How Saltydog invests: a guide to its momentum approach

Douglas Chadwick explains the fund-picking approach and how two model portfolios have fared since launch.

1st December 2020 12:09

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Douglas Chadwick explains the fund-picking approach and how two model portfolios have fared since launch.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

At Saltydog, we use an active momentum approach (sometimes called ‘trend investing’) to determine the best-performing funds in sectors of the market that are currently performing well. The basic idea is that when money is invested into a fund or sector its value will rise, and as it attracts more and more investors the impetus will increase. The opposite is also true.

We are not day traders, but we do have time-based achievement and volatility rules that mean we buy and sell funds according to their performance.

- nvest with ii: Invest in Unit Trusts | Top Investment Funds | Top Investment Trusts

Every week we give our members the latest performance data on a wide range of unit trusts, open-ended funds, ETFs and investment trusts. Our information has been carefully designed to help private investors, like ourselves, spot trends in the financial markets and easily identify the best-performing funds in those sectors. The information is designed to help private investors manage their own investments.

As part of the service, we show what we are doing with our own personal money in the Saltydog portfolios. We do not invest any customer money.

- Fund spotlight: Montanaro Better World

- Bargain Hunter: window of opportunity for these trust discounts

- Most fund sectors have clawed back Covid-19 losses

In our analysis, we focus on the short term, we are not particularly interested in what has done well over the last five years. We report on performance over the last six months, with an emphasis on what has happened over the last four weeks.

One of our key principles is to invest only in the more volatile funds when they are giving better returns than funds that have historically been more stable. We also limit the overall amount that we will ever invest in the most volatile funds.

To help with this process, we combine the Investment Association (IA) sectors into our own proprietary Saltydog Groups. The nautical names of these groups give an easily recognisable indication of the volatility of the sectors and funds that are allocated to them.

- Safe Haven: very low risk, but also very low returns.

- Slow Ahead: normally a low risk level and often with adequate returns.

- Steady as She Goes: generally medium risk, with potentially higher returns.

- Full Steam Ahead: higher risk, with potentially the best returns. There are quite a few sectors that fall into this risk category and so we split them into emerging markets and developed markets.

The IA’s specialist sector contains a range of funds that do not naturally sit within the other sectors and so we look at that separately, but we treat the funds as if they have the same risk profile as funds in the Full Steam Ahead group.

Which sectors end up in each group is determined by their historic volatility. The funds that do best in the good times tend to suffer the most when things go wrong. When we initially set up the groups, we looked at the volatility of the sectors over the previous 10 years.

These groups can be used to control the overall volatility of a portfolio. As you would expect, the larger the amount invested in funds from the lower volatility groups, the less volatile we would expect the overall portfolio to be.

As well as providing weekly performance data on the 30-plus Investment Association sectors, and the leading funds, we also run a couple of demonstration portfolios in which we made initial investments of £40,000 of our own money.

We use the demonstration portfolios to explain our methodology. The idea is that our members can then build their own portfolios - potentially aiming for larger gains (but accepting more volatility), or reducing the volatility even more, but being prepared for lower returns.

- The two UK funds Saltydog has just bought

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

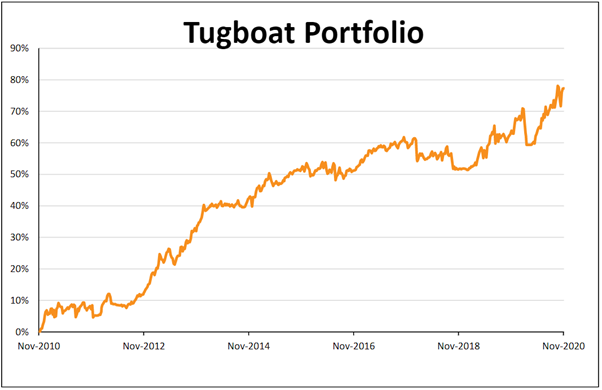

Tugboat portfolio

We thought it prudent to focus on the less risky end of the spectrum and so at the end of November 2010 we launched the Tugboat portfolio. It is a very cautious portfolio, where avoiding falls is as important as making gains. Even when conditions are favourable, we will only invest a maximum of 10% of the portfolio in funds from the most volatile sectors (funds in the Full Steam Ahead group, including those in the IA specialist fund sector).

We are looking for better returns than a cash ISA or savings account. Although we accept that we are taking more risk, we also want to avoid the worst of any downturns in the markets.

The portfolio can move between being 100% in cash and fully invested. We normally hold around 10 different funds.

In its first 10 years, ending in November 2020, our initial investment went from £40,000 to more than £70,000, a gain of 77%. We also successfully negotiated all of the major market corrections. The FTSE 100, with reinvested income, is up 67% over the last 10 years.

Past performance is not a guide to future performance

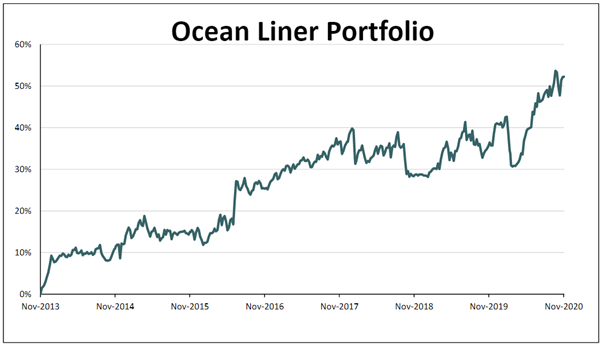

Ocean Liner portfolio

Three years after starting the Tugboat, we set up the slightly more adventurous Ocean Liner portfolio in November 2013. We are still not trying to shoot the lights out, but are willing to accept a higher level of volatility and hopefully see greater returns when conditions are favourable. We can invest up to 30% in funds from the most volatile sectors. As with Tugboat, the Ocean Liner portfolio normally holds around 10 different funds.

Over the seven-year period, it has gone up by more than 50%, while also avoiding the worst of any stock-market crashes. The FTSE 100, over the same time period, is up 25%.

Past performance is not a guide to future performance

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.