Metro Bank remains one to keep an eye on

After staging a recovery that began last summer and generated a 75% gain for the share price, independent analyst Alistair Strang believes there could be more to come.

20th February 2025 07:45

by Alistair Strang from Trends and Targets

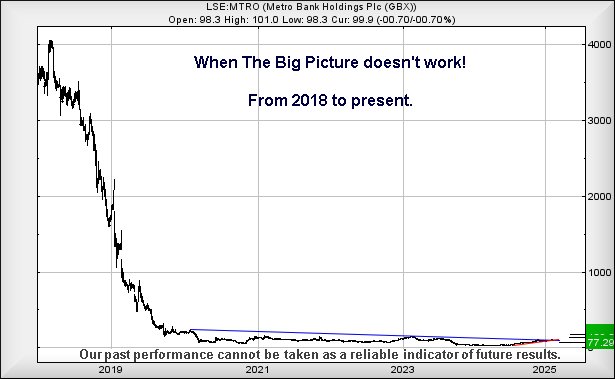

Metro Bank Holdings (LSE:MTRO) is a perfect candidate to illustrate a major issue – common across the retail banking sector – of when it can be useless to approach a subject and start from a Big Picture perspective. The chart below doesn’t need any clever arguments, a simple glance confirming it’s utterly useless, similar to other charts from the banking field but just a late starter.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

About the only safe message the chart delivers is advising traders to abandon hope as there’s an impossible mountain to climb. We think this is one where it may not be barking mad to keep an eye on.

Source: Trends and Targets. Past performance is not a guide to future performance.

Of course, if we change the timeframe and glance at the share from 2020 to current, a more legible picture appears, one which isn’t overshadowed by an impossible recovery slope to the over optimistic £40 level.

Instead, we can start to review a share price which repeated analysis declared was “cheap at 2 quid” then “cheap at 1 quid “, “a steal at 50p” and, of course, “an absolute bargain at 27p”. All things considered, the journey downward has been unpleasant but somewhat rushed to mimic the awful position of the other retail banks.

However, similar to the major banks, Metro is now showing some signs for “proper” recovery and we suspect share price movements may prove relatively useful this year. Currently, above 107p should apparently trigger some slight recovery to an initial 139p with our secondary, if beaten, a more confident sounding 173p.

Though neither ambition comes close to bothering the share price all-time highs, movement such as this would certainly prove an impressive first step on the path to recovery.

Should things intend to go wrong for Metro, price drift below 90p risks danger, calculating with the potential of reversal to an initial 77p with our secondary, if broken, a hopeful bottom at 67p.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.