The Income Investor: don’t overlook these dividend stocks

Investors willing to focus on company fundamentals can capitalise on favourable risk/reward opportunities among mid-cap income plays, writes ii columnist Robert Stephens. Here are two of his top FTSE 250 dividend picks.

7th August 2023 14:21

by Robert Stephens from interactive investor

Many income investors immediately turn to the FTSE 100 index when seeking dividend stocks. While this is understandable, given the index’s 3.9% yield, geographic diversification and the attractive valuations of many of its incumbents, it means missing out on the vast income appeal of the FTSE 250 index.

- Learn more: SIPP Portfolio Ideas | How SIPPs Work | Transfer a SIPP

Significantly, the mid-cap index’s yield is currently roughly equal to that of the large-cap index. And, while the FTSE 250’s constituent companies generate a lower proportion of their revenue from overseas compared with FTSE 100 members, they nevertheless retain substantial international exposure that provides an ample amount of geographic diversification for investors.

In fact, around 39% of sales made by mid-cap stocks are derived from abroad, versus 57% for large-cap shares. Therefore, the financial performance, and dividend prospects, of FTSE 250 index members are likely to significantly improve as the global economy’s outlook strengthens. Indeed, according to the Organisation for Economic Co-operation and Development (OECD), the world economy’s growth rate will increase from 2.7% this year to 2.9% next year as an era of rapid monetary policy tightening comes to an end.

The UK’s improving economic prospects

The FTSE 250’s greater focus on the UK vis-à-vis the FTSE 100 could prove to be an advantage, rather than a disadvantage, for income-seeking investors. The UK economy’s improving prospects could catalyse the financial performance, and dividend growth rate, of mid-cap stocks over the coming years.

The UK economy is undoubtedly lagging many of its developed market peers at present. Although it is now widely expected to avoid a recession in the current year, the International Monetary Fund (IMF) forecasts GDP growth of just 0.4% in 2023. This compares unfavourably with the economic outlook for the US and Japan, for instance, which are expected to grow by 1.8% and 1.4%, respectively, this year. However, next year, the UK’s forecast 1% GDP growth rate is set to match that of both countries, which could have a positive impact on the dividend prospects for FTSE 250-listed firms.

- Cash or shares? What the data tells us about where to invest

- Keep hold of these shares for dividends and growth

So, too, could falling inflation. Although the pace of price rises remains significantly above the Bank of England’s 2% target at 7.9%, and is therefore higher than inflation rates in the US (3%) and the Eurozone (5.3%), it is expected to fall rapidly over the coming months. In fact, the Bank of England estimates that inflation will fall to 2.8% by the third quarter of 2024, and then to 1.7% a year later as the full impact of monetary policy tightening is felt.

An inflation rate that is close to, or even below, the central bank’s target may prompt widespread calls for interest rate cuts. This could further boost the UK economy’s prospects, thereby creating operating conditions that are more conducive to profit growth and rising shareholder payouts.

