ii view: big questions being asked of Berkshire Hathaway

The conglomerate’s cash mountain is growing, so could share buy backs be expanded?

10th August 2020 11:00

by Keith Bowman from interactive investor

The conglomerate’s cash mountain is growing, so could share buy backs be expanded?

Second-quarter results

- Net earnings attributable to shareholders up 87% to $26.3 billion

- Operating earnings down 10% to $5.51 billion

- Cash of $146.6 billion

- Share buy-back of $5.1 billion

ii round-up:

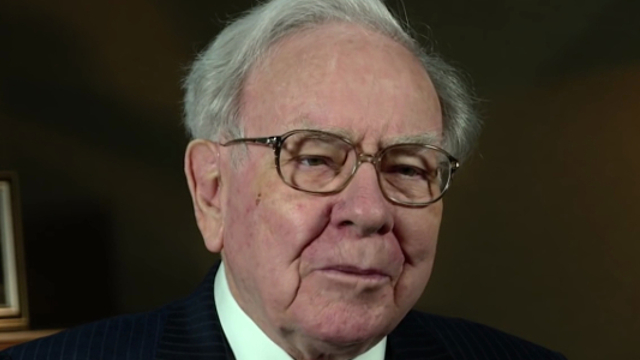

Warren Buffett-run conglomerate Berkshire Hathaway (NYSE:BRK.B) reported a 10% drop in operating profit to $5.51 billion as the Covid-19 pandemic hurt its businesses such as aircraft component makers and rail freight operators.

Berkshire swallowed a near-$10 billion write-down in the value of its Precision Castparts components business which it bought back in 2016 for $32.1 billion. Cancelled aircraft orders meant that Precision had laid-off thousands of workers.

But when allowing for investment gains made over the quarter, net earnings jumped by 87% to $26.3 billion, reversing a loss made over the first quarter.

Shares in Berkshire, which owns a stake in companies such as Apple (NASDAQ:AAPL) and JPMorgan (NYSE:JPM), are down around 7% year-to-date having gained by just under 11% in 2019. Shares of Apple have nearly doubled since stock market lows back in late March, while JP Morgan shares are up by around a quarter.

Berkshire used just over $5 billion of its $140 billion-plus cash pile to buy back its own shares during the quarter, significantly more than the $2.2 billion used in the final quarter of 2019. Year-to-date it has spent a total of $6.7 billion on acquiring its own stock.

Quarterly operating profit for its insurance underwriting business more than doubled in the period to $806 million, as drivers stayed at home under lockdown and generated fewer claims. But it also warned that a provision made of $2.5 billion to give back to policyholders on new and recently renewed policies given customers reduced need for insurance could impact the remainder of the year.

Omaha, Nebraska headquartered Berkshire operates over 90 businesses.

ii view:

Led by legendary investor and businessman Warren Buffett, Berkshire Hathaway is tracked and invested in by large and small investors alike. A conglomerate of different businesses and investments acquired under the watchful eye of Mr Buffett, Berkshire as an American company offers investors a near one-stop investment destination.

The conglomerate’s cash balance of over $140 billion continues to pose questions for shareholders. The sum could see Berkshire making a major acquisition, or provide for significant shareholder returns.

But a 10% underperformance compared to the S&P 500 index year-to-date, added to an 18% underperformance over the course of 2019, suggests thinning investor patience with Berkshire’s inability to find a home to invest its cash mountain. Mr Buffett turning 90 later this month is also raising questions regarding management succession plans.

Positives:

- Diverse portfolio of industries and businesses

- Company Chairman Warren Buffett is regarded by many as a legendary investor and businessman

Negatives:

- Subject to macro-economic and geopolitical uncertainties

- Management succession risk – who might replace current Chairman Warren Buffett

The average rating of stock market analysts:

Buy

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.