Kainos IPO makes staff millionaires

10th July 2015 14:14

by Lee Wild from interactive investor

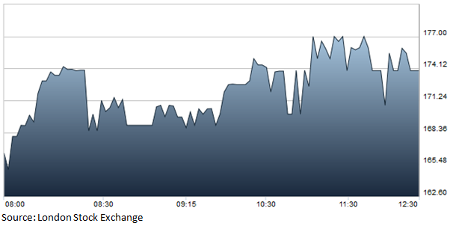

Belfast-based IT services firm got off to a cracking start when it floated on London's main market Friday. Opening 27p higher than its IPO price of 139p, investors chased the shares up to 177p late morning, valuing the business at £209 million. Key staff will be laughing all the way to the bank and at least nine are guaranteed millionaires.

Shareholders have sold a 32% stake in the company, netting £50.6 million in all. QUBIS, established in 1984 by The Queen's University of Belfast to commercialise its research and development, sold over 20 million shares as part of the IPO, halving its stake to 16%.

Kainos founder Frank Graham flogged his entire 5.8% stake for £9.4 million, while chief executive Brendan Mooney made £4 million from the IPO and still owns 14.1 million shares. Chairman John Lillywhite, sales director Paul Gannon and a host of senior management offloaded shares worth millions more. Canny finance chief Richard McCann, meanwhile, is hanging onto all his 6.1 million shares, now worth almost £11 million.

(click to enlarge)

Clearly, McCann fancies the firm's chances. Kainos was set up in April 1986 as a joint venture between ICL (now Fujitsu) and QUBIS. It's now a specialist in digital technology solutions, software design, third-party software integration and implementation, and tech support.

And it's good at what it does. The company made a pre-tax profit of £11.8 million in the year ended 31 March on revenue of £60.8 million. Last year it made £7.1 million on £41.8 million of sales, up from £3.7 million and £30 million respectively in 2013.

Shareholders will get a tasty dividend, too. Bosses target dividend cover of 1.75 times earnings and expect to pay a full interim dividend in December.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.