How we are playing the Indian stock market boom

Saltydog Investor is adding to its India fund, as the emerging market delivers economic and stock market growth.

23rd October 2023 14:36

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Towards the end of August, I highlighted the fact that the India/Indian Subcontinent sector was one of the three Investment Association (IA) sectors that had made one-month gains in May, June and July. The other two were the Standard Money Market and Short-Term Money Market sectors.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

Most sectors ended the month down, but the India/India Subcontinent sector gained a further 1% in August and was the best-performing sector in September, up 4.7%.

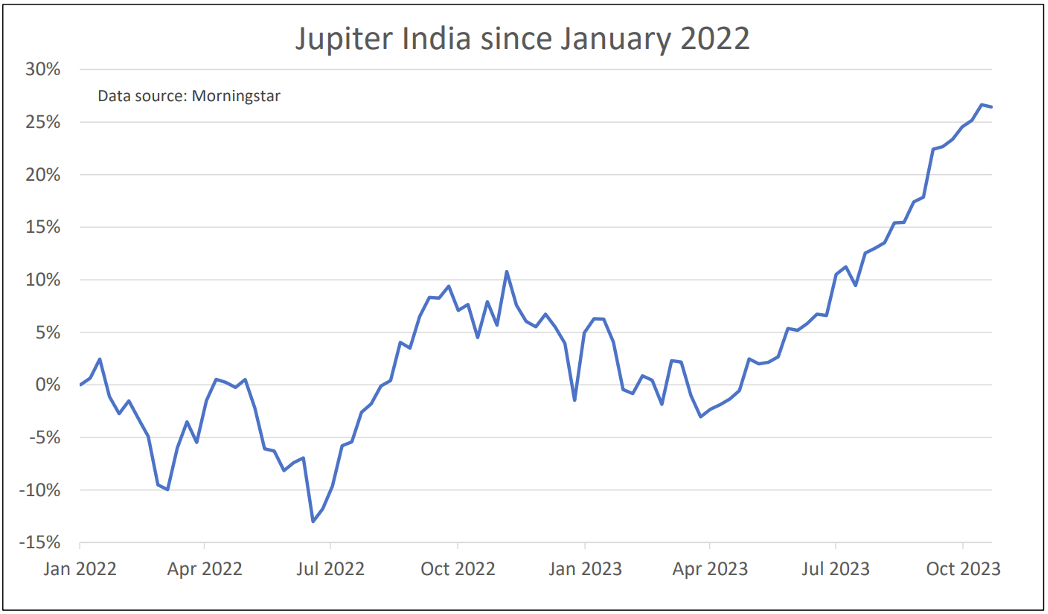

We monitor several funds that invest in India, and at the time the Jupiter India fund was the best. On 31 August, our Ocean Liner portfolio invested in this fund. Since then, it has risen 7.8%.

Past performance is not a guide to future performance.

At the time, I suggested several reasons why India might have been doing well.

It has a wealth of natural resources, along with a large and relatively young population and an expanding middle class with rising levels of wealth. Although it still gains a lot of its revenue from its exports it also has a large domestic market.

Since 2014, Prime Minister Narendra Modi and the Indian government have implemented several policies to boost the economy and they seem to be working. They include the National Infrastructure Pipeline, the Make in India campaign, and the Startup India initiative.

Although historically its growth has lagged behind China, that might now be starting to change. China has not got a great track record when it comes to sticking to internationally agreed business standards, and the government has faced numerous allegations of human rights abuses over the years. Perhaps India now looks like a more attractive option for foreign investors.

Earlier this month the International Monetary Fund (IMF) produced its latest World Economic Outlook report and the growth forecasts for India look impressive.

The IMF was founded in 1944 duringthe United Nations Monetary and Financial Conference, which took place in Bretton Woods, New Hampshire, in the US. It was towards the end of the Second World War, and the aim of the conference was to establish a new international monetary and financial order. It was when the US dollar, which was pegged to the price of gold, became the primary reserve currency, taking over from sterling,

It started with 40 members, but it has now expanded to include 190 countries. Its aim is to “foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world”.

As well as working to ensure monetary stability, and providing financial and technical assistance, the IMF also carries out research on economic and financial issues. It publishes its World Economic Outlook twice a year, in April and October. This report provides an assessment of the global economic situation, offering economic forecasts, analysis of trends, and insights into the state of the world economy.

The overview for the latest report begins by saying that “the baseline forecast is for global growth to slow from 3.5% in 2022 to 3% in 2023 and 2.9% in 2024, well below the historical (2000–19) average of 3.8%”.

- Why India could be the next superstar in your portfolio

- Portfolio diversification in action: see how it really works

It then gives projections for individual countries. For example, the US shows 2.1% growth in 2022, and a similar figure for this year, but it then drops to 1.5% in 2024. In the UK we are looking at 4.1% in 2022, but only 0.5% in 2023 and 0.6% in 2024. Comparable figures for China are 3% in 2022, which is low by its standards, but it goes up to 5% in 2023 before falling to 4.2% in 2024. The star performer is India. It grew 7.2% in 2022 and is forecasted to grow 6.3% this year and next.

If India performs as well as the IMF suggests, then the Indian funds could continue to be a good place to be invested.

Our Tugboat portfolio invested in the Jupiter India fund in September, a couple of weeks after the Ocean Liner, and last week we added to both our holdings.

For more information about Saltydog Investor, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.