Inflation watch: cost of living crisis worsens as UK inflation hits 7%

13th April 2022 13:22

by Graeme Evans from interactive investor

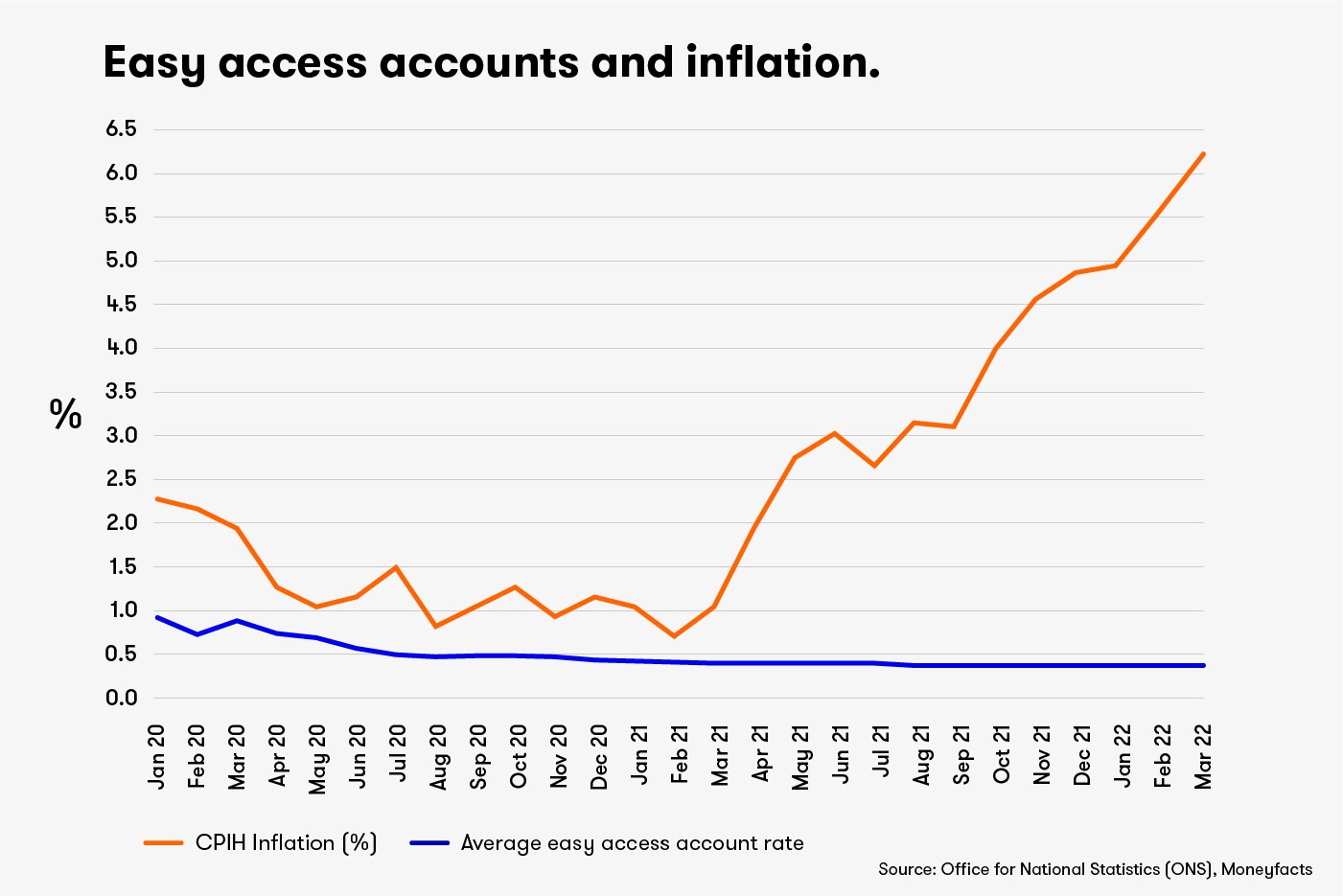

Prices kept rising during March and are poised to keep heading higher as a massive hike in utility costs kicks in. Once again, there is little for savers to cheer as bank account rates lag.

