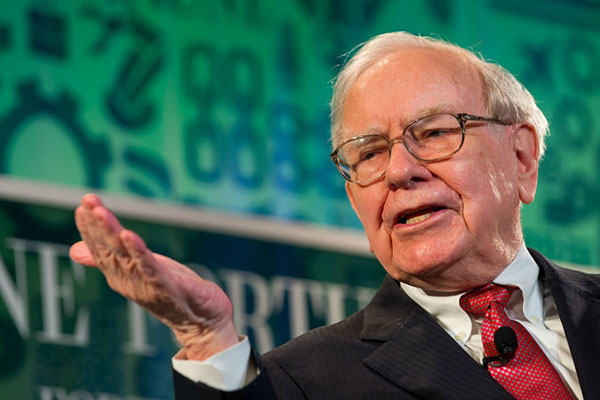

ii view: Warren Buffett's Berkshire cash tops $128 billion

27th February 2023 11:15

by Keith Bowman from interactive investor

Shares for this major US conglomerate comfortably outperformed the S&P 500 index over 2022. We assess prospects.

Fourth-quarter results to 31 December

- Operating earnings down 8% to $6.7 billion (£5.6 billion)

- Net earnings attributable to shareholders of $18.2 billion, down from $39.6 billion

- Cash held of $128.7 billion (£108.1 billion) up from $109 billion in the previous quarter

ii round-up:

The Warren Buffett run conglomerate Berkshire Hathaway Inc Class B (NYSE:BRK.B) detailed a fall in fourth quarter operating profits as earnings for its insurance related businesses retreated.

- Invest with ii: Top US Stocks | US Earnings Season | Open a Trading Account

Operating profit and excluding gains or losses from its investment portfolio fell 8% for the final quarter to the end of December. Overall profit and including gains or losses on its investments held about halved to $18.2 billion.

Berkshire shares rose by almost 4% during 2022, comfortably outperforming a 19% drop for the S&P 500 index. They are down just over 1% so far in 2023. Shares for the USA’s biggest company by stock market value, Apple Inc (NASDAQ:AAPL), fell by just over a quarter in 2022 but have gained by 12% so far in 2023 as hopes that interest rates may be somewhere near their peak have risen.

The Omaha Nebraska headquartered Berkshire, which operates over 90 businesses, bought-back a further $2.6 billion of its own stock during this latest quarter. That’s up from a $1 billion in the prior third quarter. Its cash mountain climbed to $128.7 billion from the prior quarter’s $109 billion.

Profit for its energy and utility businesses rose to $739 million during the fourth quarter from $598 million in the final quarter of 2021. Profit for its railroad business retreated to $1.47 billion from $1.68 billion in the year ago period.

Berkshire’s operating profit for the full year 2022 rose to $30.79 billion from 2021’s $27.45 billion.

ii view:

Led by legendary investor and businessman Warren Buffett, Berkshire Hathaway’s many operating companies employ over 350,000 people. Berkshire, which Mr Buffett has run since 1965, engages in a range of business activities including insurance and reinsurance, utilities and energy, and the manufacture of consumer and building related products.

For investors, an uncertain economic outlook including possible further interest rate rises and a cost-of-living crisis for consumers need to be remembered. Elevated costs for businesses generally warrant consideration, earnings for its insurance underwriting business can prove volatile, while the eventual departure of Mr Buffett from the business could well dampen investor enthusiasm.

- Stockwatch: share soars on takeover approach

- These five American giants made $100bn profit: buy, hold or sell?

- 10 shares to diversify your ISA portfolio

More favourably, its diversity of businesses regularly leaves gains for one division countering falls for another. Recent investment acquisitions, if not full business takeovers, have included shareholdings in Jefferies Financial Group Inc (NYSE:JEF), Louisiana-Pacific Corp (NYSE:LPX) and Occidental Petroleum Corp (NYSE:OXY), while its ongoing share buyback programme continues to offer support.

On balance, and with the distorting impact of previous central bank action still arguably in play on global asset prices, the judgement and experience offered by Mr Buffett’s Berkshire company remains highly reassuring.

Positives:

- Diverse portfolio of industries and businesses

- Company chairman Warren Buffett is regarded by many as a legendary investor and businessman

Negatives:

- Subject to macro-economic and geopolitical uncertainties

- Management succession risk - Mr Buffett is in his 90’s

The average rating of stock market analysts:

Buy

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.