How these investment trust tips beat the market

The Kepler Trust Intelligence team’s ‘top picks’ for 2019 generated big profits for investors.

10th January 2020 15:38

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

The Kepler Trust Intelligence team’s ‘top picks’ for 2019 generated big profits for investors.

Full house

William Sobczak is an analyst at Kepler Trust Intelligence.

This time last year the team at Kepler Trust Intelligence (KTI) chose their personal ‘top picks’ within the investment trust universe for 2019. The aim was for each member of the team to choose the trust they believed would perform best from an investor’s point of view; i.e. in share price terms rather than NAV. Any trust could be selected, regardless of whether it was equity-focused or not.

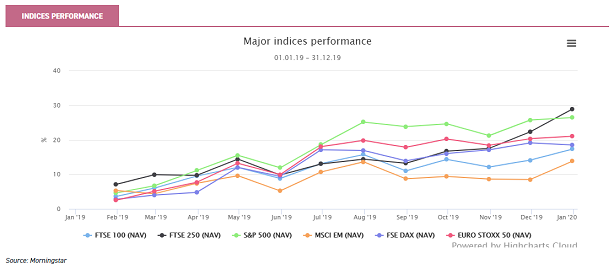

Overall the year was a prosperous one for those brave enough to hang on throughout. The MSCI World Index (in sterling terms) rose by 22.4%, with the US the best-performing major market. The S&P 500 rose by 26.4%, while the FTSE 100 and FTSE 250 were up by 17.3% and 28.9% respectively.

The DAX and MSCI Emerging and EURO STOXX 50 also increased. In terms of currencies the pound sterling ended the year roughly where it started relative to the dollar. This has masked what has actually been quite a volatile period for both currencies. The same pattern has been seen with sterling versus the yen, which started the year at around 140 and has ended at a similar level, around 143. What may surprise some investors is that sterling has appreciated relative to the euro by 5.9%; once more not without volatility, and with much of the gain coming in the second half of the year.

Two key developments have driven the performance of global markets. The first was the loosening of monetary policy by central banks (including FED, ECB, RBA and RBNZ) in an attempt to counteract the slowing of global economies. The Fed was at the forefront of this activity, cutting rates three times over the year.

The second development was an easing of political anxiety over the uncertainties surrounding the US–China trade conflict and Brexit. It is worth bearing in mind that the resolutions to these issues are still in their early stages, since much of the more positive news came later in Q4 of the year.

- Seven investment trust predictions for 2020

- Where to find investment trust bargains at the start of 2020

Events rarely play out in a straight line, as the assassination of Qasem Soleimani has shown in glaring colour this week, and we would not rule out further political uncertainty from these quarters – as well as from developments in the Middle East – as the year matures.

Reviewing our picks for 2019

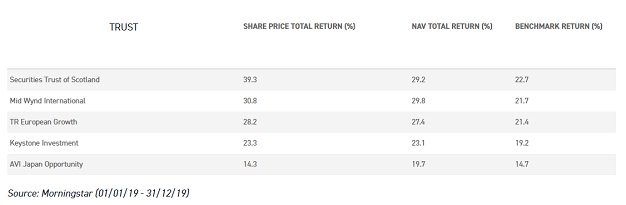

Overall the trusts selected by the KTI team performed strongly: across our picks the average share price return was 25.8%. In comparison the MSCI World Index and the FTSE All-Share Index delivered price returns of 22.7% and 19.2%, representing a strong outperformance by the team. In fact every trust chosen outperformed its respective benchmark in NAV terms, and all but one in share price terms. Relative to their respective benchmarks, the average alpha generated by the managers of our trust picks was 3.8%.

Below we show our five picks and their share price and NAV total returns over the year.

Securities Trust of Scotland | Pascal Dowling

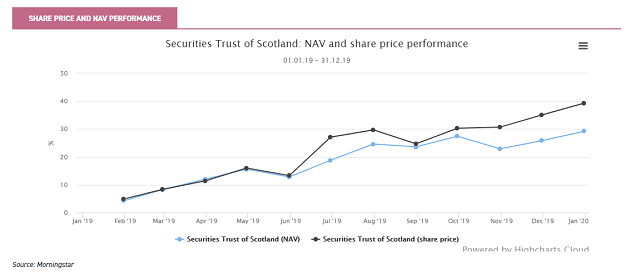

The top performing trust among our picks, chosen by Pascal Dowling, was Securities Trust of Scotland (LSE:STS), which has turned out to be one of the best turnaround stories of the past few years.

