Gold is top-performing asset class as Covid-19 and inflation fears prevail

Investors have piled into gold partly because of concern that central bank policies will lead to a su…

14th May 2020 13:28

by Tom Bailey from interactive investor

Investors have piled into gold partly because of concern that central bank policies will lead to a surge in inflation. Are such fears justified?

Warren Buffett is often quoted as saying that to buy gold is to go “long on fear”. Judging from the performance of gold in recent months, investors have plenty of fears. Gold now trades at around $1,700 an ounce, roughly 30% higher than a year ago.

Gold funds have also performed well in the face of coronavirus. In the first 50 days of the UK being in lockdown, ES Gold and Precious Metals returned 55.7%. Ninety One Global Gold, BlackRock Gold & Generaland MFM Junior Gold also all provided returns of above 50% during that period, according to data from AJ Bell.

With the global economy in lockdown and no vaccine for coronavirus expected anytime soon, many investors have been fearful of what comes next. Historically, gold has provided an effective hedge against extreme market outcomes, so for many investors, topping up on the yellow metal has made sense.

However, Talib Sheikh, head of strategy at Jupiter’s Multi-Asset team, points out that there is also a more specific fear driving investors into gold: inflation.

Around the world central banks have launched once-unthinkably large bond-buying programmes to try and deal with the economic fallout of the virus. This has raised fears that currencies will become devalued or “debased”.

Sheikh notes: “Large amounts of stimulus being released into the economy by central banks across the world, both by printing money (quantitative easing) and deficit spending, have led to concern among investors that fiat currencies are weakening as a store of value.”

With gold seen as providing a hedge against inflation, it is an attractive investment to those worried about the adverse effect of central bank largess. However, investors should note that we have been here before.

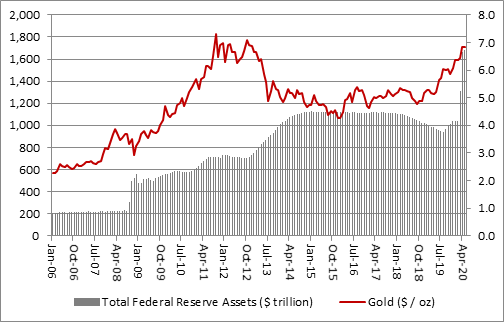

When central banks first embarked upon quantitative easing programmes after the 2008 global financial crisis, there was widespread fear about inflation.

Books and articles warned of coming hyperinflation and bad historical comparisons with Germany’s Weimar Republic were made. All this sent gold into a rally.

Source: AJ Bell, FRED – St. Louis US Federal Reserve, Refinitiv data

But the money-printing of central banks did not unleash inflation. While quantitative easing helped to support asset prices in financial markets, it did not work its way into the ‘real economy’ and cause a rise in consumer prices.

In most advanced economies, aggregate demand remained weak and as a result inflation failed to rear its head. By around 2012 financial markets had got the message and gold’s rally came to an end. Gold eventually bottomed out at $1,050 in 2015 and remained weak until 2018.

Will this time be different? Ivan Kralj, assistant fund manager of the Jupiter Absolute Return fund, certainly thinks so. He argues that in the quantitative easing that followed the 2008 financial crisis, most of the liquidity created stayed trapped in the banking system and did not flow into the real economy. As a result, it did not produce inflation.

However, he says: “This time, the biggest fiscal and monetary stimulus in history is being targeted towards lower-income individuals and small businesses. These tend to exhibit a much higher velocity of money than large institutions, so that should have a much stronger inflationary impulse.”

Another consideration is that the current crisis will see the economy reshaped in ways that will make it more inflationary.

Companies, it is argued, will start to realise that the far-flung global supply chains they have created over the past three decades are a source of vulnerability. As a result, they will try to bring production closer to their end markets.

However, these lean global supply chains have allowed prices to remain low, making them a key factor underpinning weak inflation in recent years. Such a reversal, therefore, could see inflation finally return.

As former Bank of England governor Mark Carney has previously noted: “if globalisation was deflationary, deglobalisation will be inflationary.”

More immediately, however, gold looks increasingly attractive relative to other investments.

Often gold is seen as something of a dud investment as it produces no yield or income. Returns come from someone else being willing to buy the same bar of gold for a higher price – a so called ‘greater fool’ trade.

But as Sheikh points out, interest rates around the world have collapsed thanks to central bank stimulus. Many government bonds and high-quality corporate bonds now produce a negative return in both nominal and real terms.

If bonds end up producing a negative return, their only purpose is as a store of value rather than an asset to generate income.

In that case, why not chose gold? As Sheik notes: “Gold looks more attractive as a portfolio diversifier relative to high-quality sovereign bonds.”

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.