Mid-cap appeal

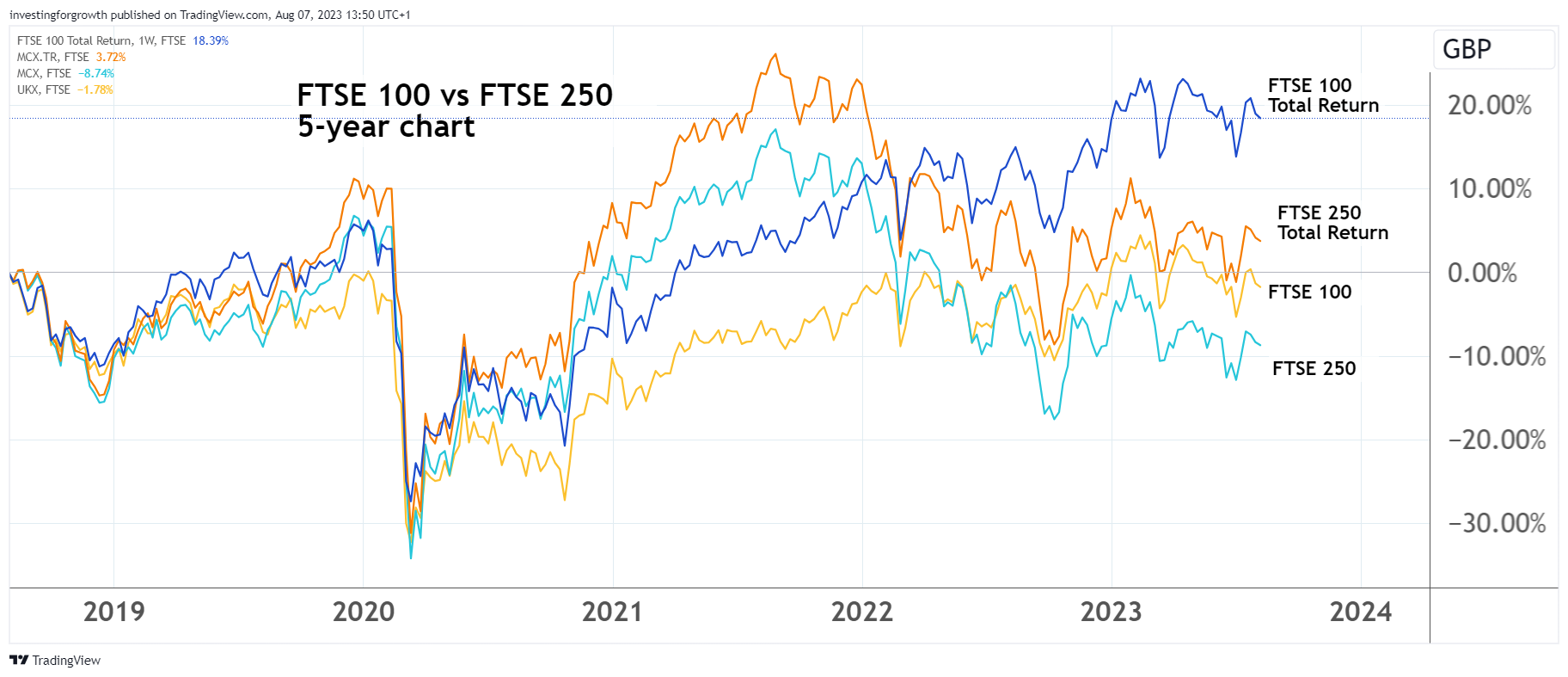

Of course, the FTSE 250 index has been hugely unpopular over recent years. In fact, it currently trades 9% lower than it did five years ago and has lagged the FTSE 100 index by eight percentage points over the same period.

As a result, many FTSE 250 shares trade on extremely low valuations, and high yields, that suggest they are grossly mispriced given their financial standing and long-term prospects. Investors who are willing to focus on company fundamentals, rather than following the views of their peers, can capitalise on favourable risk/reward opportunities among mid-cap dividend stocks.

Source: TradingView. Past performance is not a guide to future performance.

Although FTSE 250 companies are often viewed as growth stocks, rather than income shares, this standpoint may currently be out of focus. As highlighted, the mid-cap index offers a similar yield to the large-cap index and, since its members are smaller companies than their larger peers, they have greater potential to generate profit, and dividend growth over the coming years.

In many cases, FTSE 250-listed companies are mature businesses that are well-established in their respective industries. In contrast to many small-cap stocks, they do not require a large proportion of excess capital to be reinvested for future growth. As a result, they are likely to have a large capacity to pay out a sizeable proportion of profit as a dividend each year.

While mid-cap shares do not offer the size and scale of FTSE 100 businesses, and may therefore be deemed relatively risky by some income investors, a significant proportion of mid-cap stocks have excellent financial positions and wide economic moats. As a result, their risk/reward opportunity is highly favourable for long-term income seekers.

