ii coronavirus poll: investors switch focus to scoop up bargains

Our latest poll shows that bargain hunters are moving fast, and into different areas of the market.

25th March 2020 14:28

by Jemma Jackson from interactive investor

Our latest poll shows that bargain hunters are moving fast, and into different areas of the market.

This week saw the average investment trust discount at one point hit a level not seen since the global financial crisis. But whilst discounts can go either way and could widen further, bargain hunters may need to be on their toes, as investors are moving fast to scoop up bargains.

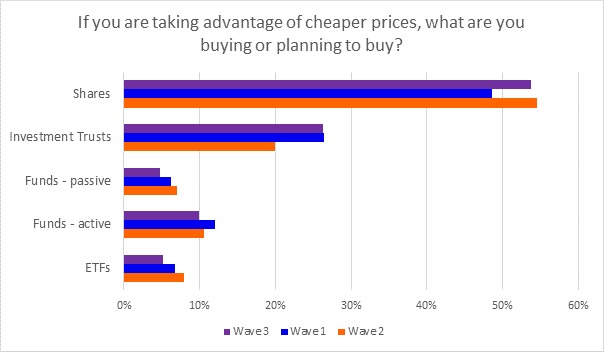

The latest interactive investor wave three poll of 949 investors conducted between 23 March to the morning of 25 March 2020 shows a six-percentage point increase to 26% in the number of bargain hunters buying investment trusts since wave two research was conducted between 11 - 16 March 2020 – little over a week ago.

This comes at the expense of passive options – the latest wave three research shows a 3-percentage point decline to 5% in the number of investors using ETFs to scoop up opportunities, whilst passive funds have seen a two-percentage point decline to 5%. Active funds are attracting 10% of bargain hunters, compared to 11% during wave two.

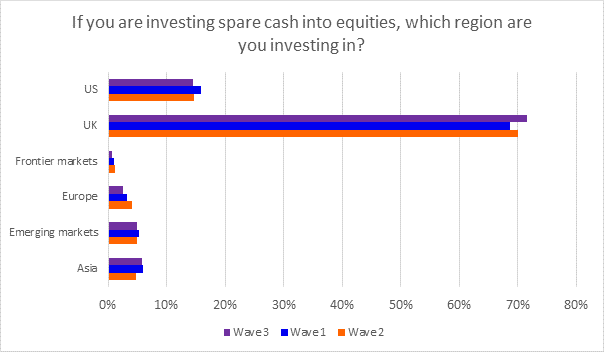

The number of investors buying up shares to pick up a bargain remained stable (54% compared to 55% in wave 2, but up from 49% in wave one), and interest in UK shares is at its highest since this crisis started, at 72% currently compared to 70% in wave two and 69% between 28 February – 2 March in wave one. This comes at the expense of Europe, which has seen a 2-percentage point decrease in investor interest since wave two to 2%.

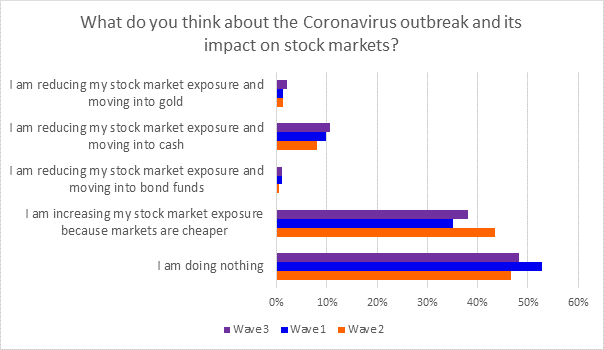

Lee Wild, Head of Equity Strategy, interactive investor, says: “Some 48% of investors are still doing nothing, compared to 53% during wave one of the research at the end of February. So, more investors are looking to scoop up opportunities.

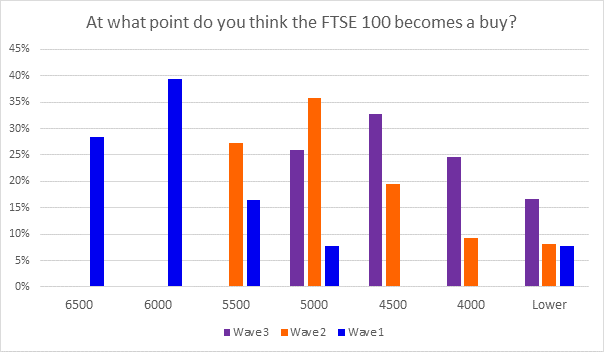

“The renewed focus on investment trusts, with a six-percentage point increase in barely a week in the number of bargain hunters swooping in, is noteworthy. This comes at the expense of passive options and shows that discount opportunists sometimes need to move fast. There’s always the chance that discounts widen further, but elsewhere; one thing is clear: the 36% of investors a week ago who said they thought the FTSE 100 was a buy at 5,000 are currently in the money – for now at least.”

Richard Hunter, Head of Markets, interactive investor says: “With our most traded stocks tending to be predominantly FTSE 100 companies, the fall in the pound may well have tempted out more investors. With the majority of FTSE 100 earnings coming from overseas, a falling pound can be beneficial for these companies.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.