The investor-loved sector you should be watching this earnings season

6th April 2023 10:39

by Paul Allison from Finimize

Earnings season will give you the chance to really dig into the details and kick your portfolio’s tires. But if this results period is anything like the last few, you’ll want to keep an eye on one particular sector.

The first three months of this year have sure felt volatile, but earnings season will give you the chance to really dig into the details and kick your portfolio’s tires. This time around, data analytics firm FactSet says analysts expect S&P 500 firms to report a 6.6% drop in first-quarter earnings-per-share (EPS) versus last year. Mind you, they reckon revenue at those firms will have edged 1.2% higher, indicating a tight squeeze on margins.

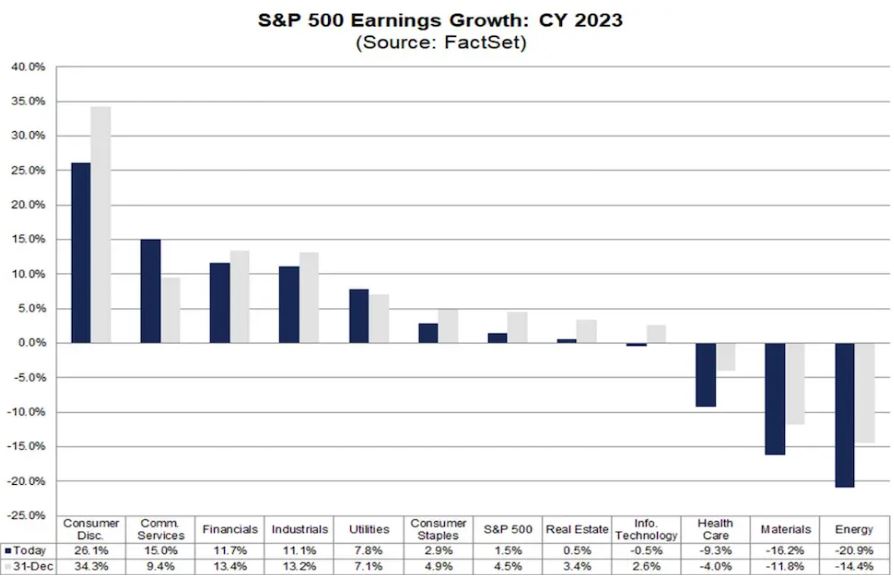

Thing is, quarterly results are backward-looking – and in investing, you’ll be more concerned about the future. So check out the chart above: it shows analyst forecasts, as of March 31st, for each sector’s EPS growth in 2023 (blue bars), and compares them to forecasts from the end of last year (gray bars). Looking at the S&P 500 overall, analysts expect 2023 earnings to inch higher by 1.5%. Bear in mind, though, that those forecasts will change as companies unveil their own updated targets during earnings season. And since those updates might impact the market’s direction, you’ll want to keep an eye out for FactSet’s earnings insight reports for all the latest stats.

Now, if this earnings season is anything like the last few, you’ll want to keep an eye on one particular sector. Take another look at that chart – specifically at technology stocks, which make up more than 25% of the S&P 500. It shows that analysts expect the tech sector’s EPS to slip 0.5% this year from last, but the tech-heavy Nasdaq 100 is up nearly 20% this year and outperforming most major global indexes. That could be a problem: the index’s all-star performance suggests investors have higher hopes for tech firms this year than analysts do – and if companies’ outlooks don’t live up to those lofty expectations, stock prices could take a tumble.

Paul Allison is a senior analyst at finimize

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.