ii launches three-day fee-free trading offer on US shares

interactive investor launches offer as US earnings season ramps up.

28th January 2025 13:56

- interactive investor customers (new and existing) will not pay trading fees (usually £3.99) on buy and sell orders of US shares from Wed 29 to Fri 31 January 2025 (inclusive), as US earnings season launches into its busiest period

interactive investor (ii) the UK’s second-largest investment platform for private investors, is launching a three-day trading offer on US shares, to coincide with the busiest period of US earnings.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

During this three-day offer, interactive investor customers (new and existing) will enjoy £0 commission on buy and sell orders of US shares placed via the ii website and the ii mobile app, executed from Wed 29 to Fri 31 January 2025 (inclusive).

The offer is open to both new and existing ii customers. Not only will investors on interactive investor be benefiting from the platform’s unique flat-fee pricing, allowing them to keep more of what they accumulate over time, they’ll also be getting a unique chance to explore opportunities in the US market without paying any additional fee.

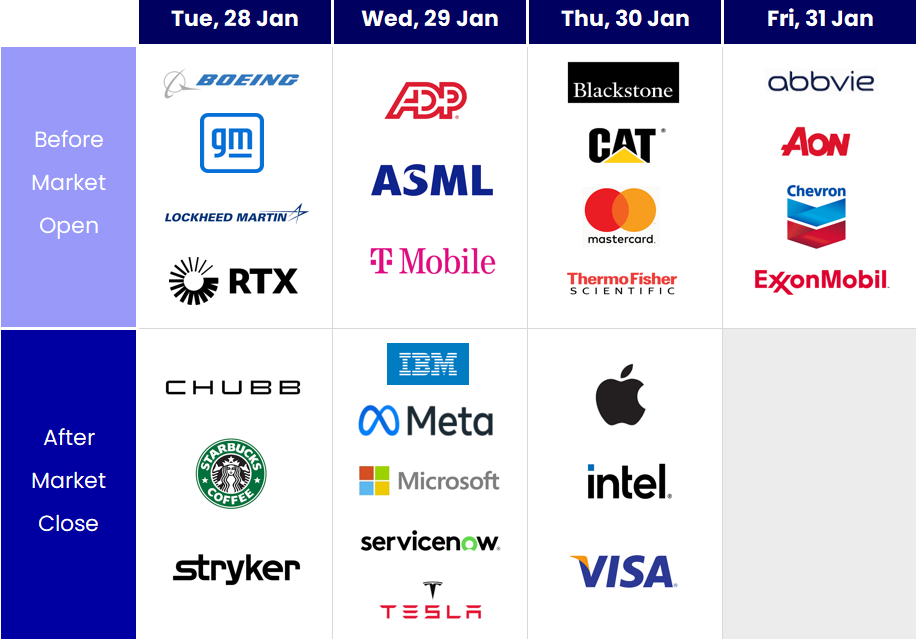

With US earnings season under way, investors might be interested in gaining access to some of the companies in the race to $4 trillion, with Apple Inc (NASDAQ:AAPL) and Microsoft Corp (NASDAQ:MSFT) both reporting. ii’s investors will also be able to access household names such as Starbucks Corp (NASDAQ:SBUX),Tesla Inc (NASDAQ:TSLA), Meta Platforms Inc Class A (NASDAQ:META), and Visa Inc Class A (NYSE:V)– who are all due to announce their results over the course of ii’s three-day US trading offer.

Lee Wild, Head of Equity Strategy, interactive investor, says: “It’s easy to have a home bias when it comes to investing, with many investors preferring to stick to UK stocks and funds. However, it’s crucial to remember that diversification is key when it comes to building your portfolio.

“By investing in US companies, you can gain access to a variety of different sectors and popular household names which are unavailable on our side of the pond. Our three-day trading offer gives investors a great opportunity to broaden their horizons and find new areas of growth.”

Key US earnings announcements this week

Earnings for US tech companies could define investor sentiment for 2025

Richard Hunter, Head of Markets at interactive investor, says “Amid the inevitable noise surrounding the inauguration of the new President, the fourth quarter and full-year reporting season is moving into full swing stateside.

“The early indications have been extremely promising, with the large banks having reported. Most helped settle any initial investor nerves for the year with a generally robust set of numbers which lifted the likes of The Goldman Sachs Group Inc (NYSE:GS) and Citigroup Inc (NYSE:C) some 12% higher.

“The DeepSeek threat has certainly ruffled feathers and even if this particular storm subsides, other challenges to the US AI dominance could follow. This is a burgeoning sector which has powered much of the US market's gain over the last couple of years, such that the unease is understandable.

“A new acid test is arguably yet to come, when earnings from the so-called 'Magnificent Seven' will take centre stage. These stocks – Apple, Microsoft, Alphabet Inc Class A (NASDAQ:GOOGL), NVIDIA Corp (NASDAQ:NVDA), Meta Platforms, Amazon.com Inc (NASDAQ:AMZN) and Tesla – were the main driving force for a highly successful 2024 for US markets, and with such momentum comes much higher expectations. Indeed, the “Magnificent Seven” have a disproportionate impact on the benchmark S&P500 and Nasdaq indices in particular, which added 23% and 29% respectively last year.

“As such, reaction to the results as they come could also have a disproportionate and defining effect on investor sentiment and market direction for the year.”

Details of the offer can be found on the interactive investor website here

US share trading offer - terms and conditions

- A trading fee of £0 is applicable to all buy and sell orders of US shares placed via the ii website and using the interactive investor mobile apps executed between 2.30pm (GMT) on 29 January 2025 and 9pm (GMT) on 31 January 2025 (the "Offer Period") (the "Offer"). For the avoidance of any doubt, any orders placed within the Offer Period but not executed until after the Offer Period has ended will not be eligible for this Offer.

- The Offer is open to new and existing customers.

- Before you can buy US-listed shares, you need to complete the relevant IRS W-8 form. If you are a UK resident and your account is in your individual name you can complete the form online. We cannot guarantee that the process of either opening a new account and/or enabling the account for international share dealing will be completed before the Offer closes.

- These terms and conditions should be read in conjunction with the Interactive Investor Services Limited ("IISL", "ii", "we" or "our") Terms of Service and the ii SIPP Terms (together, the "Terms of Service"). In the event of a conflict between these terms and conditions and the Terms of Service, these terms shall prevail.

- After the Offer Period, the trading fee you will be required to pay will be as set out in our Rates and Charges.

- Orders placed via telephone dealing are not included in this Offer and will be subject to the charge set out in our Rates and Charges.

- All other fees set out in our Rates and Charges, (eg foreign exchange rates for currency conversion and Government charges), are not subject to this Offer and shall continue to apply during the Offer Period.

- Anyone who is (in our reasonable opinion) seen to be abusing the offer may be excluded at our sole discretion.

- By participating in the Offer, you agree that ii will not be liable for any costs, expenses, loss, or damage sustained or incurred with regards to the Offer.

- We reserve the right to alter, withdraw or amend this Offer and/or these terms and conditions at any time without prior notice.

- All participants to this Offer agree to be bound by these terms and conditions.

- These terms are governed by English law.

- IISL is the promoter of this Offer. IISL’s registered office is at 201 Deansgate, Manchester M3 3NW.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.