After taking over the STS portfolio in 2016, Mark Whitehead has implemented a clear investment process, with a strong emphasis on proving the stability of potential investments. Pascal recognised this, while also identifying that the discount was much wider than any of the trust’s comparable peers, despite a creditable performance under the new manager.

As can be seen in the graph above, 2019 saw STS deliver share price returns of 39.3%. This was due to a combination of strong NAV performance and a narrowing of the discount, from -6.7% to +1.1%, over the year. This discount is now considerably closer to the AIC Global Equity Income sector average of 0.4%. Relative to the trust’s benchmark the manager has delivered an alpha of 5.8%; indeed the trust outperformed every trust in the AIC Global Equity Income sector. The trust’s decent exposure to North America, relative to the other trusts in the sector and our other picks, drove much of the outperformance; though according to Morningstar the weighting is just 42.3%, versus 63.4% in the benchmark MSCI World Index.

Mid Wynd International | William Heathcoat Amory

The second strongest performer was Mid Wynd International (LSE:MWY), picked by head of research William Heathcoat Amory. Given the volatile conditions we saw at the end of 2018, William picked MWY based on the managers’ aim to protect capital on the downside, while still delivering long-term upside. Over the year the trust delivered impressive share price returns of 30.8%, outperforming the benchmark MSCI World Index by over 8%. The NAV performance was 29.5%, with the shares trading on a slightly higher premium than at the beginning of the year. The trust’s performance was also strong relative to the AIC Global peer group, with the trust sitting in the top quartile of performers on a NAV basis.

TR European Growth | William Sobczak

I selected TR European Growth (LSE:TRG), a European smaller company trust. The company was selected following a particularly torrid 2018, with pressures coming from Fed rate rises, trade wars and political uncertainty (including Brexit). Throughout 2019 the AIC European Smaller Companies sector performed strongly, with many of these pressures subsiding, and TR European Growth was the second strongest performer in the sector, with price returns of 28.2%. Nonetheless, most of the year’s returns were derived in the second half of the year, and too much was left too late relative to our other picks. Furthermore – as one might expect with a smaller companies growth trust – the returns were delivered at high levels of standard deviation (17.1%) relative to the EMIX Smaller European Companies benchmark of 8.7%.

Keystone | Thomas McMahon

Keystone (LSE:KIT) was the investment trust pick for Thomas McMahon. He was hoping to take advantage of a bombed-out UK market, particularly consumer-facing companies, despite the economy being in a reasonably stable condition. Thomas was correct that there would be a relief rally in the wake of some clarification around the UK’s political situation. The incessant changing of dates for a Brexit decision meant that the trust only really began to prosper after the election on 12th December, but the 20 days following the election saw KIT’s shares rise 7.9%. This took the trust’s total year share price return to 23.3%, although this was marginally below the AIC UK All Companies sector average of 29.8%.

AVI Japan | Alice Rigby

Alice Rigby’s pick for 2019 was AVI Japan Opportunity (LSE:AJOT). She predicted 2019 to be even more tumultuous than 2018, from a political and economic perspective; feeling that the relative immunity of Japan to outside events would become increasingly appealing to investors. Over the year the trust performed decently in NAV terms, delivering total returns of around 19.7%. This was considerably more than the benchmark (MSCI Japan Small Cap), with the manager generating an alpha of 14.6, according to Morningstar. Price returns have been hindered, however, by the fact that the trust was trading on a hefty premium at the start of the year; whilst the manager has pursued a deep value approach in an environment which has rewarded growth.

Conclusion

Altogether 2019 was another successful year for the investment trust universe. It has been well-documented that the closed-end structure of investment trusts can help managers outperform on a NAV basis. This has been demonstrated by the team’s picks. One of the other attractions for investors – the opportunity to buy trusts on a discount to NAV – has been beneficial for most of the trusts selected within our top picks. Securities Trust of Scotland, for example, started the year on a discount of 6.7%, narrowing to a premium of 1.1%. Taken together with an NAV return of 29.2%, this meant investors were able to outperform Mark Whitehead’s open- ended equivalent (Legg Mason IF Martin Currie Global Equity Income) by close to 15% over 2019. STS’s returns were also aided by the trust’s ability to gear, which averaged 9.8% and clearly contributed to its strong performance.

Last week saw the team once more select our new ‘top picks’ for 2020 with a fresh crop of ideas for the coming year. While we don’t think returns in absolute terms will match 2019’s very strong numbers, we hope that at least each manager can use the trust structure to help them outperform their benchmarks.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.