Here's what will end this record equities bull run

23rd August 2018 11:01

by Lee Wild from interactive investor

The UK market has remained rangebound all summer, but things may be about to change, writes Lee Wild, head of equity strategy at interactive investor.

Donald Trump may have had a bad day at the office but, it seems, like the teflon president, little can shake this bull market.

While the US economy continues to grow at pace and pro-business policies help underpin corporate earnings, this late cycle market could head higher still near term.

The rally will end, but it's unlikely to be Trump's alleged political misdemeanours that strike the fatal blow. More probable is a step up in trade war tensions or a policy mistake, likely an overly aggressive interest rate tightening cycle aimed at tackling inflation.

Latest Federal Reserve minutes suggest US rates will rise again in September and possibly again in December if economic data holds up.

Don't expect anything new from Fed governor Jerome Powell's Jackson Hole speech on Friday. Given low unemployment and on-target inflation, we're only likely to see repetition of current Fed strategy and some comment on weak wages growth and productivity.

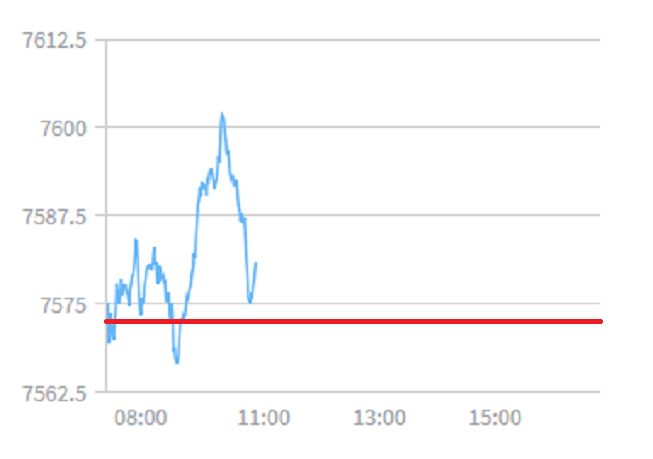

Markets traded either side of breakeven in early trade Thursday as tariffs threatened by both the US and China came into effect overnight.

Source: interactive investor Past performance is not a guide to future performance

And there's a real risk to global economic growth if the US slaps duties on another $200 billion (£155 billion) of Chinese goods, and especially if other countries get sucked into this dispute.

At a time when other economies are beginning to struggle, a sharp slowdown in US expansion could have a significant impact worldwide.

These developments come at a particularly sensitive time for a UK stockmarket rangebound for the past three months. September is statistically the worst month of the year for UK shares, but there have been wild swings either way in recent years, so don’t expect this stale period to last.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.