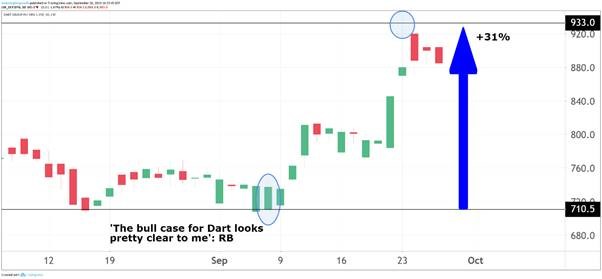

How Dart Group turned our analyst a 31% profit in two weeks

In a case of great timing and luck, backing this well-run travel operator was a stroke of genius.

26th September 2019 17:04

by Lee Wild from interactive investor

In a case of great timing and luck, backing this well-run travel operator was a stroke of genius.

A couple of weeks ago, our companies analyst Richard Beddard, a long-time fan of travel operator Dart Group (LSE:DTG), reminded us why he has an army of followers and why you reject 'value' investing at your peril.

Published on Friday 6 September, Dart Group's share price had traded as low as 710.5p, closing the day at 737.5p. But on 23 September, the day Thomas Cook went bust, the shares peaked at 933p for 31% gain.

In his original article, Richard talked about "a growing business that has been getting better at making money" and whose shares are "cheap and should be a good investment over the long term."

Source: TradingView Past performance is not a guide to future performance

"The whole Thomas Cook (LSE:TCG) thing has been a revelation," says Richard. "TUI (LSE:TUI) has had to cancel holidays because it used Thomas Cook's planes to fly people on TUI packages. Jet2 only uses its own planes. Unlike the rest of the world, it seems, I'm a big fan of vertical integration. On The Beach (LSE:OTB) has come a cropper too, because it is having to rearrange packages using Thomas Cook flights.

"The other thing that surprises me is the press coverage, which talks a lot about TUI (dinosaur that has adapted better than Cook) and On the Beach (an example of the internet disruption that undid Cook), but almost completely ignores Jet2. It's like it is invisible.

"But the fact that Jet2 overtook Thomas Cook as the UK's second-biggest package tour operator a number of years ago (from a standing start in 2006!) surely was a huge factor in Thomas Cook's demise.

"I think its origins in the North are one of the reasons the City has routinely underestimated Dart, and perhaps caused competitors to underestimate it too."

So, it seems that few investors appreciated just how good a business Jet2 is. This is where those who dig deep and do the research can uncover gems like Richard did with Dart Group.

You can read more of Richard Beddard's shares analysis on his interactive investor page.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.