Gold and commodity funds back in form

17th April 2023 13:59

by Douglas Chadwick from ii contributor

To take advantage of the gold price shining, Saltydog has bought a new fund in an attempt to profit from a trend that could well continue.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Gold funds, which we highlighted as the best-performing funds in March, have also led the way in the first couple of weeks of April. They are the top funds over the last four weeks, followed by the energy and commodity funds.

- Invest with ii: Top ISA Funds | Top Junior ISA Funds | Open a Stocks & Shares ISA

Saltydog’s leading funds over four weeks

| Fund Name | 4-week return(%) | 12-week return(%) | 26-week return(%) |

| Ninety One Global Gold | 19.7 | 10.0 | 40.8 |

| BlackRock Gold and General | 19.3 | 10.2 | 36.8 |

| SVS Sanlam Global Gold & Resources | 17.4 | 9.4 | 28.8 |

| LF Ruffer Gold | 16.0 | 8.1 | 30.9 |

| BGF World Energy | 12.3 | -1.0 | -2.1 |

| JPM Natural Resources | 10.3 | -3.8 | 3.8 |

| Schroder ISF Global Energy | 9.8 | -1.1 | 3.1 |

| TB Guinness Global Energy | 9.5 | -2.4 | -1.0 |

Data source: Morningstar. Past performance is not a guide to future performance.

Gold funds do not hold physical gold. Instead, they invest in companies that mine and process gold and other precious metals. However, their performance is closely linked to the price of gold, which is up at record levels last seen in the summer of 2020 during the Covid-19 lockdowns.

- Nine gold mining shares that could add sparkle to your ISA

- Gold: four exciting companies to track this year

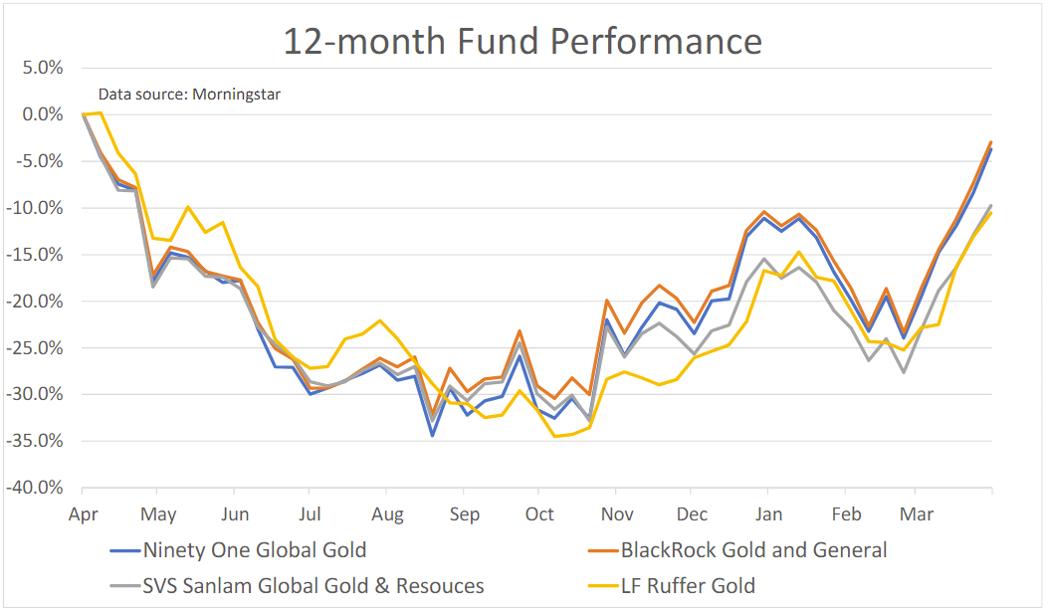

Although gold is often seen as a ‘safe’ investment, because over the very long term it has always held its value, it can be very volatile in the short term. In the past 12 months we have seen the value of the gold funds drop by around a third, but then rebound strongly.

Past performance is not a guide to future performance.

I am not sure exactly why gold has performed so well over the past few weeks but would have thought that it has something to do with the recent banking crisis and concerns over the global economy. This in turn is linked to rising government bond yields, which are a result of interest rates needing to increase to combat inflation.

That then begs the question ‘Why did inflation reach 40-year highs?’

I find it hard to believe that the answer is not related to the vast amounts of cash injected into the economy by governments and central banks, which simply manipulated their central reserves to purchase government bonds/gilts, which were in turn produced at the wave of a wand.

That process is even more of a mystery to me, but this is my faltering understanding of how it happened.

Governments needed money to finance the country and their projects. So, out of thin air, as if by magic, they issued government bonds with a variety of maturity dates (some very long) bearing a fixed rate of interest, which at the time was next to nothing.

Having reduced interest rates to nearly zero, which still failed to boost the economy, central banks (such as the Bank of England) were eager to buy these bonds to stimulate growth in a process known as quantitative easing (money-printing).

- Funds and trusts four professionals are buying and selling: Q2 2023

- Gilts and gold funds shine during flight to safety

- Day in the life of a fund manager: M&G’s Eva Sun-Wai

Instead of using money that had been raised from government taxation or borrowing, the central banks simply ‘created’ the money digitally in the form of central bank reserves - another wave of the wand.

The central bank now owns the government gilts, which they can either hold until maturity, or at some point sell them to pension funds, commercial banks, and other financial institutions.

All is fine up to a point, but if interest rates then rise the value of the government bonds will fall. This may not be a problem if they are held until maturity, as they will still be repaid at their original value. However, anybody who has these bonds on their books will face carrying these at their new lower asset value, and that could be for a long time.

While the government and central banks do not have to account to anybody, other institutions who own these depreciating gilts have to balance and publish their accounts, which will include these reduced assets, and this may mean insolvency. Not much fun if you are borrowing or looking for investment money for your businesses. Hence, the run on the banks and other financial institutions that are in this situation.

In the UK, the Treasury indemnifies the Bank of England for any losses arising from bond purchases. So, when the music stops, guess who is going to pay for that? The taxpayer (you and me). And it has already begun.

The Bank of England has started trying to offload some of the gilts and surprise, surprise they are not worth what they paid for them. The Treasury has recently asked Parliament to authorise up to £200 billion to cover expected losses from its quantitative easing programme, and it could be more.

I do believe that the Bank of England is between a rock and a hard place. They are charged by the government with keeping inflation at around 2%. To do this, they have to raise interest rates from the lows of yesterday, and this creates collapsing gilt prices and today’s financial problems.

With all the uncertainty around how this process will unwind, it is not surprising that markets are volatile.

Our Saltydog portfolios remain cautious with our largest holdings inmoney market funds or cash, but we have recently invested a small amount in the BlackRock Gold and General fund and so will benefit if this current trend continues.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.