Lloyds Bank: surely the sluggish share price must rev up soon?

Charts suggest this stock is meant to be going up, but progress is slow.

12th April 2021 08:45

by Alistair Strang from Trends and Targets

Charts suggest this stock is meant to be going up, but progress is slow.

Lloyds Banking Group

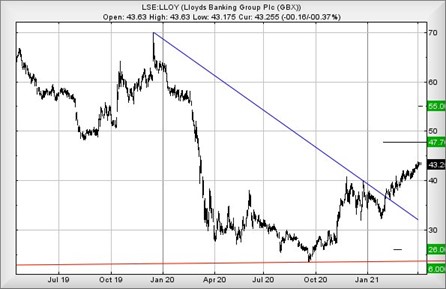

Since we last covered Lloyds Banking Group (LSE:LLOY), the share price has exceeded the magical 42p trigger level and is supposed to be going up. Similar to our recent bout of vaccine-related mild flu symptoms, movements are slow, but surely things must speed up anytime soon.

Presently trading around 43.2p, the share price need only better 43.8p to once again hint at the potential for recovery. Unfortunately the pace of growth is proving slightly worrisome, as above 43.8p calculates with the potential of an initial 47.7p, slightly lower than our previous expectation of 50p as a ‘breakout’ target level.

The better news comes if 47.7p is exceeded, thanks to our longer-term potential of 55p remaining an intact ambition. We have some real concerns about the 55p level, as our in-house rules almost demand volatility at such a point.

- Bestselling ISA investments in the 2020-21 tax year

- Your vote counts: this is a big step forward for shareholder democracy

- Why reading charts can help you become a better investor

It shall be interesting, should the market commence gapping (manipulating) Lloyds’s share price up at the opening of trade anytime soon. This will strongly suggest someone else has done their homework and the stock market intends avoid the banking sector opting to park itself at share price levels below the pre-pandemic highs.

For panic to ensue, Lloyds still needs to fall below 36p, risking a sharp 10p drop and a hopeful bounce. Visually, this looks unlikely.

Source: Trends and Targets. Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.