| Yield (%) | |||||

| Asset | Current | 10-Jul | Change (Jul-current) | 12-Jun | 11-May |

| FTSE 100 | 3.91 | 4.07 | -3.9 | 3.90 | 3.86 |

| FTSE 250 | 3.85 | 4.03 | -4.5 | 3.72 | 3.57 |

| S&P 500 | 2.01 | 2.04 | -1.5 | 2.08 | 2.13 |

| DAX 40 (Germany) | 3.31 | 3.38 | -2.1 | 3.31 | 3.27 |

| Nikkei 225 (Japan) | 1.86 | 1.85 | 0.5 | 1.85 | 2.04 |

| UK 2-yr Gilt | 4.888 | 5.382 | -9.2 | 4.582 | 3.729 |

| UK 10-yr Gilt | 4.381 | 4.659 | -6.0 | 4.279 | 3.704 |

| US 2-yr Treasury | 4.768 | 4.915 | -3.0 | 4.617 | 3.860 |

| US 10-yr Treasury | 4.042 | 4.06 | -0.4 | 3.753 | 3.384 |

| UK money market bond | 4.55 | NA | NA | NA | NA |

| UK corporate bond | 5.63 | NA | NA | NA | NA |

| Global high yield bond | 7.14 | NA | NA | NA | NA |

| Global infrastructure bond | 2.29 | NA | NA | NA | NA |

| LIBOR | 5.4505 | 5.4871 | -0.7 | 4.9325 | 4.6657 |

| Best savings account (easy access) | 4.63 | 4.35 | 6.4 | 3.85 | 3.71 |

| Best fixed rate bond (one year) | 6.05 | 6.10 | -0.8 | 5.30 | 4.90 |

| Best cash ISA (easy access) | 4.40 | 4.10 | 7.3 | 3.75 | 3.50 |

Source: Refinitiv as at end of day 4 August 2023. Bond yields are distribution yields of selected Royal London active bond funds at 30 June 2023, except global infrastructure bond which is 12-month trailing yield for iShares Global Infras ETF USD Dist in August. LIBOR is interest rate that banks lend money to one another (3 month LIBOR as at 31 July). Best accounts by moneyfactscompare.co.uk refer to Annual Equivalent Rate (AER). | |||||

ITV

Having fallen by 15% over the past six months, shares in FTSE 250-listed media company ITV (LSE:ITV) now offer a 6.8% dividend yield. Crucially, the company’s dividend payouts are covered more than twice by profit as it seeks to navigate a hugely challenging advertising market.

Indeed, the company’s recently released first-half results showed that revenue declined by 1% as demand for TV advertising came under pressure amid a weak economic environment. As a cyclical company, ITV is highly dependent on the macroeconomic outlook and should therefore benefit to a greater extent than most firms from the UK’s improving GDP growth prospects.

With the company planning to increase dividends per share as profits grow, the stock offers much more than just an exceptionally high yield. It also has capital growth potential as its investments in digital services begin to pay off, with the firm expecting to generate at least £750 million in annual digital revenue by 2026. This represents around 20% of last year’s sales.

Furthermore, with a relatively modest net debt-to-equity ratio of 40% and interest cover of 3.5 in the first half of the year, the firm has the financial strength to overcome a tough period for the wider media sector. It also expects to deliver cost savings of £50 million between 2023 and 2026, which will further enhance its financial prospects.

- The high-yielding shares I am backing to deliver market-beating income

- Why this dividend hero is a reliable income payer

Trading on a price-to-earnings ratio of 7, ITV’s share price offers a wide margin of safety. For long-term investors who can look ahead to a stronger operating environment, the company’s high yield, low valuation and solid financial position are likely to hold significant appeal.

British Land

Real estate investment trust (REIT) British Land Co (LSE:BLND) has also fallen out of favour among investors over recent months. Its shares have declined by 27% in the past six months as the economy’s weak performance and rising interest rates have weighed on the commercial property sector. Indeed, the value of British Land’s property portfolio fell by 12.3% in its latest financial year.

However, the firm’s solid financial position, as evidenced by a loan-to-value (LTV) ratio of 36% and lack of requirement to refinance any debt until 2026, means it is well placed to pivot towards supply constrained market segments such as urban logistics assets.

- Investors to receive £5.4bn of holiday money in August

- Will investors keep buying during historically weak August?

With a price-to-book ratio of just 0.6, the company’s shares offer a wide margin of safety and capital growth potential. In addition, a 6.9% yield highlights their income appeal. And with an improving economic outlook, as well as the potential for a more dovish monetary policy, the company’s prospects are likely to strengthen over the medium term. This could positively catalyse its share price, and dividend growth rate, over the coming years.

Clearly, British Land and ITV are decidedly unpopular among investors at present. As with many FTSE 250-listed companies, though, they have highly attractive yields, dividend growth potential and solid financial positions. As such, they offer more favourable risk/reward opportunities than many FTSE 100 dividend stocks and are worth including in a long-term income portfolio.

Robert Stephens is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.