Insider: boss deals in Raspberry Pi shares

After an incredible rally in recent weeks, the founder has been trading shares in this low-cost computer firm. There’s also activity at an AIM listed finance company.

6th January 2025 07:53

by Graeme Evans from interactive investor

Senior directors at Brooks Macdonald Group (LSE:BRK) have marked a year of significant change for the wealth management firm by spending £210,000 on larger shareholdings.

The company, which has increased its annual dividend every year during two decades on AIM, has offloaded its international operations through a £50.8 million deal and made a greater push into financial planning following two recent acquisitions.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

However, the shares have endured a tougher autumn in line with the rest of the sector after Budget uncertainty reduced inflows in its most recent trading update in mid-October.

The three directors bought their shares at 1,660p, which compares with more than 2,000p at the end of August and Panmure Liberum’s 3,000p price target.

The broker said in October that the more simplified company, with its enhanced financial advice offer, was better placed to capitalise on future growth opportunities.

Andrea Montague now leads the business, having joined as chief financial officer in 2023 as part of the succession planning strategy for the chief executive’s role.

The former Aviva chief risk officer replaced Andrew Shepherd, who stepped down in the summer after 22 years with the group and three as chief executive.

Montague led the board’s buying of shares over the final two sessions of the stock market year, spending a total of £132,800 in two separate transactions.

Maarten Slendebroek, who became chair in March, and Montague’s successor as finance boss, Katherine Jones, also made purchases worth £23,000 and £53,600 respectively.

- Five AIM share tips for 2025

- AIM share tips review 2024: my stocks beat the AIM market

- The UK stock market outlook for 2025

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

The appointment of Jones was announced alongside September’s annual results, which showed 7% growth in funds under management to £18 billion and a 12.5% rise in underlying profit to £34.1 million. The total dividend rose 4% to 78p a share.

The results presentation also included the sale of the international operations to Canaccord Genuity Wealth Management, part of a wider strategy update designed by Montague to “reignite growth”. She added: “To be the best, we know there is more we can do.”

Her pledge to target opportunities that will deliver scale and efficiencies was followed by October’s £30 million purchase of Manchester-based LIFT, a move that further enhanced financial planning capabilities following September’s purchase of Lucas Fettes.

Montague said in October’s first quarter update that the two deals showed the pace at which the company has been executing on its new strategy.

She also highlighted the resilience of the business after reporting a second sequential reduction in gross outflows, offset by the 6% drop in quarter-on-quarter inflows.

Peel Hunt reduced its price target on the stock to 1,945p following the update, having cut its profit estimates for this year and next by 11% to reflect the various changes. It expects the new valuation of 14 times 2025 earnings “to be the trough”.

Panmure Liberum added that LIFT and Lucas Fettes offered useful earnings enhancement to mitigate the dilution of the international disposal, leaving Brooks “better placed within the financial advice market to capture the secular growth opportunity within UK wealth”.

It added: “We believe the current rating fails to reflect this, especially within a consolidating sector.”

The company, whose AIM admission took place in March 2005 at a price of 140p, is worth about £270 million after shares closed on Friday at 1,630p. Half-year results are due on 27 February.

