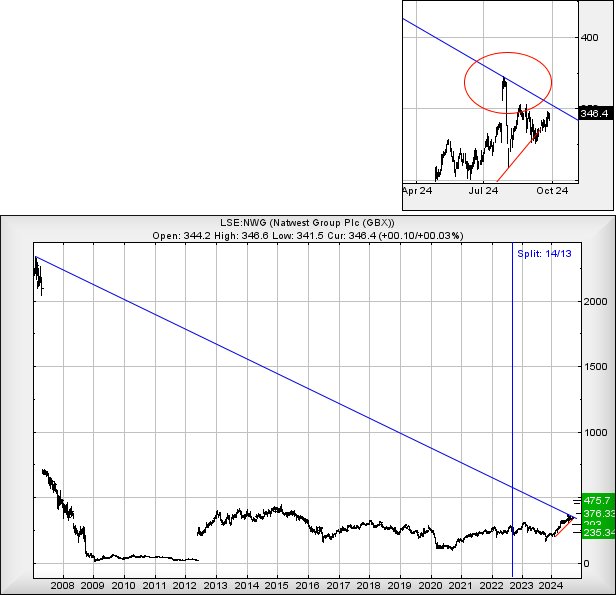

NatWest shares could be following this long-term trend

After hitting a nine-year high over the summer, shares in the high street bank still haven't traded sideways. Independent analyst Alistair Strang issues an update after spotting a different trend.

30th September 2024 07:23

by Alistair Strang from Trends and Targets

There’s a chance we may be ignoring something fairly obvious against NatWest Group (LSE:NWG), a share notorious for failing to grab opportunity when it comes along.

What caught our attention was a series of share price movements at the end of July (shown on insert), when for four sessions it began to appear possible the share price was reacting to an absurd trend line which dates back to 2007. If this is indeed the case, there’s a pretty strong argument suggesting we pay close attention to any break of this trend, due to the chance this retail bank may start to do something useful.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Currently, for NatWest, above 355p should break trend, potentially triggering a lift to an initial 376p with our secondary, if exceeded, calculating at 452p or perhaps even 475p, thanks to the effect of quite a few price manipulation gaps at the open of trade this year.

To trash the opportunity, the share need only slither below 324p (if the movement triggers), leading to a favourable stop loss level.

Below 324p risks being slightly dangerous, working out with an initial drop target of 292p with our secondary, if broken, at 235p and hopefully yet another bounce as the share once again attempts to storm the future!

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.