The investment outlook: introduction and house view

It’s in times of uncertainty and volatility that great investment opportunities emerge. It’s also during these times when long-term investors need to keep a cool head.

29th July 2024 10:17

by Peter Branner from Aberdeen

The recent attempt on Donald Trump’s life has got me thinking about “black swans” – those unexpected once-in-a-lifetime events that can change everything.

When a misguided young man crawled on to a roof and took aim at the former US president, he could have thrown the world into turmoil. As it is, the shooter’s actions may have already tipped the balance in the race for the White House.

We can’t predict the future. We can only anticipate, to the best of our ability, what’s likely to happen and take measures to mitigate the risks that we do identify. Here’s our earlier analysis of the upcoming US election that includes three scenarios in which Trump wins.

Our latest House View report, which was completed before the tragic events in Pennsylvania, didn’t anticipate an assassination attempt. But it does recognise the unpredictability that’s making our jobs as investors more difficult, but also more exciting.

When so much is unknown, it can lead to decision paralysis. However, as I keep reminding anyone who’ll listen, investors still have opportunities. In fact, we’ve developed a range of options to address the impact of what I’d classify as “grey swans” - those risks that are recognised, but less likely.

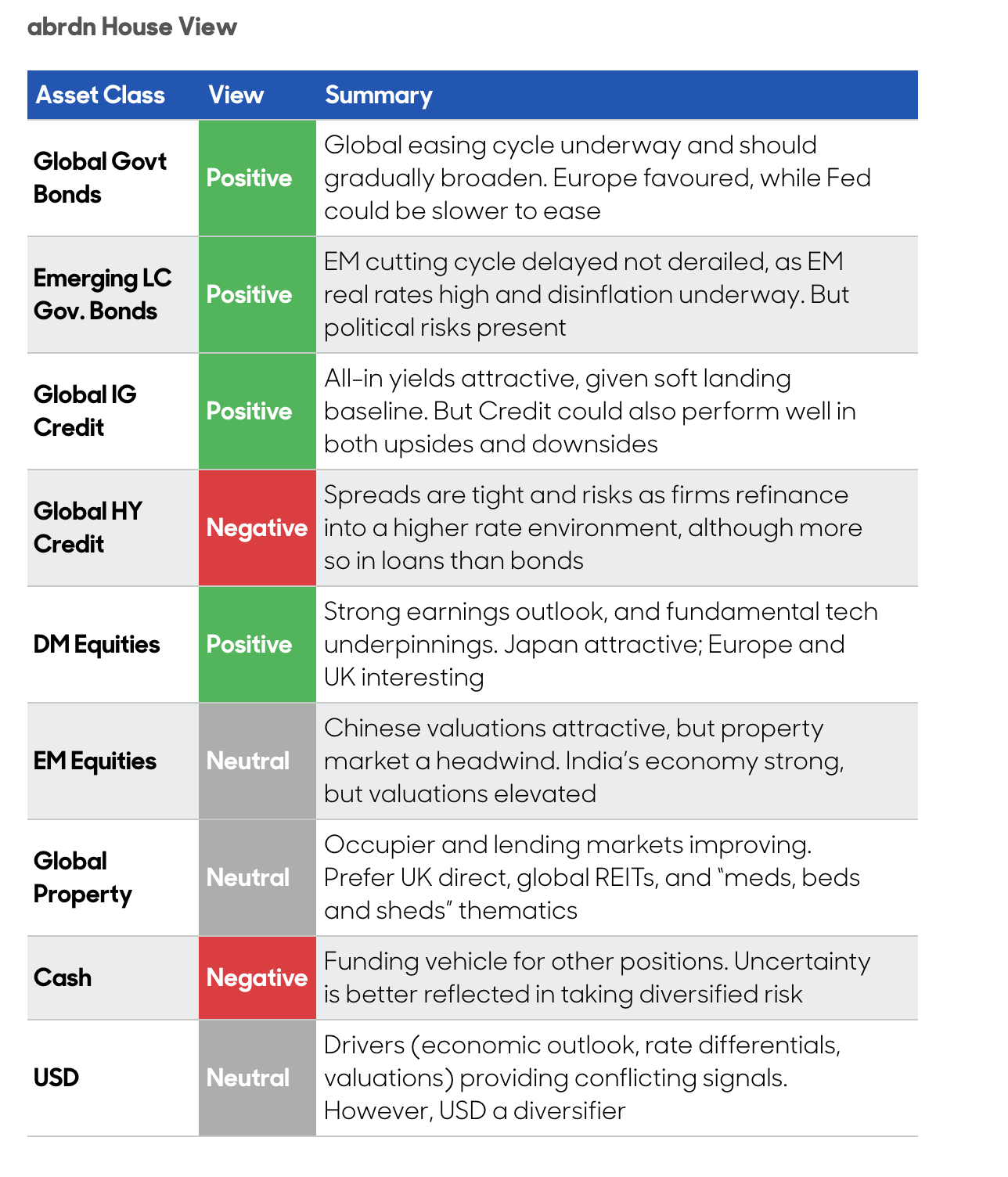

We continue to see opportunities in corporate risk and are modestly overweight duration, amid expectations of a “soft landing“ for the US economy, encouraging inflation data and in anticipation of more interest-rate cuts by major central banks. We’ve also upgraded our view on real estate.

Here’s a summary by asset class:

Source: abrdn, June 2024. The views expressed should not be construed as advice or an investment recommendation on how to construct a portfolio or whether to buy, retain or sell a particular investment.

Peter Branner is chief Investment Officer, abrdn.

ii is an abrdn business.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.