Savers continue to have nowhere to hide from inflation’s devastating impact as today’s latest big jump adds to fears the annual rate could peak at close to 10% this summer.

Today’s 30-year high for the consumer prices index (CPI) of 7% in March compares with 6.2% the previous month and the 5.9% forecast by the Bank of England as recently as February. The Consumer Prices Index including owner occupiers' housing costs (CPIH) jumped 6.2% versus 5.5% in February.

A 54% leap in utility prices is poised to add 1.6 percentage points to inflation, meaning savers should be braced for a figure of around 8.7% next month. But given a recent run of upside surprises, there’s every chance this could be higher.

Panmure Gordon chief economist Simon French wrote on Twitter that there was nothing in today’s release from the Office for National Statistics (ONS) to change his view that CPI will peak at around 10%. He added that a half-point interest rate hike by the Bank of England at its May meeting should no longer be viewed as a long shot.

The prospect of aggressive action by the Bank’s monetary policy committee will be small consolation for savers searching in vain for a competitive return to ease inflation’s force.

- Tactics the pros use to combat rising levels of inflation

- FTSE 100 winners and losers in a turbulent first quarter

- Recessions are becoming more likely – here’s how to invest

The current market leader for easy access accounts based on £10,000 gross is the 1.49% on offer from Chase Bank, falling to 1% in the ISA market with Marcus by Goldman Sachs. The best fixed rate is a five-year bond of 2.5% from Gatehouse Bank.

Moneyfacts notes that the average easy access cash ISA rate at the start of this month was 0.38%, based on £5,000 gross. Its finance expert Rachel Springall said challenger banks and building societies have been competing fiercely with rate changes over the past month but that these have not tended to stay around for long.

She added: “The inflation pressure on the everyday lives of consumers this year has been relentless and for savers it’s impossible to beat it unless it sat closer to the government’s desired target of 2%. Despite an uplift in rates across the savings spectrum, not one standard savings account can outpace inflation today.”

In April 2021, when inflation stood at 0.7%, there were 90 deals that could beat the annual rate. Since then, the base effect of last year’s low figure has been exacerbated by severe price pressures fuelled by supply chain disruption and more recently the Ukraine war.

Today’s 9.9% surge in fuel prices in March was the largest monthly rise on record and added significantly to the CPI annual rate, while there was also an upward impact from annual food and drink inflation moving from 5.1% to a near 11-year high of 5.9%.

The 2% monthly rise in restaurants and hotel prices was the highest since records began in 1988 and there was also a 2.7% increase for furniture/household equipment inflation.

Economists are particularly worried by the 0.9% monthly jump in core inflation, given that this excludes food, energy, alcohol and tobacco and is more indicative of wider trends.

Investec Securities said the bigger-than-expected annual rate for core inflation of 5.7%, up from 5.2%, will be viewed with particular discomfort at the Bank of England.

Economist Sandra Horsfield said: “In the context of the tightness of the labour market, employees seeking higher wages to compensate for increases in their cost of living is a distinct possibility.”

- Shares to protect against persistently high inflation

- An inflation toolkit: fund tips to protect and profit

- How high could US interest rates really go?

She added that the outlook for household spending in light of the price pressures will depend on the ability and willingness of consumers to dig into their stock of savings.

Shares across the retail sector fell sharply today, with the latest inflation shock and speculation of more rapid rises in interest rates sending Marks & Spencer (LSE:MKS), Next (LSE:NXT) and Pets at Home (LSE:PETS) more than 2% lower.

Ruth Gregory, senior UK economist at Capital Economics, sees the Bank’s monetary policy committee raising rates from 0.75% to 1% on 5 May.

She added: “With high inflation feeding into price/wage decisions, we think the Bank of England will have to raise rates further than it expects, perhaps to at least 2% next year.”

The CPI figure in the US yesterday hit 8.5%, but weaker-than-expected core inflation raised hopes that price pressures may be nearing their peak. The Federal Reserve has signalled it will raise rates at all six of its remaining meetings this year, with Wall Street braced for a potential half point increase in May.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.