Leading funds in sector up by 15% in a month

Gold funds gave a glittering performance in 2024, a trend that has continued in the first month of this year.

10th February 2025 15:32

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Although the best-performing sector last month was Latin America, with an 11.4% one-month return, the leading funds were actually from the Specialist sector.

The Specialist sector consists of “funds that have an investment universe that is not accommodated by the mainstream sectors”. This means that across the sector you can find funds investing in a wide range of underlying assets. However, some are very similar. For example, the gold funds that are at the top of our “Top 10 funds in January”.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

Saltydog’s top 10 funds in January 2025

| Fund name | Investment Association sector | Monthly return (%) |

| BlackRock Gold and General | Specialist | 16.6 |

| Ninety One Global Gold | Specialist | 16.1 |

| SVS Sanlam Global Gold & Resources | Specialist | 13.1 |

| WS Ruffer Gold | Specialist | 12.3 |

| Jupiter Global Financial Innovation | Financials and Financial Innovation | 11.4 |

| CT Latin America | Latin America | 11.4 |

| abrdn Latin American Equity | Latin America | 11.1 |

| Liontrust Latin America | Latin America | 10.5 |

| Barings Korea | Specialist | 10.4 |

| Baillie Gifford American | North America | 9.9 |

Data source: Morningstar. Past performance is not a guide to future performance.

These funds do not directly track the price of gold, like an exchange-traded fund (ETF) could. Instead, they invest in companies that are involved in mining and processing gold and other precious metals. However, the performance of these funds does tend to correlate fairly closely with the price of gold.

The BlackRock Gold and General fund“invests at least 70% of its total assets in global equity securities (e.g. shares) of companies which derive a significant proportion of their income from gold mining or commodities such as precious metals”.

In March 2024, the spot price of gold went above $2,200, for the first time ever, and it continued to rise. In October, it broke through $2,700, but then dropped back to around $2,600 at the end of the year. Since then, it has been going up fairly steadily, and has just gone through $2,900. It could well go above $3,000 in the next couple of months.

- Three reasons why 2025 could be another glittering year for gold

- Funds and trusts four pros are buying and selling: Q1 2025

Gold is traditionally considered a “safe-haven” asset and a reliable store of value, particularly during periods of geopolitical uncertainty. Last year the wars in Ukraine and Gaza, coupled with elections around the world, fuelled demand for gold.

Another factor supporting prices has been central bank gold-buying since 2022, especially by China, which has bolstered demand for the precious metal. This trend continued throughout 2023 and carried into 2024.

With Donald Trump in office, you can understand why countries such as China and Russia would be keen to reduce their dependency on US Treasuries and the US dollar, to protect themselves from potential sanctions on dollar-denominated assets.

As we have seen over the past few weeks, ongoing trade tensions and tariff threats have heightened market volatility. A good reason for investors to seek stability in gold.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Where to invest in Q1 2025? Four experts have their say

Gold is usually priced in US dollars, because the dollar serves as the primary global reserve currency and is widely used in international trade. Over the past few months, the dollar has strengthened against most currencies, including the pound. At the end of September, one pound was worth around $1.34, it's now worth $1.24.

This means that when you look at the price of gold in sterling, its recent rise has been even more spectacular.

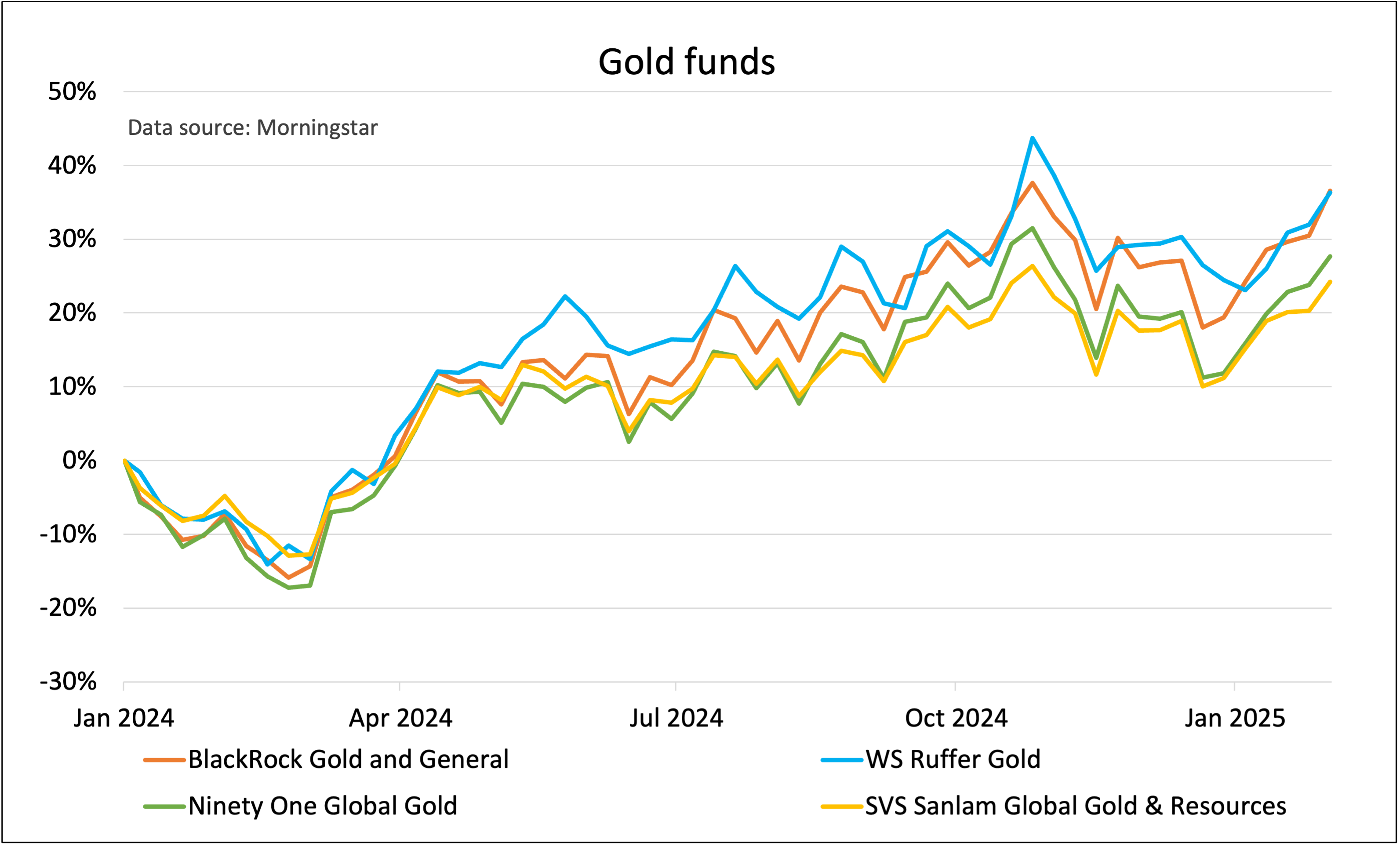

The leading “gold” funds have gone up by more than 15% in the past month, and some have risen by over 30% since the beginning of last year.

Past performance is not a guide to future performance.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.