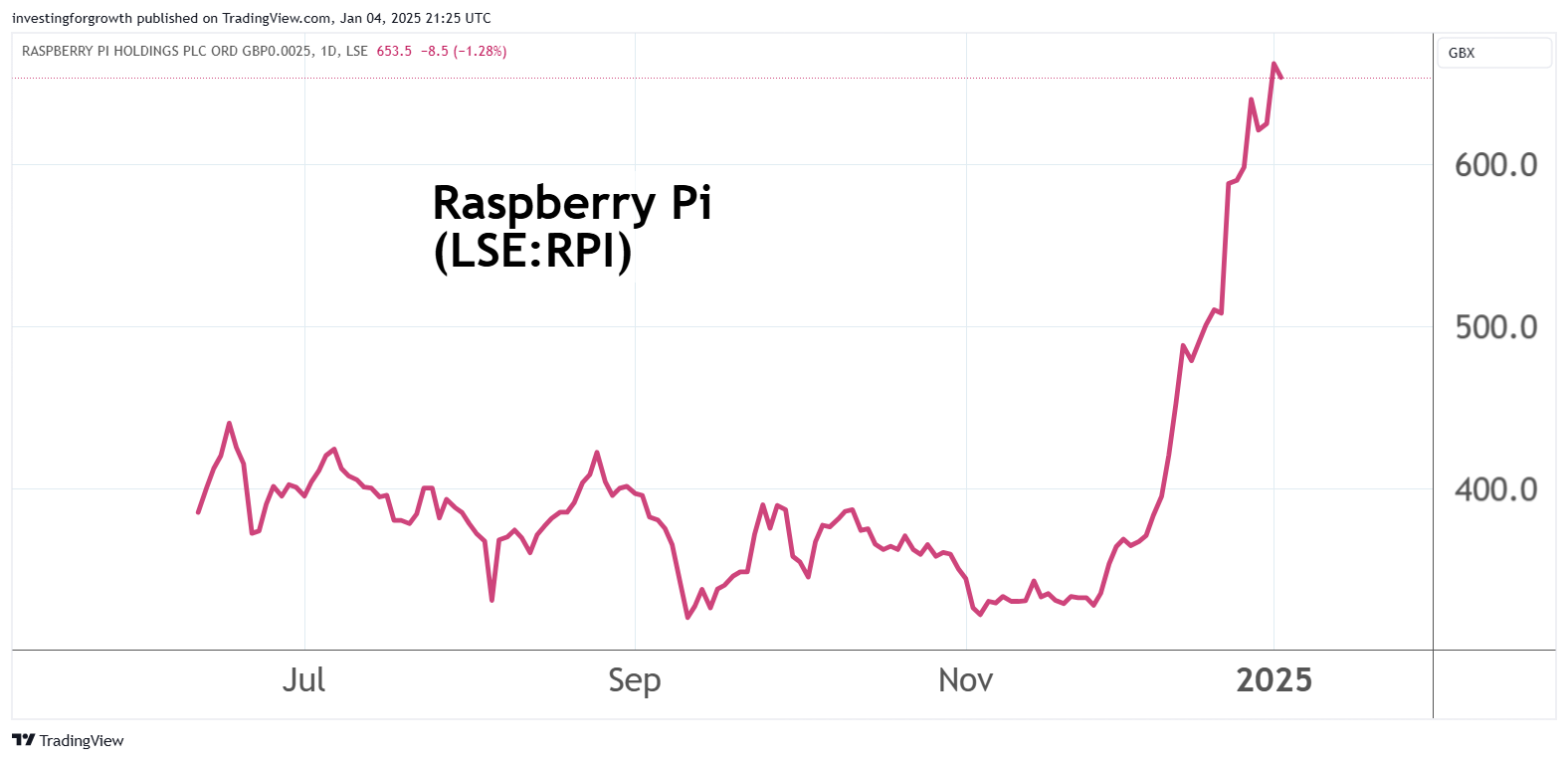

Profit taking after rapid rally

Raspberry Pi Holdings (LSE:RPI) chief executive and founder Eben Upton has disclosed the £185,000 sale of shares at a price 70% higher than the start of December.

The dealings by Upton’s wife Elizabeth took place on New Year’s Eve at 619.5p.

The shares were 363.8p on 29 November and 280p when the Cambridge-based maker of high-performance, low-cost general-purpose computing platforms listed in June.

The advance, which has taken the valuation above £1 billion, follows a strategic partnership with an Italian provider of IoT solutions, payment systems and industrial hardware.

The tie-up has supported the launch of an expanded range of applications using Raspberry Pi’s Compute Module, a product line already in use by over 1,000 industrial customers.

- Watch our video: a FTSE 100 stock to watch in 2025

- Dozen FTSE 100 stocks promise dividends in January

- Watch our video: the megatrend I'm following in 2025

- Ian Cowie: why this is the biggest theme in my forever fund

Upton said in November that the company’s public profile in the wake of June's IPO had opened doors at multiple industrial-focused original equipment manufacturers, such as SECO.

He added: “Our two companies' combined hardware and software capabilities will allow us to deliver solutions for our mutual customers that address demanding use cases at cost effective price points.”

The Uptons held 3.6 million shares equivalent to a 1.88% stake immediately following the company’s IPO. Last week’s transaction involved the sale of 30,000 shares.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.