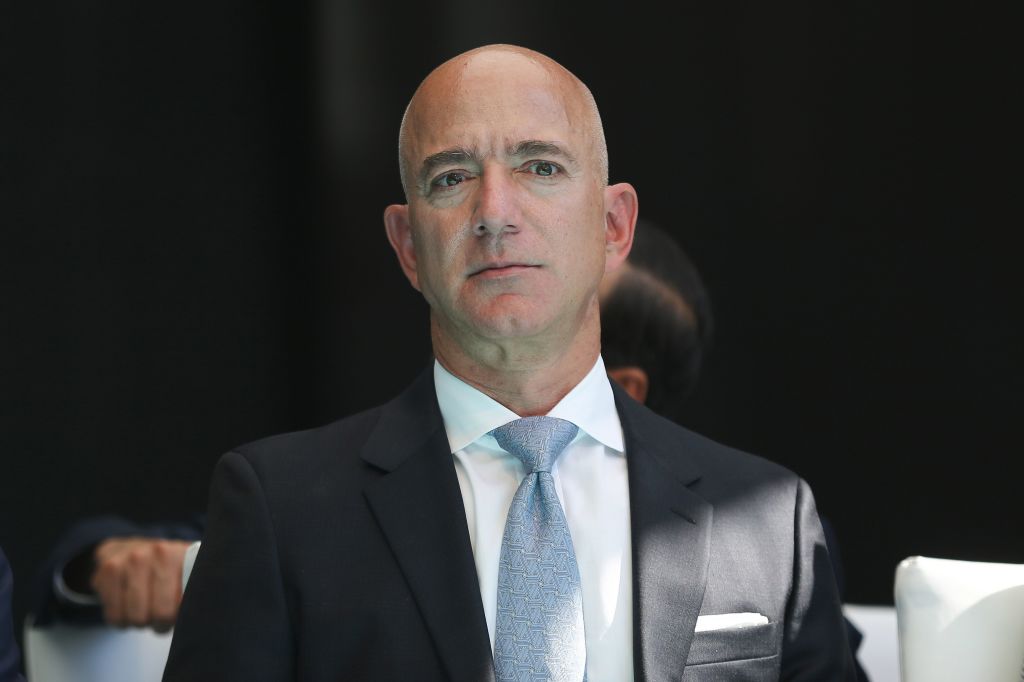

ii view: Bezos steps down as Amazon sales blast past $100bn

Amazon's founder and CEO, now synonymous with online retail, has a change of role. We assess prospects.

3rd February 2021 11:59

by Keith Bowman from interactive investor

Amazon's founder and CEO, now synonymous with online retail, has a change of role. We assess prospects.

Fourth-quarter results to 31 December

- Net sales up by 44% to $125.6 billion (£91.7 billion)

- Operating income up 77% to $6.87 billion (£5 billion)

- Earnings Per Share (EPS) up 118% to $14.09

Guidance:

- Expects Q1 sales of between $100 billion & $106 billion, giving year-over-year growth of 33% to 40%

- Expects operating income of $3 billion to $6.5 billion compared with $4 billion in 2020

Chief executive Jeff Bezos said:

“Amazon is what it is because of invention. We do crazy things together and then make them normal. We pioneered customer reviews, 1-Click, personalized recommendations, Prime’s insanely fast shipping, Just Walk Out shopping, the Climate Pledge, Kindle, Alexa, marketplace, infrastructure cloud computing, Career Choice, and much more. If you do it right, a few years after a surprising invention, the new thing has become normal. People yawn. That yawn is the greatest compliment an inventor can receive.

“When you look at our financial results, what you’re actually seeing are the long-run cumulative results of invention. Right now I see Amazon at its most inventive ever, making it an optimal time for this transition.”

ii round-up:

Online retailing mammoth Amazon (NASDAQ:AMZN) reported quarterly sales of over $100 billion for the first time ever, as it continued to benefit from closed shopping outlets and consumers’ desire to shop from home under the global pandemic.

Sales spiked by 44% to $125.6 billion (£91.7 billion), surpassing Wall Street forecasts for nearer $120 billion. It also surprised investors with news that founder and chief executive Jeff Bezos is to step back come the autumn. He'll become executive chair, with the current head of its cloud computing AWS business Andy Jassy promoted to CEO.

Amazon shares rose marginally in after-hours US trading, leaving them up close to 70% over the last year. Shares of eBay (NASDAQ:EBAY) are up by a similar amount, while shares for UK online food delivery company Ocado (LSE:OCDO) have more than doubled.

Mr Bezos will remain on hand to guide the new chief executive but will now focus on new products and early initiatives.

AWS net sales rose by 28% year-over-year to $12.7 billion and currently account for around 10% of overall group revenue. Cloud profit rose by more than a third to $3.56 billion, just over half of Amazon’s total.

Jassy has headed the cloud business since it started back in 1997. Today it competes with the likes of Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL) and IBM (NYSE:IBM) in courting customers to use its server banks. AWS customers include JPMorgan (NYSE:JPM), BMW and the NHS.

Net retail sales for its home North American market rose by 40%, with profit up 55% to $2.95 billion and accounting for 43% of the overall total. Its international retail business, including the UK, moved back into a profit of $363 million from a loss of $617 million this time last year, just 5% of Amazon’s quarterly profit total. International sales rose by 57%.

Prime Video, which competes against streamer Netflix (NASDAQ:NFLX), reported its strongest quarterly viewing numbers for its live sports content yet. The quarter also saw Amazon announcing the first Alexa built-in commercial trucking integration with Volvo Trucks.

Current group first quarter sales are forecast to grow by up to 40% to a potential $106 billion from $75.5 billion in early 2020.

ii view:

Jeff Bezos founded Amazon in 1994. Selling books online generated sales in 1998 of $610 million. A vast array of products and services sold in 2020 generated sales of $386 billion. Amazon has effectively become a byword for online retail.

2020 and the pandemic have brought both opportunity and challenges. Population restrictions and the disruption to many of its high street rivals has given it opportunity. Protecting its own staff, with an anticipated Covid-19 related spend of around $2 billion in the current first quarter, its own hinderances.

For investors, government concerns regarding the growing dominance of tech giants offers concern. A US government committee in October concluded that Amazon enjoys monopolistic power. The rollout of vaccines could also eventually see the current pandemic tailwind calming. That said, Amazon shares still sit on an estimated one-year price/earnings (PE) ratio of close to 100, suggesting analysts continue to anticipate further strong growth. The hand-over of leadership to a colleague seen as key in building its now significant cloud computing business also generates a some reassurance. For now, long-term momentum and optimism look to remain in Amazon’s favour.

Positives

- Dominant position in online retailing

- The Amazon Web Services (AWS) business is now a major global player

Negatives

- The threat of increased regulation across many of its markets

- Subject to tech valuation concerns

The average rating of stock market analysts:

Strong buy

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.