Lloyds Bank among winning stocks on FTSE 100 and AIM

A number of stocks registered impressive rallied Tuesday. We round up some of the best.

2nd June 2020 15:01

by Graeme Evans from interactive investor

A number of stocks registered impressive rallied Tuesday. We round up some of the best.

Rock-bottom Hammerson (LSE:HMSO) and De La Rue (LSE:DLAR) were again targets for value-hunting investors as shares in the pair continued their recent fightbacks in spectacular fashion today.

Shopping centre owner Hammerson has now more than doubled in value since hitting an all-time low in mid-May, while bank note and passport printer De La Rue is up 255% since Monday's surprisingly robust trading update propelled its shares off a record low.

Their performances reflect growing investor appetite for stocks whose value has been decimated in recent weeks by the impact of the Covid-19 pandemic.

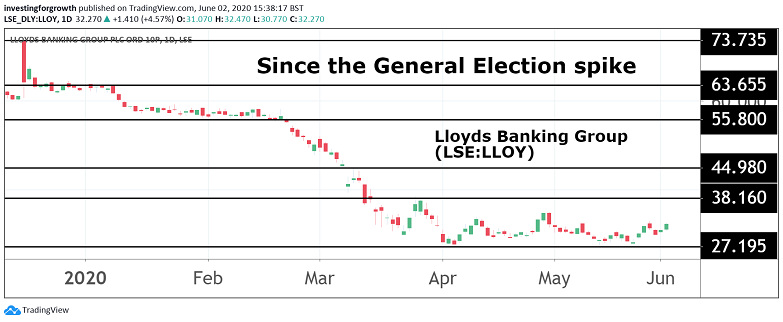

Recovery examples in the FTSE 100 index today included Rolls-Royce (LSE:RR.) shares - up 6% to 304p - and Lloyds Banking Group (LSE:LLOY), which climbed away from its 30p all-time low with a rise of 5% to 32.4p.

Source: TradingView. Past performance is not a guide to future performance.

Other blue-chip risers helping the FTSE 100 to test its highest level since early March were oil giant BP (LSE:BP.), which climbed 5% to 32.4p, and contract caterer Compass Group (LSE:CPG) with a gain of 5% to 1,254p.

In contrast, robust growth stocks AstraZeneca (LSE:AZN) and GlaxoSmithKline (LSE:GSK) - now London's most valuable companies following the recent market volatility — fell by more than 1%.

Hammerson was comfortably the biggest riser in the FTSE 250 index, with its shares up another 32% to 109.15p as the prospect of non-essential retail stores reopening in England from 15 June continuing to boost sentiment. Top flight stock British Land (LSE:BLND) was also 7% higher at 434.2p.

The sudden turnaround for Hammerson has wrong-footed the many hedge funds that have made the Bullring shopping centre owner the second most shorted stock on the London market, with more than 12% of the shares currently out on loan.

Hammerson's revival comes just days after CEO David Atkins said he would leave the company by next spring, having been in a charge for the past decade.

It appears that last autumn's arrival of turnaround specialist Clive Vacher as CEO is already paying off at De La Rue after the company revealed yesterday that it was not being as impacted by Covid-19 as many analysts had feared.

De La Rue has recorded some significant contract wins, including a five-year agreement for its authentication division to supply polycarbonate data pages for the new Australian passport. It also countered expectations that Covid-19 will hasten the demise of cash by securing contracts worth 80% of its available printing capacity.

Shares jumped 130% on Monday and rose another 16% to 139p today, leaving them close to where they were before the wider market slump in late February. There's still a long way back for the shares, however, given that they were trading at near to 700p in 2017.

- Stockwatch: De La Rue up 350%, what now?

- Ian Cowie: tomorrow’s big winners in Asia

- Prospects for UK bank shares

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Electrocomponents (LSE:ECM), which published its annual results today, is already a long way down the recovery road after shares dived to 449.5p in mid-March. The stalwart FTSE 250 index stock is now changing hands at 682.5p, which is close to the multi-year high seen last summer.

The supplier of more than 500,000 industrial and electronic components boosted confidence today when it said that the rate of revenues declines seen during the pandemic had moderated slightly in May as lockdown restrictions began to ease. The like-for-like revenues decline of 14% for the eight weeks from 31 March includes a fall of just 2% for the Asia Pacific region.

A decision on its full-year dividend has been delayed until later in the year, although shares still rose 7% after the company stressed that it had sufficient liquidity under a demanding range of stress test scenarios. Adjusted earnings per share for the year to 31 March rose 1.9% to 37.7p.

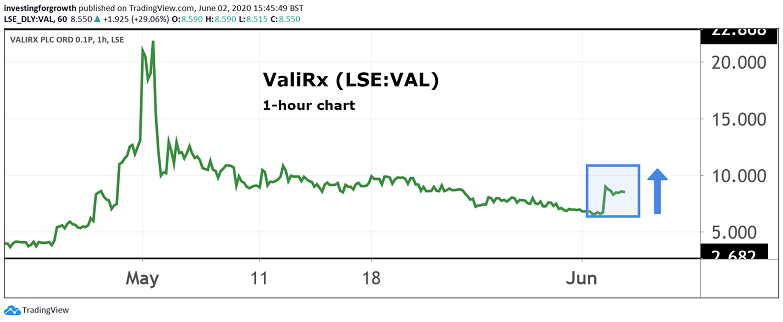

Among smaller cap stocks, clinical stage biotech ValiRx (LSE:VAL) surged 27% to 8.3p after entering into a collaboration agreement that will look into the potential use of its anti-cancer therapeutic VAL201 in a treatment for patients suffering a hyperimmune response to Covid-19.

The company, which has been on the AIM junior market since 2006, has surged in value since raising £200,000 through a placing in early April at a price of 3.5p a share. The stock peaked at 13p later that month.

Source: TradingView. Past performance is not a guide to future performance.

Gaming Realms (LSE:GMR), which creates and licenses games for mobile, tablet and desktop devices, was another AIM-listed stock firmly on the front foot today.

Its shares surged 41% to 14.2p after reporting high levels of growth in licensing revenues during April and May, helped by deals with 888casino.com and Sky Betting & Gaming and the release of three new Slingo games this year. Underlying earnings for 2020 should now be significantly ahead of current market expectations.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.