Jupiter India rebounds after one-day loss of over 9%

Saltydog Investor is reviewing its position in the single-country fund after a steep one-day decline in response to India’s general election result.

11th June 2024 09:12

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

One of our overriding philosophies at Saltydog Investor is that we do not encourage people to invest too much into funds that we know have been the most volatile in the past.

It is often said that the faster things rise, the faster they fall, and that certainly seems to be the case when it comes to investing.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Top ISA Funds

That is one of the reasons why we created our Saltydog Groups. We are trying to help private investors make more informed decisions about the type of funds they hold in their portfolios.

We believe that, for most people, it makes sense to hold a range of investments with different performance characteristics to help create a balanced portfolio. More specifically, a mix of very low-risk funds, in what we call the “Safe Haven” group, along with something slightly more adventurous from our “Slow Ahead” group. Then, when conditions are favourable, there is the option to venture into funds from our “Steady as She Goes” group, and finally into funds from our two “Full Steam Ahead” groups and the “Specialist” sector.

Funds in the “Safe Haven” group are the most boring, but the least likely to suffer any significant losses.

As an example, our demonstration portfolios have been holding the Royal London Short Term Money Market fund since October 2022.

It is hardly setting the world on fire, but it is making steady progress. The graph below shows how it has performed over the last year.

Past performance is not a guide to future performance.

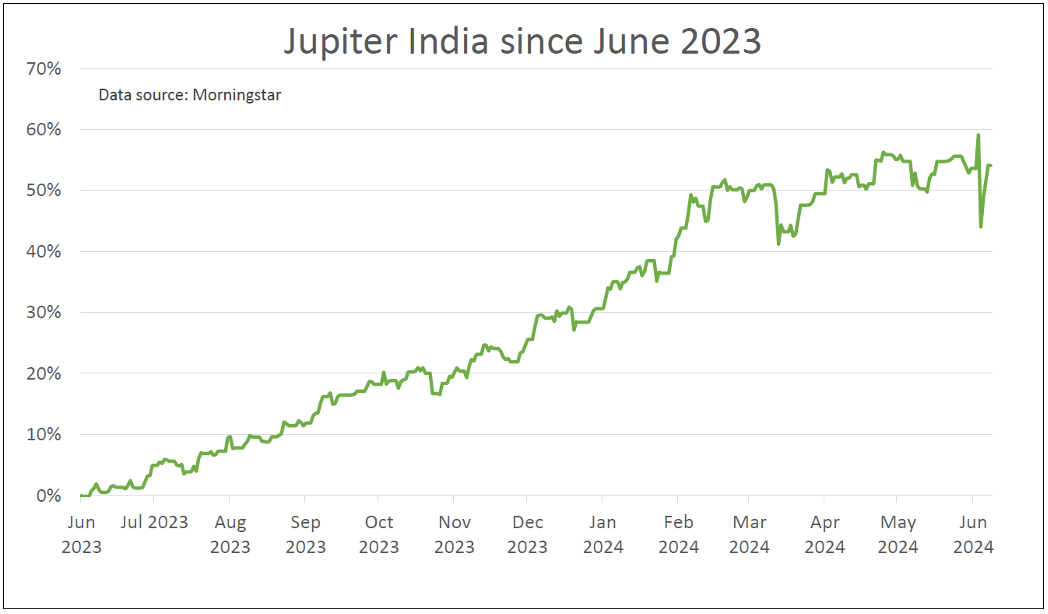

At the opposite end of the spectrum is the Jupiter India fund.

Like all the more volatile funds, we know that when the conditions are right the Jupiter India fund can do “very, very well”, but when things go wrong it can be “rotten”.

Our demonstration portfolios started investing in this fund at the end of August last year, and since then it has gone up by 38.6%.

Obviously, we are not complaining, but there have been a few significant setbacks along the way. That is why investing in funds like this is not for the faint-hearted.

However, we think that it is OK to have a little bit of exposure to some of these “racier” funds, as long as you can still sleep at night. It is all about managing the overall volatility of your portfolio.

At Saltydog Investor, we provide a lot of data about which sectors are doing well, over varying time scales, and which are the best-performing funds. We try not to get too caught up in the reasons why. At the end of the day, if the prices are going up, they are going up.

However, in our demonstration portfolios, I do think it helps if we have a basic understanding of what we are investing in and the potential risks and opportunities.

- The top 10 most-popular investment funds: May 2024

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

I have written about investing in India before on several occasions. It has a wealth of natural resources, along with a large and relatively young population, and an expanding middle class with rising levels of wealth. Although it still gains a lot of its revenue from its exports it also has a large domestic market.

Since 2014, the prime minister, Narendra Modi, and the Indian government, have introduced several policies to boost the economy and they seem to be working. They include the National Infrastructure Pipeline, the Make in India campaign, and the Startup India initiative.

Although historically India’s growth has lagged China’s, that has started to change. As I've said before, China hasn't got a great track record when it comes to sticking to internationally agreed business standards, and the government has faced numerous allegations of human rights abuses over the years. India has started to look like a more attractive option for overseas investors.

However, they have recently held a general election which always has the potential of putting a spanner in the works. It took place in seven phases from 19 April to 1 June, with the results declared earlier this month.

It was the largest democratic election in history, involving more than 968 million eligible voters out of a population of 1.4 billion. Out of these, it looks like more than 600 million people cast their votes.

Just to put that into perspective.In the 2019 UK general election, approximately 32 million votes were cast out of a total electorate of just over 47.5 million.

Before the Indian election, and in exit polls immediately after, most people anticipated that the incumbent Prime Minister Narendra Modi's party, the Bharatiya Janata Party (BJP), would win with a clear majority. In the end, his party scraped over the line, winning the most seats, but without a majority.

There are various possible reasons why he did not achieve the majority expected.

- Why India’s stock market is booming: opportunities and risks

- The global stock market looks expensive: what should investors do?

The opposition parties, primarily the Indian National Congress (INC), formed a new coalition called the Indian National Developmental Inclusive Alliance (INDIA). This alliance managed to mount significant gains, with Congress recording its highest tally since 2014.

There was widespread discontent over economic and social issues, including unemployment and inflation. These issues particularly affected young voters and rural populations, leading to reduced support for the BJP. On top of that, many votersfelt disillusioned with the Modi government's handling of certain policies and governance issues, which was capitalised on by the opposition during the campaign.

It highlighted the fact that although the current government reforms may have helped the country as a whole, and boosted the ever-growing middle class, there were some sections of society still lagging behind.

The prime minister’s coalition, the National Democratic Alliance, still has control over the Indian parliament, but it is not as strong as it was.

Initially, the Indian stock market did not react well to the news. We had a bit of a shock when we reviewed the portfolios last week and the Jupiter India fund had just lost 9.46% in one day.

We held our nerve, and since then it has started to recover. However, the steady growth we saw from this time last year through until mid-March seems to have stopped and since then it has been more volatile.

We are glad that it has recovered, but perhaps it is now time to reconsider our position.

Past performance is not a guide to future performance.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.